TOP CONTRACTORS

2012 Total Revenue ($)1 Turner Corporation, The $9,084,870,0002 Fluor $4,268,290,5003 Skanska USA $4,076,092,8144 PCL Construction Enterprises $3,981,419,1645 Whiting-Turner Contracting Co., The $3,699,782,7716 Clark Group $3,563,246,7197 Balfour Beatty $3,453,790,8478 Gilbane $3,083,529,0009 Structure Tone $2,947,433,00010 McCarthy Holdings $2,546,000,000

TOP CONSTRUCTION MANAGEMENT FIRMS

2012 Total Revenue ($)1 URS Corp. $297,282,0762 STV $227,390,0003 JE Dunn Construction $207,304,1544 Barton Malow $182,697,8975 Parsons Brinckerhoff $179,900,0006 S. M. Wilson & Co. $168,859,7407 Turner Corporation, The $157,920,0008 Jones Lang LaSalle $140,020,0009 LPCiminelli $139,198,32910 Structure Tone $132,000,000

Read BD+C's full Giants 300 Report

Related Stories

Higher Education | Aug 22, 2023

How boldly uniting divergent disciplines boosts students’ career viability

CannonDesign's Charles Smith and Patricia Bou argue that spaces designed for interdisciplinary learning will help fuel a strong, resilient generation of students in an ever-changing economy.

Apartments | Aug 22, 2023

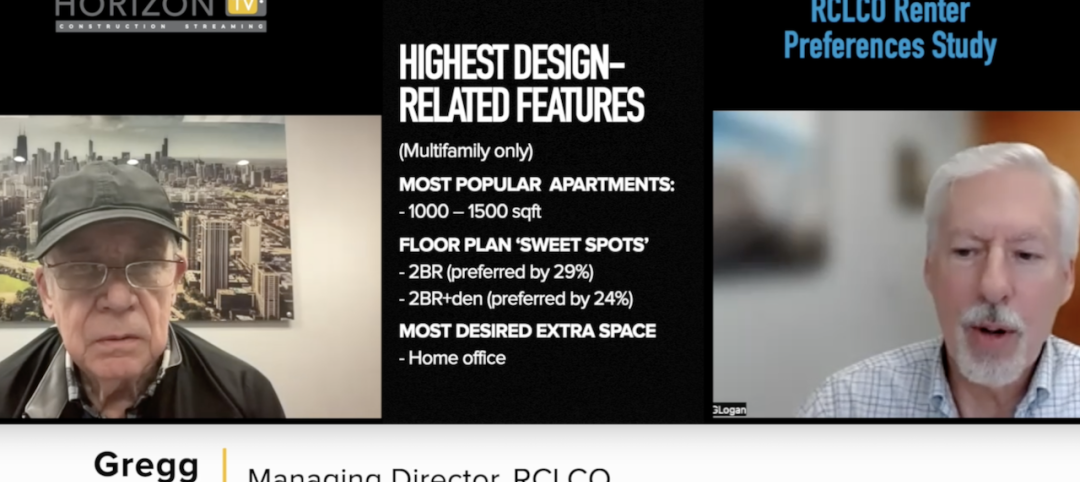

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Shopping Centers | Aug 22, 2023

The mall of the future

There are three critical aspects of mall design that, through evolution, have proven to be instrumental in the staying power of a retail destination: parking, planning, and customer experience. This are crucial to the mall of the future.

Affordable Housing | Aug 21, 2023

Essential housing: What’s in a name?

For many in our communities, rising rents and increased demand for housing means they are only one paycheck away from being unhoused. It’s time to stop thinking of affordable housing as a handout and start calling it what it is: Essential Housing.

Healthcare Facilities | Aug 21, 2023

Sutter Health’s new surgical care center finishes three months early, $3 million under budget

Sutter Health’s Samaritan Court Ambulatory Care and Surgery Center (Samaritan Court), a three-story, 69,000 sf medical office building, was recently completed three months early and $3 million under budget, according to general contractor Skanska.

Healthcare Facilities | Aug 18, 2023

Psychiatric hospital to feature biophilic elements, aim for net-zero energy

A new 521,000 sf, 350-bed behavioral health hospital in Lakewood, Wash., a Tacoma suburb, will serve forensic patients who enter care through the criminal court system, freeing other areas of campus to serve civil patients. The facility at Western State Hospital, to be designed by HOK, will promote a holistic approach to rehabilitation as part of the state’s vision for transforming behavioral health.

Vertical Transportation | Aug 17, 2023

Latest version of elevator safety code has more than 100 changes

A new version of ASME A17.1/CSA B44, a safety code for elevators, escalators, and related equipment developed by the American Society of Mechanical Engineers, will be released next month.

Adaptive Reuse | Aug 16, 2023

One of New York’s largest office-to-residential conversions kicks off soon

One of New York City’s largest office-to-residential conversions will soon be underway in lower Manhattan. 55 Broad Street, which served as the headquarters for Goldman Sachs from 1967 until 1983, will be reborn as a residence with 571 market rate apartments. The 30-story building will offer a wealth of amenities including a private club, wellness and fitness activities.

Sustainability | Aug 15, 2023

Carbon management platform offers free carbon emissions assessment for NYC buildings

nZero, developer of a real-time carbon accounting and management platform, is offering free carbon emissions assessments for buildings in New York City. The offer is intended to help building owners prepare for the city’s upcoming Local Law 97 reporting requirements and compliance. This law will soon assess monetary fines for buildings with emissions that are in non-compliance.

Office Buildings | Aug 15, 2023

Amount of office space in U.S. is declining for the first time, says JLL

In what is likely a historic first, the amount of office space in the U.S. is forecast to decline in 2023, according to Jones Lang LaSalle. This would be the first net decline according to data going back to 2000, JLL says, and it’s likely the first decline ever.