Virtually every hospital and health system has embarked upon a strategy to employee, recruit and retain physicians, especially primary care physicians, to their delivery networks. With a national deficiency of primary care physicians, these practitioners can pick and choose their affiliations. In addition, since the adoption of the Affordable Care Act, the cost of attracting and hiring these doctors has risen dramatically.

An often overlooked tool that can be used in the recruitment and retention of physicians is the opportunity to partner with doctors on the development or monetization of medical office buildings owned or in development by the system.

Most hospital ventures have focused on strategies to increase market share via ambulatory surgery, cancer or imaging centers. Investment in these ventures is generally restricted to those specialists that will use the facilities. This has left primary care doctors on the sidelines and thus unable to participate in these partnerships. Utilizing real estate for venture opportunities is one of the few areas in which health systems can work with their primary care doctors for a chance to co-invest.

While physicians typically are among the highest earners in the United States, there is great variability among practitioners. Primary care physicians are at the lower end with average earnings around $225,000 per year and radiologist and anesthesiologist often topping $500,000 per year. Most physicians have also become employees over the past decade with their earnings tied to productivity. Historically, physicians assumed they would be able to sell their practice to aid in funding their retirement. However, this opportunity has faded over the years. Physicians are seeking new investments which have led to the nexus of binding physicians to their health systems through shared real estate deals.

With bond yields at historically sustained low rates, a volatile stock market, and money market funds paying virtually nothing, many, including physicians, are looking for alternative investments to build wealth. This, along with ever increasing rents, has led to an expansion of syndications of existing and new medical office buildings targeted to physicians. Many are now being sponsored by health systems directly or with third party developers.

This interest in physician focused medical office syndication has waxed and waned usually in tandem with the overall real estate market. There were many partnerships formed during the 1980’s through 1990’s where physicians were given “free” ownership if they committed to a long term lease that had built-in automatic annual increases. They were also fueled by significant tax advantages to real estate ownership. The tax benefits were largely stripped away by changes in the tax law in 1986. Physicians also discovered that by the time these leases were into the fifth or sixth year, the physicians realized that their rents were well above market rates and their “free” ownership was anything but free. While tantalizing initially, many of these deals required restructuring in order to refinance the buildings when loans came due. Lenders were unwilling to underwrite loan amounts based on above market rents requiring capital calls that most physicians never anticipated and they walked away from the investment.

By the turn of the century, institutional investors had developed an appetite for medical office buildings. They had traditionally ignored this sector as it was complicated by ground leases, use restrictions and small tenants. Given the newly found demand, several healthcare real estate investment trusts (REITs) were formed to invest in the sector and became the primary candidate for physicians and health systems seeking to monetize their real estate. Today, capital groups spanning traded and nontraded REITs to pension funds have made significant allocations to the medical office sector. The sector has transitioned from a “niche” product to a mainstream investment. “We continue to see new capital entering the medical office sector on a monthly basis seeking investment and development opportunities. Institutional investors are rebalancing their portfolios and looking for opportunities to hedge their risk if there is a correction in the market. Medical office withstood the last downturn much better than other real estate sectors and investors see the product as part of a growth market while also acting as a safe haven if the global economy experiences more volatility, “said Chris Bodnar, Executive Vice President with CBRE’s U.S. Healthcare Capital Markets Group.

Compared to offering properties as physician syndications, this was a quick and efficient way to monetize a sizeable chuck of assets. The effort required for physician partnerships is significant to meet all of the regulatory requirements – both from a securities and compliance perspective.

Physician syndications for medical office buildings fall into two categories: new and existing.

New Medical Office Buildings

Health Systems typically look to third party developers who specialize in medical office development to build their new projects. While the primary funding source is from institutional investors, health systems typically require that an ownership opportunity be offered to the physicians as part of the deal.

This, coupled with systems looking to expand access to their primary care networks by moving into community settings, has changed the type of medical space being developed migrating away from large, on campus buildings to smaller neighborhood facilities. This shift has created opportunities for smaller capital dollars to fund projects as these reduced commitments are less attractive for institutional investors.

n the past, these investment opportunities have often been quite complex, but the market has migrated to simpler structures. Most now allow physicians to invest on a “para per su” basis – that is all investment dollars are treated equally.

“We have historically structured our deals with a preferred return but have found that structure difficult to explain to physicians who often don’t have a financial background. Recently we have utilized a structure wherein physicians receive all cash flow until their initial investment is returned followed by a split of cash flow after all their equity is returned. This structure is much easier to explain and understand and the economics are equivalent to a standard waterfall.” noted Mark Toothacre, CEO of Pacific Medical Buildings.

