A recent Urban Land Institute survey of 38 leading real estate economists and analysts from across the U.S. projects broad improvements for the nation’s economy, real estate capital markets, real estate fundamentals, and the housing industry through 2014.

The findings mark the start of a semi-annual survey of economists, the ULI Real Estate Consensus Forecast, being conducted by the ULI Center for Capital Markets and Real Estate. The survey results show reason for optimism throughout much of the real estate industry. Over the next three years:

- Commercial property transaction volume is expected to increase by nearly 50%

- Issuance of commercial mortgage-backed securities (CMBS) is expected to more than double

- Institutional real estate assets and real estate investment trusts (REITs) are expected to provide returns ranging from 8.5% to 11% annually

- Vacancy rates are expected to drop in a range of between 1.2 and 3.7 percentage points for office, retail, and industrial properties and remain stable at low levels for apartments; while hotel occupancy rates will likely rise

- Rents are expected to increase for all property types, with 2012 increases ranging from 0.8% for retail up to 5.0% for apartments

- Housing starts will nearly double by 2014, and home prices will begin to rise in 2013, with prices increasing by 3.5% in 2014

These strong projections are based on a promising outlook for the overall economy. The survey results show the real gross domestic product (GDP) is expected to rise steadily from 2.5% this year to 3% in 2013 to 3.2% by 2014; the nation’s unemployment rate is expected to fall to 8.0% in 2012, 7.5% in 2013, and 6.9% by 2014; and the number of jobs created is expected to rise from and expected 2 million in 2012 to 2.5 million in 2013 to 2.75 million in 2014.

The improving economy, however, will likely lead to higher inflation and interest rates, which will raise the cost of borrowing for consumers and investors. For 2012, 2013 and 2014, inflation as measured by the Consumer Price Index (CPI) is expected to be 2.4%, 2.8% and 3.0%, respectively; and ten-year treasury rates will rise along with inflation, with a rate of 2.4% projected for 2012, 3.1% for 2013, and 3.8% for 2014.

The survey, conducted during late February and early March, is a consensus view and reflects the median forecast for 26 economic indicators, including property transaction volumes and issuance of commercial mortgage-backed securities; property investment returns, vacancy rates and rents for several property sectors; and housing starts and home prices. Comparisons are made on a year-by-year basis from 2009, when the nation was in the throes of recession, through 2014.

While the ULI Real Estate Consensus Forecast suggests that economic growth will be steady rather than sporadic, it must be viewed within the context of numerous risk factors such as the continuing impact of Europe’s debt crisis; the impact of the upcoming presidential election in the U.S. and major elections overseas; and the complexities of tighter financial regulations in the U.S. and abroad, said ULI Chief Executive Officer Patrick L. Phillips. “While geopolitical and global economic events could change the forecast going forward, what we see in this survey is confidence that the U.S. real estate economy has weathered the brunt of the recent financial storm and is poised for significant improvement over the next three years. These results hold much promise for the real estate industry.”

The survey results suggest a marked increase in commercial real estate activity, with total transaction volume expected to rise from $250 billion in 2012 to $312 billion in 2014. CBMS issuance, a key source of financing for commercial real estate, is expected to jump from $40 billion in 2012 to $75 billion in 2014 (a considerable increase from the recession’s low point of $3 billion in 2009).

Total returns for equity REITs are expected to be 10% in 2012, 9% in 2013 and 8.5% in 2014, a sharp decrease from the surging REIT returns of 28% in both 2009 and 2010, but settling closer to the more sustainable level seen in 2011.Total returns for institutional-quality real estate assets, as measured by the National Council of Real Estate Investment Fiduciaries Property Index, have also been strong over the past two years and these returns are expected to remain healthy, providing returns of 11% in 2012, 9.5% in 2013, and 8.5% in 2014.

“Commercial real estate returns for institutional quality and REIT assets have performed very well in recent years, and this performance is expected to remain strong but trend lower over the next three years,” said Dean Schwanke, executive director of the ULI Center for Capital Markets and Real Estate.

A slight cooling trend in the apartment sector – the investors’ darling for the past two years – is seen in the survey results, with other property types projected to gain momentum over the next two years. By property type, total returns for institutional quality assets in 2012 are expected to be strongest for apartments, at 12.1%; followed by industrial, at 11.5%; office, at 10.8%; and retail, at 10%. By 2014, however, returns are expected to be strongest for office, at 10%, and industrial, at 10%; followed by apartments at 8.8% and retail at 8.5%.

- Apartments – The forecast predicts a modest increase in vacancy rates, from 5% this year to 5.1% in 2013 to 5.3% in 2014; and a decrease in rental growth rates, with rents expected to grow by 5% this year, and then moderate to a growth rate of 4.0% for 2013 and 3.8% by 2014. This may be indicative of supply catching up with demand.

- Office – The improved employment outlook is reflected in predictions for the office sector. Vacancy rates are expected to keep declining, reaching 15.4% in 2012, 14.4% in 2013, and 12.3% by the end of 2014. Office rental rates are expected to rise steadily, increasing 3.0% in 2012, 3.7% in 2013, and 4.3% in 2014.

- Retail – The strengthening economy is expected to boost the retail sector. Following years of rising vacancies, vacancy rates are expected to tighten to 13.0% by the end of 2012, 12.5% by 2013, and 12.0% by 2014. Retail rental rates are projected to rise by a slight 0.8% in 2012, and then increase more substantially in 2013 by 2%, and by 2.8% in 2014.

- Industrial/warehouse -- Vacancy rates are expected to continue declining to 12.8% by the end of 2012, 12.1% in 2013, and 11.5% by the end of 2014. Warehouse rental rates are expected to show growing strength, with an increase of 1.9% anticipated for 2012, 3.0% in 2013, and 3.6% in 2014.

