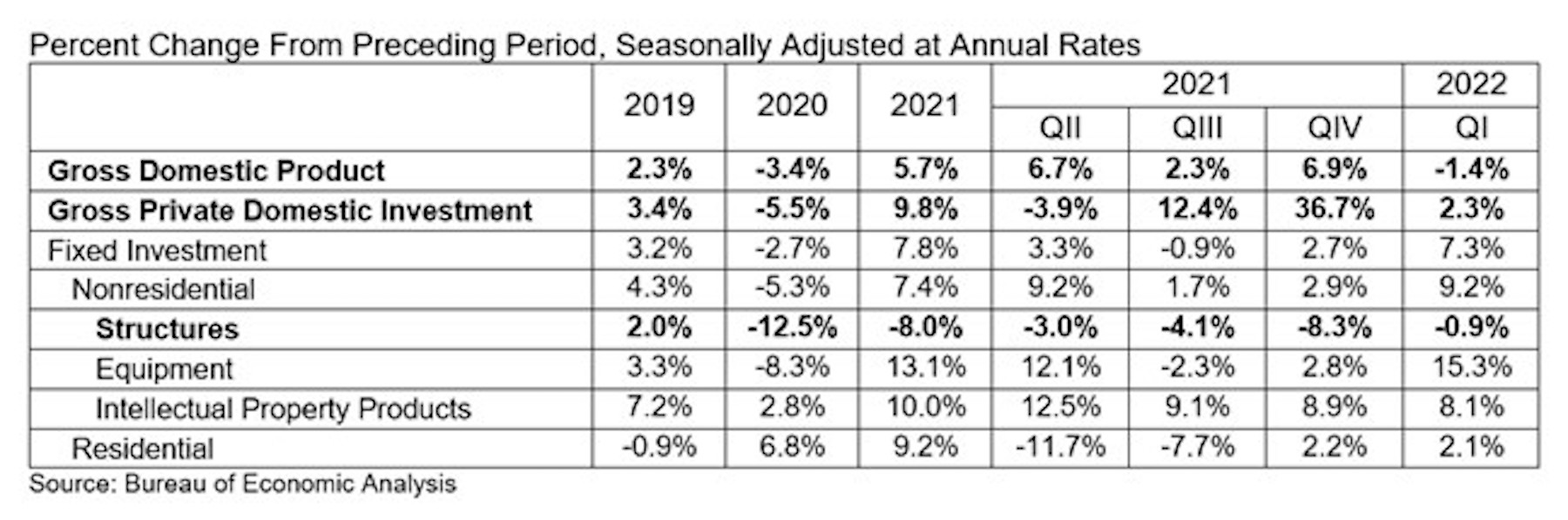

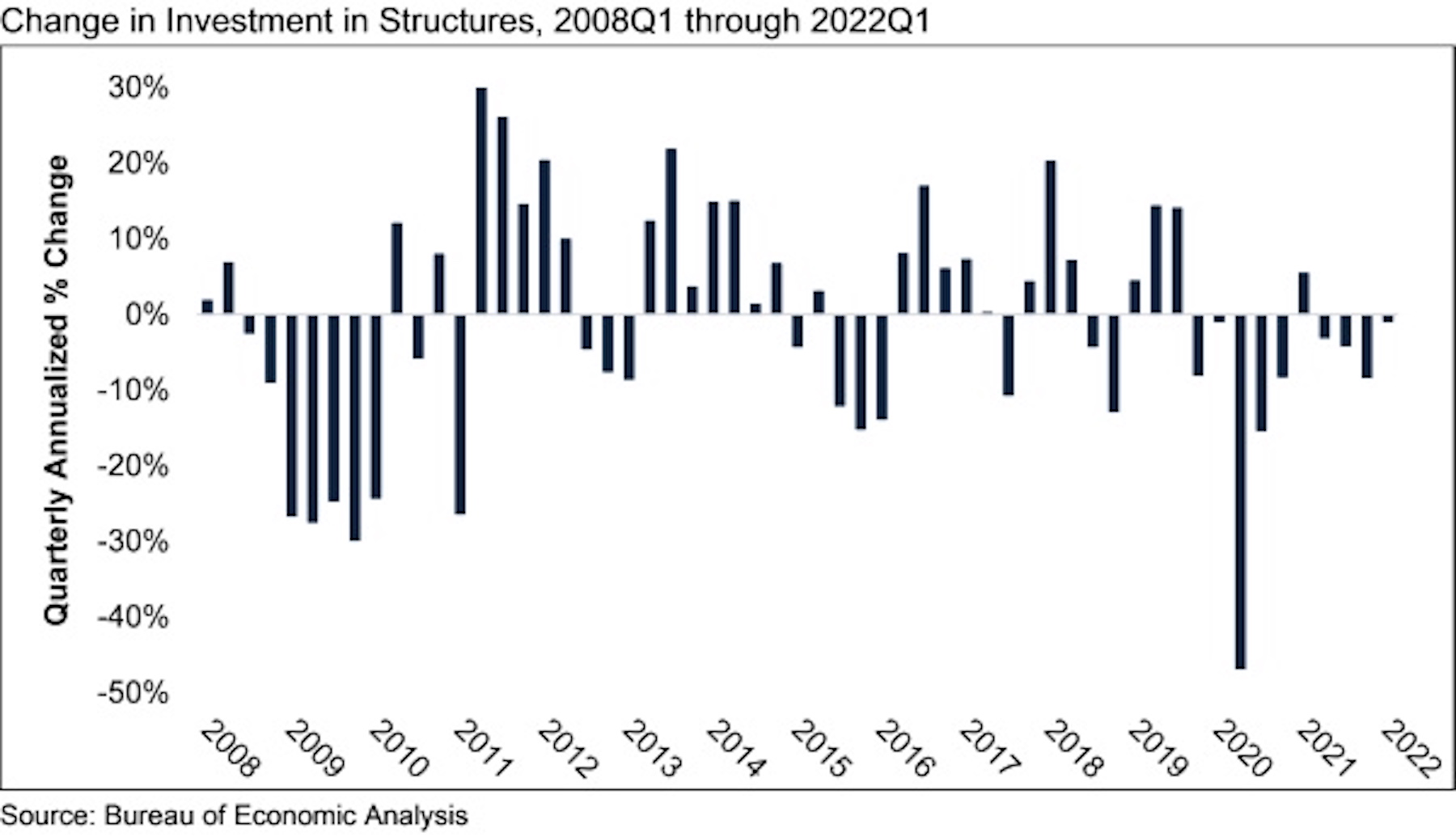

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022. Investment in nonresidential structures declined at an annual rate of 0.9% during the quarter and has contracted nine of the past 10 quarters, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Economic Analysis.

“The economy’s woeful performance during 2022’s first quarter complicates matters,” said ABC Chief Economist Anirban Basu. “Conventional wisdom says the economy has enough momentum to contend with the tighter monetary policy the Federal Reserve is pursuing to countervail inflation. Today’s data indicate that the economy is weaker than thought, which means the Federal Reserve will have a very difficult time curbing inflation without driving the economy into recession in late 2022 or 2023.

“That said, the economy should manage to generate some positive momentum during the next two to three quarters,” said Basu. “Consumer demand for goods and services remains strong. The omicron variant affected the economy during the first quarter and that does not appear to be the case during the second. Global supply chains have been adjusting to the dislocations caused by the Russian-Ukraine war. Many state and local governments are flush with cash and continue to plan for a period of elevated infrastructure outlays.

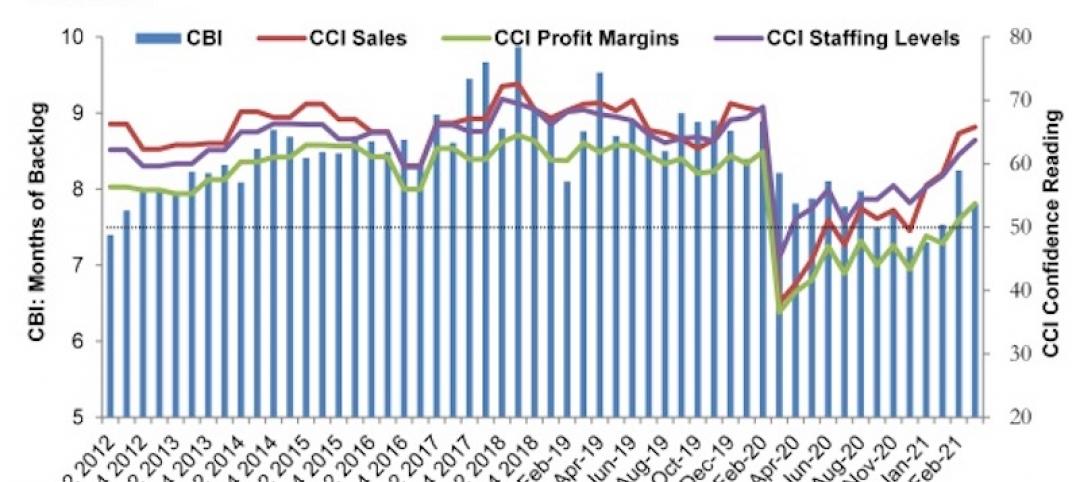

“There is one other bit of good news,” said Basu. “The weakness exhibited by the economy during the first quarter may persuade monetary policymakers to raise interest rates less aggressively. This is a matter of significance for nonresidential contractors, who have become less confident in recent months, according to ABC’s Construction Confidence Indicator. Investment in structures continues to decline in America, in part due to weakness in office, lodging and shopping mall segments. Presumably, additional rapid increases in borrowing costs would further dampen new construction in these categories. It may be that the Federal Reserve will raise interest rates more gradually than they would have knowing that the U.S. economy is already rather fragile.”

