TOP CONTRACTORS

2012 Total Revenue ($)1 Turner Corporation, The $9,084,870,0002 Fluor $4,268,290,5003 Skanska USA $4,076,092,8144 PCL Construction Enterprises $3,981,419,1645 Whiting-Turner Contracting Co., The $3,699,782,7716 Clark Group $3,563,246,7197 Balfour Beatty $3,453,790,8478 Gilbane $3,083,529,0009 Structure Tone $2,947,433,00010 McCarthy Holdings $2,546,000,000

TOP CONSTRUCTION MANAGEMENT FIRMS

2012 Total Revenue ($)1 URS Corp. $297,282,0762 STV $227,390,0003 JE Dunn Construction $207,304,1544 Barton Malow $182,697,8975 Parsons Brinckerhoff $179,900,0006 S. M. Wilson & Co. $168,859,7407 Turner Corporation, The $157,920,0008 Jones Lang LaSalle $140,020,0009 LPCiminelli $139,198,32910 Structure Tone $132,000,000

Read BD+C's full Giants 300 Report

Related Stories

Affordable Housing | Apr 1, 2024

Chicago voters nix ‘mansion tax’ to fund efforts to reduce homelessness

Chicago voters in March rejected a proposed “mansion tax” that would have funded efforts to reduce homelessness in the city.

Standards | Apr 1, 2024

New technical bulletin covers window opening control devices

A new technical bulletin clarifies the definition of a window opening control device (WOCD) to promote greater understanding of the role of WOCDs and provide an understanding of a WOCD’s function.

Adaptive Reuse | Mar 30, 2024

Hotel vs. office: Different challenges in commercial to residential conversions

In the midst of a national housing shortage, developers are examining the viability of commercial to residential conversions as a solution to both problems.

Sustainability | Mar 29, 2024

Demystifying carbon offsets vs direct reductions

Chris Forney, Principal, Brightworks Sustainability, and Rob Atkinson, Senior Project Manager, IA Interior Architects, share the misconceptions about carbon offsets and identify opportunities for realizing a carbon-neutral building portfolio.

Reconstruction & Renovation | Mar 28, 2024

Longwood Gardens reimagines its horticulture experience with 17-acre conservatory

Longwood Gardens announced this week that Longwood Reimagined: A New Garden Experience, the most ambitious revitalization in a century of America’s greatest center for horticultural display, will open to the public on November 22, 2024.

Office Buildings | Mar 27, 2024

A new Singapore office campus inaugurates the Jurong Innovation District, a business park located in a tropical rainforest

Surbana Jurong, an urban, infrastructure and managed services consulting firm, recently opened its new headquarters in Singapore. Surbana Jurong Campus inaugurates the Jurong Innovation District, a business park set in a tropical rainforest.

Cultural Facilities | Mar 27, 2024

Kansas City’s new Sobela Ocean Aquarium home to nearly 8,000 animals in 34 habitats

Kansas City’s new Sobela Ocean Aquarium is a world-class facility home to nearly 8,000 animals in 34 habitats ranging from small tanks to a giant 400,000-gallon shark tank.

Market Data | Mar 26, 2024

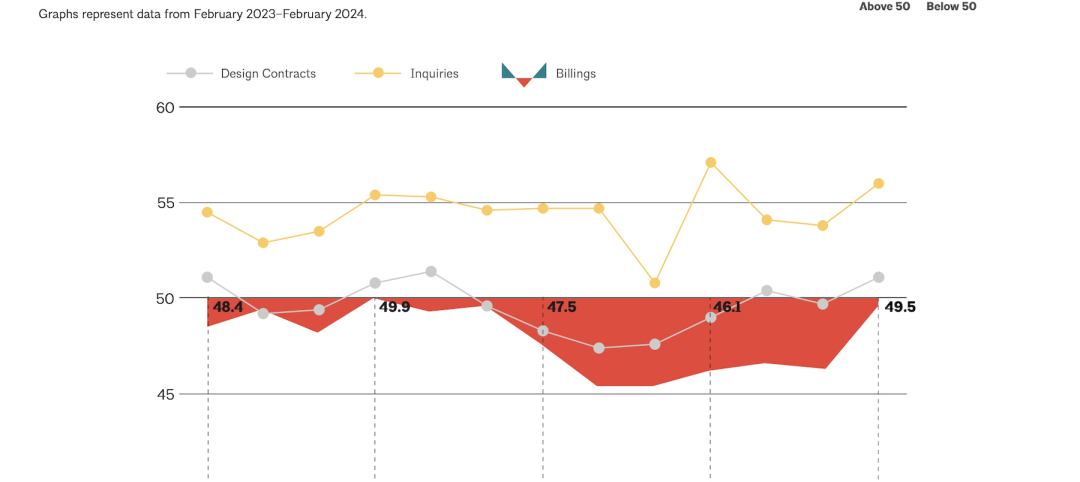

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

Cultural Facilities | Mar 26, 2024

Renovation restores century-old Brooklyn Paramount Theater to its original use

The renovation of the iconic Brooklyn Paramount Theater restored the building to its original purpose as a movie theater and music performance venue. Long Island University had acquired the venue in the 1960s and repurposed it as the school’s basketball court.

Adaptive Reuse | Mar 26, 2024

Adaptive Reuse Scorecard released to help developers assess project viability

Lamar Johnson Collaborative announced the debut of the firm’s Adaptive Reuse Scorecard, a proprietary methodology to quickly analyze the viability of converting buildings to other uses.