For the housing industry, the survey results suggest that 2012 could mark the beginning of a turnaround – albeit a slow one. Single-family housing starts, which have been near record lows over the past three years, are projected to reach 500,000 in 2012, 660,000 in 2013, and 800,000 in 2014. The national average home price is expected to stop declining this year, and then rise by 2% in 2013 and by 3.5% in 2014. The overhang of foreclosed properties in markets hit hardest by the housing collapse will continue to affect the housing recovery in those markets. However, in general, improved job prospects and strengthening consumer confidence will likely bring buyers back to the housing market. BD+C

Related Stories

| Jan 4, 2011

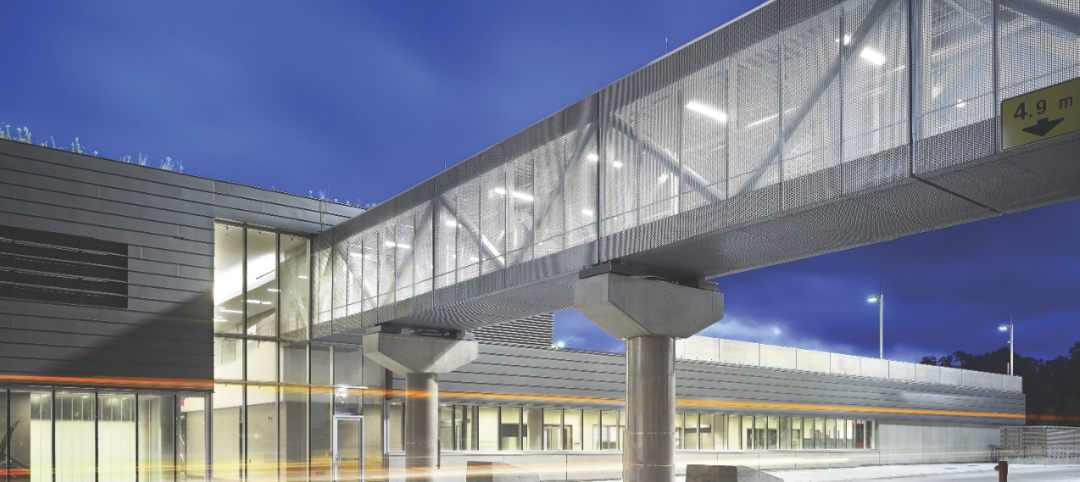

Product of the Week: Zinc cladding helps border crossing blend in with surroundings

Zinc panels provide natural-looking, durable cladding for an administrative building and toll canopies at the newly expanded Queenstown Plaza U.S.-Canada border crossing at the Niagara Gorge. Toronto’s Moriyama & Teshima Architects chose the zinc alloy panels for their ability to blend with the structures’ scenic surroundings, as well as for their low maintenance and sustainable qualities. The structures incorporate 14,000 sf of Rheinzink’s branded Angled Standing Seam and Reveal Panels in graphite gray.

| Jan 4, 2011

6 green building trends to watch in 2011

According to a report by New York-based JWT Intelligence, there are six key green building trends to watch in 2011, including: 3D printing, biomimicry, and more transparent and accurate green claims.

| Jan 4, 2011

LEED standards under fire in NYC

This year, for the first time, owners of 25,000 commercial properties in New York must report their buildings’ energy use to the city. However, LEED doesn’t measure energy use and costs, something a growing number of engineers, architects, and landlords insist must be done. Their concerns and a general blossoming of environmental awareness have spawned a host of rating systems that could test LEED’s dominance.

| Jan 4, 2011

LEED 2012: 10 changes you should know about

The USGBC is beginning its review and planning for the next version of LEED—LEED 2012. The draft version of LEED 2012 is currently in the first of at least two public comment periods, and it’s important to take a look at proposed changes to see the direction USGBC is taking, the plans they have for LEED, and—most importantly—how they affect you.

| Jan 4, 2011

California buildings: now even more efficient

New buildings in California must now be more sustainable under the state’s Green Building Standards Code, which took effect with the new year. CALGreen, the first statewide green building code in the country, requires new buildings to be more energy efficient, use less water, and emit fewer pollutants, among many other requirements. And they have the potential to affect LEED ratings.

| Jan 4, 2011

New Years resolutions for architects, urban planners, and real estate developers

Roger K. Lewis, an architect and a professor emeritus of architecture at the University of Maryland, writes in the Washington Post about New Years resolutions he proposes for anyone involved in influencing buildings and cities. Among his proposals: recycle and reuse aging or obsolete buildings instead of demolishing them; amend or eliminate out-of-date, obstructive, and overly complex zoning ordinances; and make all city and suburban streets safe for cyclists and pedestrians.

| Jan 4, 2011

An official bargain, White House loses $79 million in property value

One of the most famous office buildings in the world—and the official the residence of the President of the United States—is now worth only $251.6 million. At the top of the housing boom, the 132-room complex was valued at $331.5 million (still sounds like a bargain), according to Zillow, the online real estate marketplace. That reflects a decline in property value of about 24%.

| Jan 4, 2011

Luxury hotel planned for Palace of Versailles

Want to spend the night at the Palace of Versailles? The Hotel du Grand Controle, a 1680s mansion built on palace grounds for the king's treasurer and vacant since the French Revolution, will soon be turned into a luxury hotel. Versailles is partnering with Belgian hotel company Ivy International to restore the dilapidated estate into a 23-room luxury hotel. Guests can live like a king or queen for a while—and keep their heads.

| Jan 4, 2011

Grubb & Ellis predicts commercial real estate recovery

Grubb & Ellis Company, a leading real estate services and investment firm, released its 2011 Real Estate Forecast, which foresees the start of a slow recovery in the leasing market for all property types in the coming year.