The US construction & real estate industry saw a drop of 30.4% in overall deal activity during December 2019, when compared with the last 12-month average, according to GlobalData’s deals database.

A total of 48 deals worth $505.11m were announced in December 2019, compared to the 12-month average of 69 deals.

M&A was the leading category in the month in terms of volume with 34 deals which accounted for 70.8% of all deals.

In second place was private equity with 11 deals, followed by venture financing with three transactions, respectively accounting for 22.9% and 6.3% of overall deal activity in the country's construction & real estate industry during the month.

In terms of value of deals, M&A was the leading deal category in the US construction & real estate industry with total deals worth $463.1m, while private equity and venture financing deals totalled $40.21m and $1.8m, respectively.

US construction & real estate industry deals in December 2019: Top deals

The top five construction & real estate industry deals accounted for 99.6% of the overall value during December 2019.

The combined value of the top five construction & real estate deals stood at $503m, against the overall value of $505.11m recorded for the month.

The top five construction & real estate industry deals of December 2019 tracked by GlobalData were:

1. Huntsman's $350m acquisition of Icynene-Lapolla

2. The $92m acquisition of NewSouth Window Solutions by PGT Innovations

3. Accomplice, Insight Partners, JLL Spark Global Venture Fund, Navitas Capital and Pritzker Group Venture Capital's $34.2m venture financing of HqO

4. The $20.8m asset transaction with CBL & Associates Properties by Horizon Group Properties

5. Halogen Ventures, Link Ventures, LLLP, Luma Launch, Rest Seed Fund, Techstars Ventures and Western Technology Investment's venture financing of Trust & Will for $6m.

Related Stories

AEC Tech | Jan 16, 2020

EC firms with a clear ‘digital roadmap’ should excel in 2020

Deloitte, in new report, lays out a risk mitigation strategy that relies on tech.

Market Data | Jan 13, 2020

Construction employment increases by 20,000 in December and 151,000 in 2019

Survey finds optimism about 2020 along with even tighter labor supply as construction unemployment sets record December low.

Market Data | Jan 10, 2020

North America’s office market should enjoy continued expansion in 2020

Brokers and analysts at two major CRE firms observe that tenants are taking longer to make lease decisions.

Market Data | Dec 17, 2019

Architecture Billings Index continues to show modest growth

AIA’s Architecture Billings Index (ABI) score of 51.9 for November reflects an increase in design services provided by U.S. architecture firms.

Market Data | Dec 12, 2019

2019 sets new record for supertall building completion

Overall, the number of completed buildings of at least 200 meters in 2019 declined by 13.7%.

Market Data | Dec 4, 2019

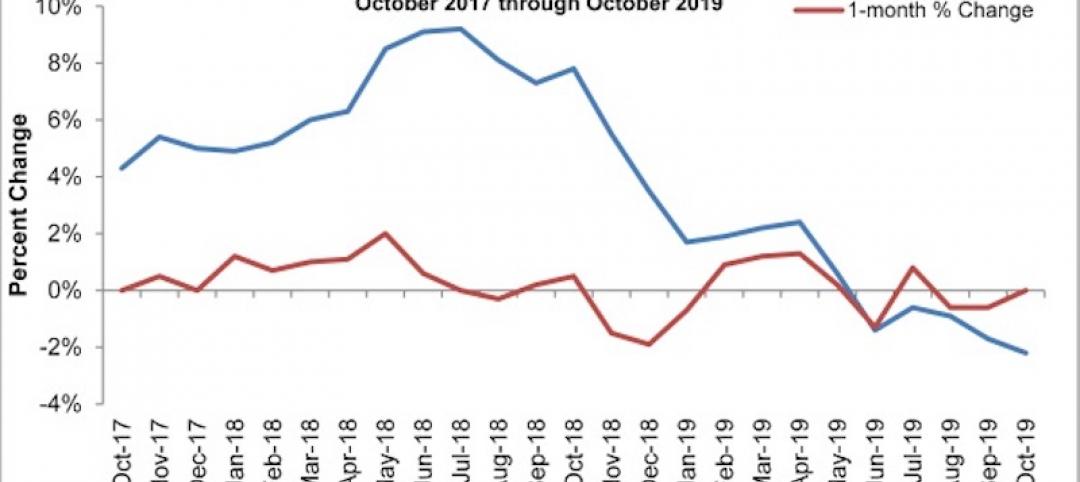

Nonresidential construction spending falls in October

Private nonresidential spending fell 1.2% on a monthly basis and is down 4.3% from October 2018.

Market Data | Nov 25, 2019

Office construction lifts U.S. asking rental rate, but slowing absorption in Q3 raises concerns

12-month net absorption decelerates by one-third from 2018 total.

Market Data | Nov 22, 2019

Architecture Billings Index rebounds after two down months

The Architecture Billings Index (ABI) score in October is 52.0.

Market Data | Nov 14, 2019

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.