At the end of the first quarter of 2019, analysts at Lodging Econometrics (LE) reported that the total U.S. construction pipeline continued to expand with 5,647 projects/687,941 rooms, up a strong 7% by projects and 8% by rooms year-over-year (YOY). Pipeline totals are a mere 236 projects, or 4%, shy of the all-time high of 5,883 projects/785,547 rooms reached in the second quarter of 2008. The record should be pierced later in the year. Conversions and renovations are already at record levels.

Projects currently under construction stand at 1,709 projects/227,924 rooms with projects scheduled to start construction in the next 12 months at 2,429 projects/281,395 rooms. Projects in the early planning stage stand at 1,509 projects/178,622 rooms.

The upscale, upper-midscale, and midscale chain scales, all reached record-highs for both projects and rooms. Sixty-six percent of projects in the total pipeline are concentrated in two chain scales: upscale and upper midscale.

Annualized construction starts are at the highest level since 2008. In 2019, LE forecasts a 2.2% supply growth rate with 1,038 new hotels/118,385 rooms expected to open. For 2020, LE anticipates 1,174 new hotel openings and 128,598 rooms.

Hotel operations had a good quarter but mostly from expense improvements. Only 7 of the top 25 markets showed occupancy increases, quarter-over-quarter (QOQ). Only 11 markets had rev-par increases. Overall, U.S. demand growth was up 2.4% while supply was up 2%.

Leading Markets in the U.S. Hotel Construction Pipeline

In the first quarter of 2019, analysts at Lodging Econometrics (LE) report that the top five markets with the largest hotel construction pipelines are New York City with 170 projects/29,247 rooms. Next are Dallas and Los Angeles, both at record highs, with 163 projects/19,689 rooms and 158 projects/25,578 rooms, respectively. Houston follows with 151 projects/15,643 rooms, and Nashville with 116 projects/15,599 rooms.

Markets with the greatest number of projects already under construction are New York with 119 projects/20,068 rooms, Dallas with 48 projects/6,265 rooms, and Los Angeles with 42 projects/6,288 rooms. Houston has 36 projects/4,162 rooms while Nashville, Austin, and San Jose all have 34 projects presently under construction.

Reflective of the increasing pipeline, LE’s forecast for new hotel openings will continue to rise through 2020. In 2019, New York City tops the list with 63 new hotels expected to open with 9,605 rooms, followed by Dallas with 30 projects/3,604 rooms, Houston with 28 projects/3,342 rooms, Austin with 25 projects/2,512 rooms, and Nashville with 23 projects/3,030 rooms. In the 2020 forecast, New York continues to lead with the highest number of new hotels anticipated to open with 44 projects/6,225 rooms followed by Los Angeles with 35 projects/5,140 rooms and Dallas with 33 projects/4,163 rooms.

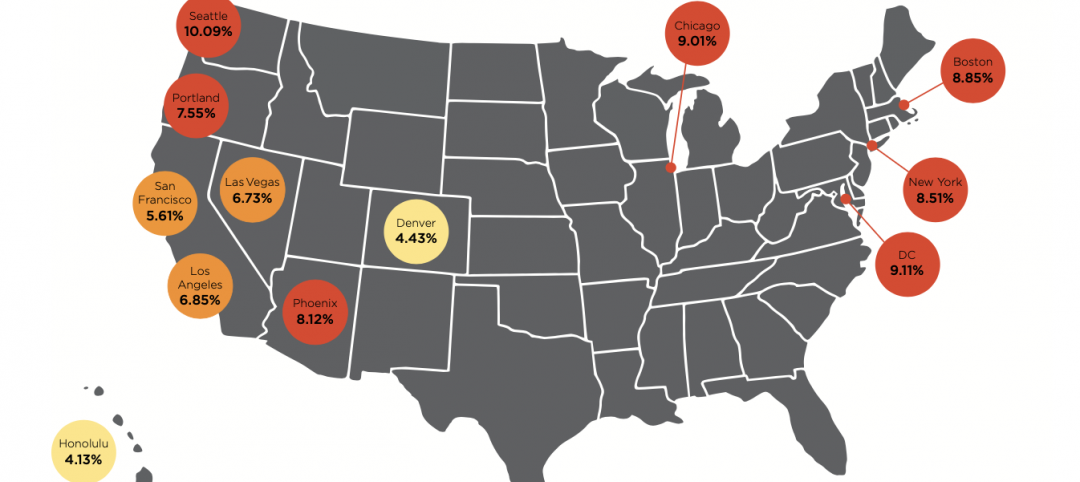

The number of markets where supply growth is now exceeding demand growth continues to increase. At the first quarter, 18 of the top 25 markets experienced the shift, up from 12 of the top 25 markets at the end of the fourth quarter of 2018.

Markets of concern where new supply is already outpacing demand and future new openings are forecasted to be high are Houston, New York, Dallas, and Los Angeles.

Related Stories

Market Data | Jan 7, 2022

Construction adds 22,000 jobs in December

Jobless rate falls to 5% as ongoing nonresidential recovery offsets rare dip in residential total.

Market Data | Jan 6, 2022

Inflation tempers optimism about construction in North America

Rider Levett Bucknall’s latest report cites labor shortages and supply chain snags among causes for cost increases.

Market Data | Jan 6, 2022

A new survey offers a snapshot of New York’s construction market

Anchin’s poll of 20 AEC clients finds a “growing optimism,” but also multiple pressure points.

Market Data | Jan 3, 2022

Construction spending in November increases from October and year ago

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate.

Market Data | Dec 22, 2021

Two out of three metro areas add construction jobs from November 2020 to November 2021

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months.

Market Data | Dec 17, 2021

Construction jobs exceed pre-pandemic level in 18 states and D.C.

Firms struggle to find qualified workers to keep up with demand.

Market Data | Dec 15, 2021

Widespread steep increases in materials costs in November outrun prices for construction projects

Construction officials say efforts to address supply chain challenges have been insufficient.

Market Data | Dec 15, 2021

Demand for design services continues to grow

Changing conditions could be on the horizon.

Market Data | Dec 5, 2021

Construction adds 31,000 jobs in November

Gains were in all segments, but the industry will need even more workers as demand accelerates.

Market Data | Dec 5, 2021

Construction spending rebounds in October

Growth in most public and private nonresidential types is offsetting the decline in residential work.