Related Stories

Market Data | May 7, 2021

Construction employment stalls in April

Soaring costs, supply-chain challenges, and workforce shortages undermine industry's recovery.

Market Data | May 4, 2021

Nonresidential construction outlays drop in March for fourth-straight month

Weak demand, supply-chain woes make further declines likely.

Market Data | May 3, 2021

Nonresidential construction spending decreases 1.1% in March

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories.

Market Data | Apr 30, 2021

New York City market continues to lead the U.S. Construction Pipeline

New York City has the greatest number of projects under construction with 110 projects/19,457 rooms.

Market Data | Apr 29, 2021

U.S. Hotel Construction pipeline beings 2021 with 4,967 projects/622,218 rooms at Q1 close

Although hotel development may still be tepid in Q1, continued government support and the extension of programs has aided many businesses to get back on their feet as more and more are working to re-staff and re-open.

Market Data | Apr 28, 2021

Construction employment declines in 203 metro areas from March 2020 to March 2021

The decline occurs despite homebuilding boom and improving economy.

Market Data | Apr 20, 2021

The pandemic moves subs and vendors closer to technology

Consigli’s latest market outlook identifies building products that are high risk for future price increases.

Market Data | Apr 20, 2021

Demand for design services continues to rapidly escalate

AIA’s ABI score for March rose to 55.6 compared to 53.3 in February.

Market Data | Apr 16, 2021

Construction employment in March trails March 2020 mark in 35 states

Nonresidential projects lag despite hot homebuilding market.

Market Data | Apr 13, 2021

ABC’s Construction Backlog slips in March; Contractor optimism continues to improve

The Construction Backlog Indicator fell to 7.8 months in March.