Existing Medical Office Buildings

Many health systems own the medical office buildings on their campus. These also provide a chance to structure partnerships with physicians while monetizing these assets. Such arrangements can be used by hospitals or healthcare systems that own medical offices or standalone medical retail buildings as an incentive to retain medical staff. The system usually maintains a controlling interest in the property. For example, MemorialCare Health System in Orange County has sold fractional interests to physicians and other syndicates in seven different pieces of medically related real estate.

Another hospital system in Orange County, offered a syndicate for one of its office buildings to a group of its affiliated physicians. Constructed in 1993, the debt on the structure was recently retired, and the hospital was looking for a way to retain some of its physicians, particularly primary care practitioners. As noted, primary care doctors are at the low end of the earning scale in medicine and they have historically been prohibited from investing in most joint ventures. The hospital viewed this as a unique opportunity to include this group.

The hospital retained a majority stake in the building with certain conditions attached to those wishing to invest. Primary care physicians were offered the first tranche of investments, followed by other members of the medical staff, and finally physicians who were affiliated or held privileges at the system’s hospitals.

Altogether, some 250 physicians – about half of whom were primary care doctors -- invested a total of $13 million, with the transaction fully funded in about two weeks. Some doctors were able to invest as little as $25,000. The number of fractional shares each physician was able to purchase was capped. If a physician leaves the group or surrenders their affiliation, they must sell their shares back to the hospital. The deal was structured as a very conservative investment, cash on ca with no debt, allowing for immediate cash on cash-return of 6%. The hospital retained unsold shares which could be offered at current market value as a recruitment tool for new primary care physicians. This demonstrates one of the few ways that health systems can create coinvestment opportunities with primary care physicians.

There are many laws and regulations that govern how hospitals and systems can enter into financial arrangements with physicians. While quite complicated, the basic rules are that all transactions must be based on fair market values, arms-length, and commercially reasonable. Thus, all syndication must be supported by appraisals, valuations and strict legal review.

The renewed approach to physician syndication is now fairly straightforward. The physicians within a group medical practice make fractional investments in the property (sometimes no more than the low five figures) in a Limited Liability Partnership. Securities rules vary from state to state, but most are referred to as “Reg D” private placement offerings. Typical regulations include the minimum net worth of each investor, the number of investors, and the location of investors (intrastate). Retirement funds are often used, however, if the physician is a tenant in the building this is generally not allowed. The shares can be included as part of the physician’s family trust. Larger medical groups can make the investment on behalf of each physician, allowing their shares to vest after a certain period of time has passed.

A minimum return on investment is often underwritten so there is immediate cash flow for these syndicates, allowing dividend payments from the onset. Real estate investors, or a sponsoring hospital or system, can also co-invest and provide financing if construction is involved. In all of these situations, the physicians themselves have no personal liability attached to the project or syndicate.

The End Result

What does a syndicate look like when a property is liquidated? The Southern California Orthopedic Institute (SCOI) in the San Fernando Valley offers a good example. The group of orthopedic surgeons owned the building through a syndicate formed via shares in an S-corporation. SCOI was engaged in a long-term ground lease with Valley Presbyterian. The 90,000 square foot build-to-suit facility, adjacent to Valley Presbyterian Medical Center in Van Nuys, was built in the early 1990s. A significant amount of space in the building was also leased out to third party physicians. As the mortgage on the building was nearing payoff, “we got the idea that perhaps we could do a sale leaseback and we could monetize the leasehold interest,” said Steve Goodman, SCOI’s Vice President of Finance.

In 2008, the syndicate of SCOI physicians who owned the building sold the property to a real estate investment trust. Although SCOI will continue to pay rent on the building for the foreseeable future, its individual physicians reaped the benefit of a market where values increased four to fivefold between the early 1990s and late last decade.

While the physicians were able to harvest a nice return, the hospital continues to own and control the uses in the building and the medical group was and continues to be major admitters to the hospital.

Carefully crafted, conservative and compliant real estate deals can be an important part of the tool kit that a hospital or health system can use to recruit and retain primary care physicians.

