The US construction & real estate industry saw a drop of 30.4% in overall deal activity during December 2019, when compared with the last 12-month average, according to GlobalData’s deals database.

A total of 48 deals worth $505.11m were announced in December 2019, compared to the 12-month average of 69 deals.

M&A was the leading category in the month in terms of volume with 34 deals which accounted for 70.8% of all deals.

In second place was private equity with 11 deals, followed by venture financing with three transactions, respectively accounting for 22.9% and 6.3% of overall deal activity in the country's construction & real estate industry during the month.

In terms of value of deals, M&A was the leading deal category in the US construction & real estate industry with total deals worth $463.1m, while private equity and venture financing deals totalled $40.21m and $1.8m, respectively.

US construction & real estate industry deals in December 2019: Top deals

The top five construction & real estate industry deals accounted for 99.6% of the overall value during December 2019.

The combined value of the top five construction & real estate deals stood at $503m, against the overall value of $505.11m recorded for the month.

The top five construction & real estate industry deals of December 2019 tracked by GlobalData were:

1. Huntsman's $350m acquisition of Icynene-Lapolla

2. The $92m acquisition of NewSouth Window Solutions by PGT Innovations

3. Accomplice, Insight Partners, JLL Spark Global Venture Fund, Navitas Capital and Pritzker Group Venture Capital's $34.2m venture financing of HqO

4. The $20.8m asset transaction with CBL & Associates Properties by Horizon Group Properties

5. Halogen Ventures, Link Ventures, LLLP, Luma Launch, Rest Seed Fund, Techstars Ventures and Western Technology Investment's venture financing of Trust & Will for $6m.

Related Stories

Market Data | Mar 26, 2024

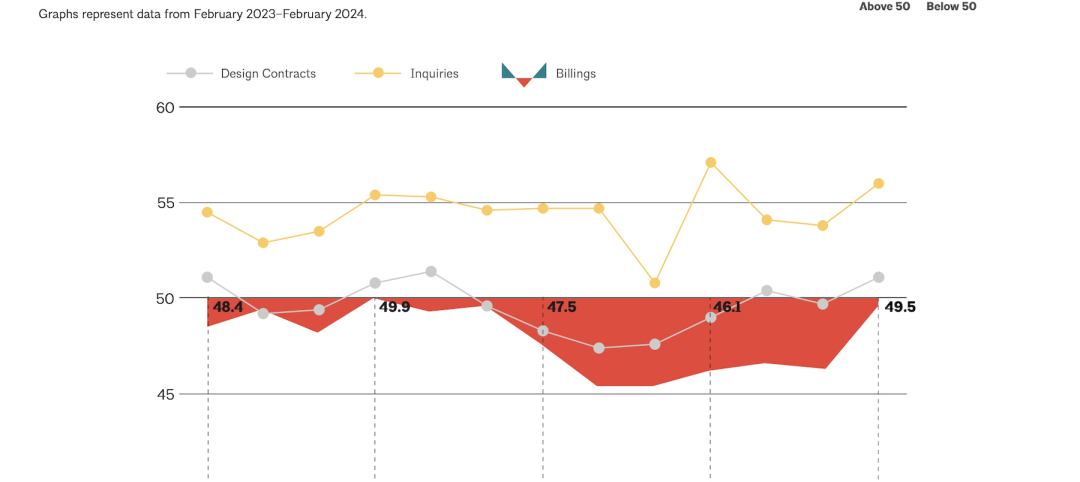

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

K-12 Schools | Mar 18, 2024

New study shows connections between K-12 school modernizations, improved test scores, graduation rates

Conducted by Drexel University in conjunction with Perkins Eastman, the research study reveals K-12 school modernizations significantly impact key educational indicators, including test scores, graduation rates, and enrollment over time.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.

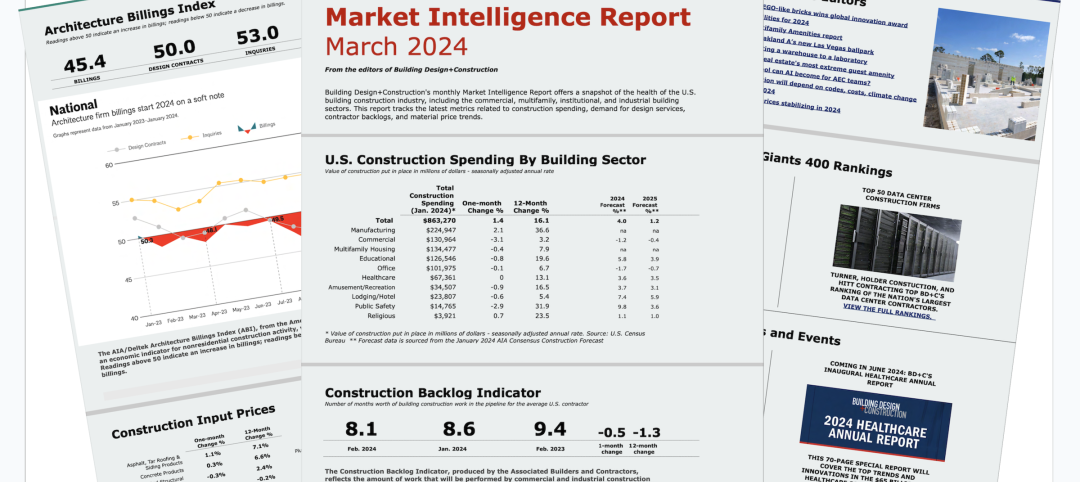

Market Data | Mar 14, 2024

Download BD+C's March 2024 Market Intelligence Report

U.S. construction spending on buildings-related work rose 1.4% in January, but project teams continue to face headwinds related to inflation, interest rates, and supply chain issues, according to Building Design+Construction's March 2024 Market Intelligence Report (free PDF download).

Contractors | Mar 12, 2024

The average U.S. contractor has 8.1 months worth of construction work in the pipeline, as of February 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.1 months in February, according to an ABC member survey conducted Feb. 20 to March 5. The reading is down 1.1 months from February 2023.

Market Data | Mar 6, 2024

Nonresidential construction spending slips 0.4% in January

National nonresidential construction spending decreased 0.4% in January, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.190 trillion.

Multifamily Housing | Mar 4, 2024

Single-family rentals continue to grow in BTR communities

Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

MFPRO+ News | Mar 2, 2024

Job gains boost Yardi Matrix National Rent Forecast for 2024

Multifamily asking rents broke the five-month streak of sequential average declines in January, rising 0.07 percent, shows a new special report from Yardi Matrix.

K-12 Schools | Feb 29, 2024

Average age of U.S. school buildings is just under 50 years

The average age of a main instructional school building in the United States is 49 years, according to a survey by the National Center for Education Statistics (NCES). About 38% of schools were built before 1970. Roughly half of the schools surveyed have undergone a major building renovation or addition.

MFPRO+ Research | Feb 27, 2024

Most competitive rental markets of early 2024

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report.