The U.S. economy grew at an annual rate of 2.6% in the fourth quarter of 2018, according to an Associated Builders and Contractors analysis of data published today by the U.S. Bureau of Economic Analysis. Year-over-year GDP growth was 3.1%, while average growth for 2018 was 2.9%.

“Today’s GDP report confirms continued strong investment in nonresidential segments in America,” said ABC Chief Economist Anirban Basu. “Separately, construction spending data show significant expenditures on the construction of data centers, hotel rooms, theme parks and fulfillment centers. These data also indicate stepped up public construction spending in categories such as transportation, education, and water systems. Despite that, today’s GDP release indicated that investment in nonresidential structures actually declined 4.2% on an annualized basis during last year’s fourth quarter. Despite that setback, this form of investment was up by 5% for the entirety of 2018.

“Undoubtedly, some attention will be given to the fact that the U.S. economy expanded by just shy of 3% in 2018,” said Basu. “Unless that figure is revised upward in subsequent releases, it will mean that America has failed to reach the 3% annual threshold since 2005. But while much attention will be given to a perceived shortfall in growth, the fourth quarter figure of 2.6% signifies that the U.S. economy entered this year with substantial momentum. Were it not for a weak residential construction sector, 3% growth would have been attained. Moreover, the data indicate strength in disposable income growth and in business investment.

“It is quite likely that the U.S. economy will expand at around 2% this year,” said Basu. “Though interest rates remain low and hiring is still brisk, a number of leading indicators suggest that the nation’s economy will soften somewhat during the quarters ahead, which can be partly attributed to a weakening global economy. This won’t unduly impact nonresidential construction activity, however, since the pace of activity in this segment tends to lag the overall economy, and strong nonresidential construction spending expected in 2019. Finally, ABC’s Construction Backlog Indicator continues to reflect strong demand for contractors, which have nearly nine months of work lined up.”

Related Stories

Market Data | Dec 4, 2019

Nonresidential construction spending falls in October

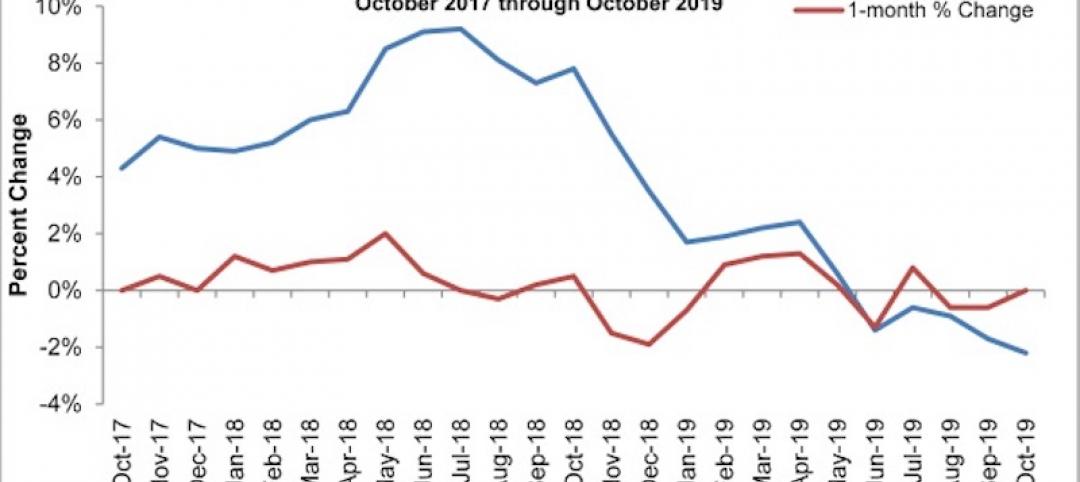

Private nonresidential spending fell 1.2% on a monthly basis and is down 4.3% from October 2018.

Market Data | Nov 25, 2019

Office construction lifts U.S. asking rental rate, but slowing absorption in Q3 raises concerns

12-month net absorption decelerates by one-third from 2018 total.

Market Data | Nov 22, 2019

Architecture Billings Index rebounds after two down months

The Architecture Billings Index (ABI) score in October is 52.0.

Market Data | Nov 14, 2019

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.

Market Data | Nov 4, 2019

Nonresidential construction spending rebounds slightly in September

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year.

Market Data | Nov 1, 2019

GDP growth expands despite reduction in nonresident investment

The annual rate for nonresidential fixed investment in structures declined 15.3% in the third quarter.

Market Data | Oct 24, 2019

Architecture Billings Index downturn moderates as challenging conditions continue

The Architecture Billings Index (ABI) score in September is 49.7.

Market Data | Oct 23, 2019

ABC’s Construction Backlog Indicator rebounds in August

The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.