Related Stories

Market Data | Apr 11, 2023

Construction crane count reaches all-time high in Q1 2023

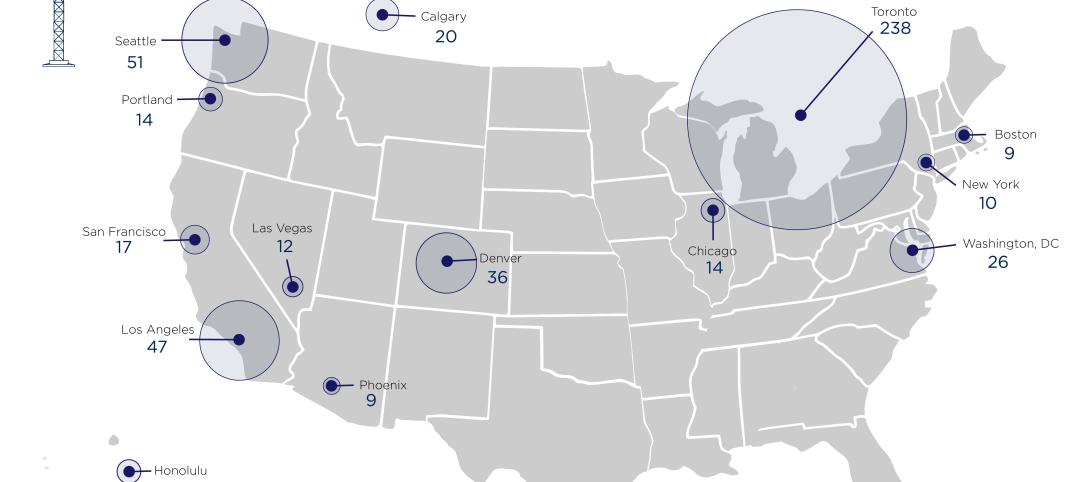

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 10, 2023

What makes prefabrication work? Factors every construction project should consider

There are many factors requiring careful consideration when determining whether a project is a good fit for prefabrication. JE Dunn’s Brian Burkett breaks down the most important considerations.

Architects | Apr 6, 2023

New tool from Perkins&Will will make public health data more accessible to designers and architects

Called PRECEDE, the dashboard is an open-source tool developed by Perkins&Will that draws on federal data to identify and assess community health priorities within the U.S. by location. The firm was recently awarded a $30,000 ASID Foundation Grant to enhance the tool.

Sustainability | Apr 4, 2023

NIBS report: Decarbonizing the U.S. building sector will require massive, coordinated effort

Decarbonizing the building sector will require a massive, strategic, and coordinated effort by the public and private sectors, according to a report by the National Institute of Building Sciences (NIBS).

Healthcare Facilities | Mar 26, 2023

UC Davis Health opens new eye institute building for eye care, research, and training

UC Davis Health recently marked the opening of the new Ernest E. Tschannen Eye Institute Building and the expansion of the Ambulatory Care Center (ACC). Located in Sacramento, Calif., the Eye Center provides eye care, vision research, and training for specialists and investigators. With the new building, the Eye Center’s vision scientists can increase capacity for clinical trials by 50%.

Healthcare Facilities | Mar 25, 2023

California medical center breaks ground on behavioral health facility for both adults and children

In San Jose, Calif., Santa Clara Valley Medical Center (SCVMC) has broken ground on a new behavioral health facility: the Child, Adolescent, and Adult Behavioral Health Services Center. Designed by HGA, the center will bring together under one roof Santa Clara County’s behavioral health offerings, including Emergency Psychiatric Services and Urgent Care.

Healthcare Facilities | Mar 22, 2023

New Jersey’s new surgical tower features state’s first intraoperative MRI system

Hackensack (N.J.) University Medical Center recently opened its 530,000-sf Helena Theurer Pavilion, a nine-story surgical and intensive care tower designed by RSC Architects and Page. The county’s first hospital, Hackensack University Medical Center, a 781-bed nonprofit teaching and research hospital, was founded in 1888.

Project + Process Innovation | Mar 22, 2023

Onsite prefabrication for healthcare construction: It's more than a process, it's a partnership

Prefabrication can help project teams navigate an uncertain market. GBBN's Mickey LeRoy, AIA, ACHA, LEED AP, explains the difference between onsite and offsite prefabrication methods for healthcare construction projects.

Modular Building | Mar 20, 2023

3 ways prefabrication doubles as a sustainability strategy

Corie Baker, AIA, shares three modular Gresham Smith projects that found sustainability benefits from the use of prefabrication.

Building Tech | Mar 14, 2023

Reaping the benefits of offsite construction, with ICC's Ryan Colker

Ryan Colker, VP of Innovation at the International Code Council, discusses how municipal regulations and inspections are keeping up with the expansion of off-site manufacturing for commercial construction. Colker speaks with BD+C's John Caulfield.