The US construction & real estate industry saw a drop of 30.4% in overall deal activity during December 2019, when compared with the last 12-month average, according to GlobalData’s deals database.

A total of 48 deals worth $505.11m were announced in December 2019, compared to the 12-month average of 69 deals.

M&A was the leading category in the month in terms of volume with 34 deals which accounted for 70.8% of all deals.

In second place was private equity with 11 deals, followed by venture financing with three transactions, respectively accounting for 22.9% and 6.3% of overall deal activity in the country's construction & real estate industry during the month.

In terms of value of deals, M&A was the leading deal category in the US construction & real estate industry with total deals worth $463.1m, while private equity and venture financing deals totalled $40.21m and $1.8m, respectively.

US construction & real estate industry deals in December 2019: Top deals

The top five construction & real estate industry deals accounted for 99.6% of the overall value during December 2019.

The combined value of the top five construction & real estate deals stood at $503m, against the overall value of $505.11m recorded for the month.

The top five construction & real estate industry deals of December 2019 tracked by GlobalData were:

1. Huntsman's $350m acquisition of Icynene-Lapolla

2. The $92m acquisition of NewSouth Window Solutions by PGT Innovations

3. Accomplice, Insight Partners, JLL Spark Global Venture Fund, Navitas Capital and Pritzker Group Venture Capital's $34.2m venture financing of HqO

4. The $20.8m asset transaction with CBL & Associates Properties by Horizon Group Properties

5. Halogen Ventures, Link Ventures, LLLP, Luma Launch, Rest Seed Fund, Techstars Ventures and Western Technology Investment's venture financing of Trust & Will for $6m.

Related Stories

Market Data | Jun 9, 2020

ABC’s Construction Backlog Indicator inches higher in May; Contractor confidence continues to rebound

Nonresidential construction backlog is down 0.8 months compared to May 2019 and declined year over year in every industry.

Market Data | Jun 9, 2020

6 must reads for the AEC industry today: June 9, 2020

OSHA safety inspections fall 84% and the office isn't dead.

Market Data | Jun 8, 2020

Construction jobs rise by 464,000 jobs but remain 596,000 below recent peak

Gains in may reflect temporary support from paycheck protection program loans and easing of construction restrictions, but hobbled economy and tight state and local budgets risk future job losses.

Market Data | Jun 5, 2020

7 must reads for the AEC industry today: June 5, 2020

The world's first carbon-fiber reinforced concrete building and what will college be like in the fall?

Market Data | Jun 4, 2020

7 must reads for the AEC industry today: June 4, 2020

Construction unemployment declines in 326 of 358 metro areas and is the show over for AMC Theatres?

Market Data | Jun 3, 2020

Construction employment declines in 326 out of 358 metro areas in April

Association says new transportation proposal could help restore jobs.

Market Data | Jun 3, 2020

6 must reads for the AEC industry today: June 3, 2020

5 ways to improve cleanliness of public restrooms and office owners are in no hurry for tenants to return.

Market Data | Jun 2, 2020

Architects, health experts release strategies, tools for safely reopening buildings

AIA issues three new and enhanced tools for reducing risk of COVID-19 transmission in buildings.

Market Data | Jun 2, 2020

5 must reads for the AEC industry today: June 2, 2020

New Luxembourg office complex breaks ground and nonresidential construction spending falls.

Market Data | Jun 1, 2020

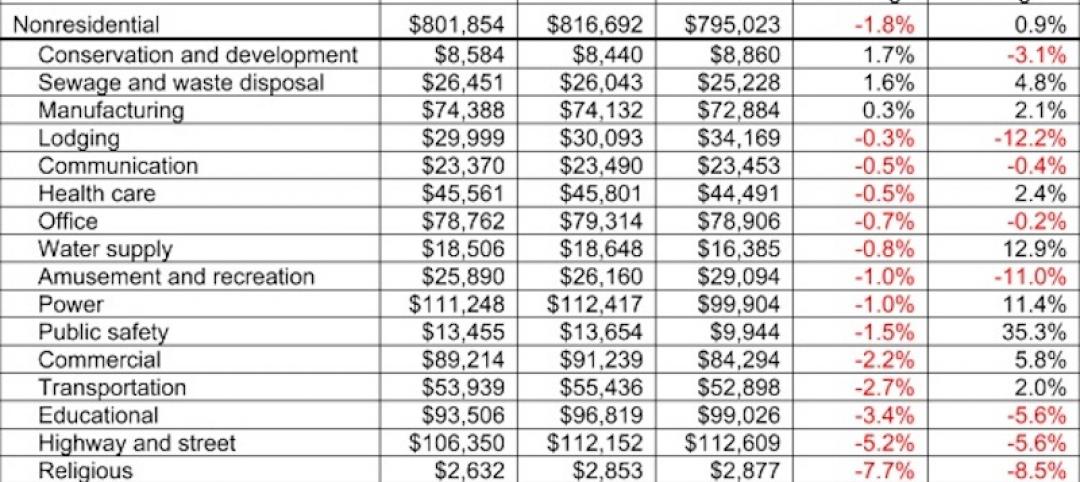

Nonresidential construction spending falls in April

Of the 16 subcategories, 13 were down on a monthly basis.