AEC firms and their developer clients should be watching the progress of two bills wending their way through Congress that, if passed, could become important first steps toward opening the writing of flood insurance policies to private-sector carriers.

The U.S. House of Representatives recently passed HR 2901, the Flood Insurance Market Parity and Modernization Act of 2015, on a vote of 419-0. The U.S. Senate is currently reviewing similar legislation, SB 1679, on which it is expected to vote this summer.

The bills expand upon the controversial Biggert-Waters Flood Insurance Reform Act of 2012, which clarified the intent of Congress to get the private insurance sector to develop flood-insurance products that could compete with taxpayer-subsidized policies offered through the National Flood Insurance Program (NFIP).

That program is more than $23 billion in debt and has more than $1.1 trillion in total property exposure. NFIP’s main problem has been that it hasn’t been charging policyholders enough for flood coverage, explains Anthony Kammas, a partner with New York-based Skyline Risk Management, surety and insurance brokerage, who is also Secretary-Elect of the Professional Insurance Association (PIA).

Biggert-Waters called for the phasing out of subsidies and discounts on flood insurance premiums, and pushing more risk onto private-sector insurers and policyholders. Under Biggert-Waters, 5% of policyholders—including owners of non-primary private residences, business properties, and “severe repetitive loss properties” that are subject to redrawn floodplain maps—would have incurred 25% per year rate increases “until the true risk premium is reached.” Another 10% of policies would retain their NFIP subsidy until the owners sell their houses or let their policies lapse.

Policyholders screamed about those premium hikes, especially since the new maps put a lot more real estate within floodplains.

“It became clear that flood insurance needed to be repriced,” says Kammas. By the government agreeing ultimately to more gradual premium increases that would be priced using actuarial models, “private carriers started to think that they could make money on a primary basis.” Kammas adds that reinsurers are looking for places where they can put investors’ dollars to work.

Last month, PIA and a contingent of members spent two days on Capitol Hill meeting with lawmakers, including New York Sen. Chuck Schumer and New Jersey Sen. Robert Menendez, to urge them to support the bills that would open up the flood market to private carriers.

Kammas says the association’s goal is not to eliminate NFIP—“it will never disappear,” he says—but to make it the carrier of last resort. Kammas acknowledges that NFIP would be needed to provide flood insurance in flood-prone areas for which private carriers are less likely to offer policies. PIA also wants Congress to reauthorize the government flood program for 10 years, instead of annually, which the association believes would lend more stability to the marketplace.

Under NFIP’s “write your own” program, private carriers are allowed to service coverage that’s written by NFIP (Skyline does this). If the Senate passes SB 1679, the next step, says Kammas, would be to get private insurers engaged in offering their own flood-insurance products. (He could not provide names, but Kammas says a number of private insurers have policies that are ready to go.) The terms and conditions of such policies still need to be worked out, however, including their pricing.

“There’s a lot of work to be done, because there’s no historical information in place,” says Kammas.

He says AEC firms and developers need to be paying attention to how floodplains have been rezoned, and to make sure their policies are in compliance with their lenders’ requirements. They should also make sure that, in the event they choose to switch coverage to a private carrier, their current policies provide a continuity of coverage. And lastly, given how there’s no competitive pricing currently, policyholders would need to price-shop carefully to make sure they are getting the coverage that matches their needs at the lowest price.

Related Stories

| Jun 26, 2014

Ohio is first state to roll back renewable energy standards

Ohio became the nation’s first state to roll back renewable energy standards after the state House of Representatives passed Senate Bill 310 and Gov. John Kasich recently signed the measure.

| Jun 25, 2014

AIA Foundation launches Regional Resilient Design Studio

The Studio is the first to be launched as part of the AIA Foundation’s National Resilience Program, which plans to open a total of five Regional Resilience Design Studios nationwide in collaboration with Architecture for Humanity, and Public Architecture.

| Jun 18, 2014

Senate passes ‘compromise’ bill that green lights 26 new VA hospitals, clinics

The U.S. Senate reached a compromise deal combining elements of two competing Veterans Administration reform bills that would, among other things, gives the go-ahead for the construction of 26 new VA hospitals and clinics.

| Jun 11, 2014

Federal bill would promote shifting to energy-efficient roofs

A bipartisan proposal from U.S. Reps. Tom Reed, R-N.Y., and Bill Pascrell, D-N.J., would make roof replacement cost less and would help commercial building owners adopt energy-efficient systems.

| Jun 5, 2014

Over budget Homeland Security headquarters project may be canceled

A massive new headquarters for the Department of Homeland Security is more than $1.5 billion over budget, 11 years behind schedule, and may never be completed.

| Jun 4, 2014

Dikes, water pumps, and parks will help New York City area be more resilient

The Obama Administration has pledged $1 billion in federal funding to protect the New York City region from flooding like the area experienced from Superstorm Sandy.

| May 22, 2014

Senate kills bipartisan energy efficiency bill over Keystone pipeline amendment

The legislation focused on energy efficiency standards such as water heaters with smart meters and cheaper heating and cooling systems for office buildings.

| May 13, 2014

19 industry groups team to promote resilient planning and building materials

The industry associations, with more than 700,000 members generating almost $1 trillion in GDP, have issued a joint statement on resilience, pushing design and building solutions for disaster mitigation.

| May 8, 2014

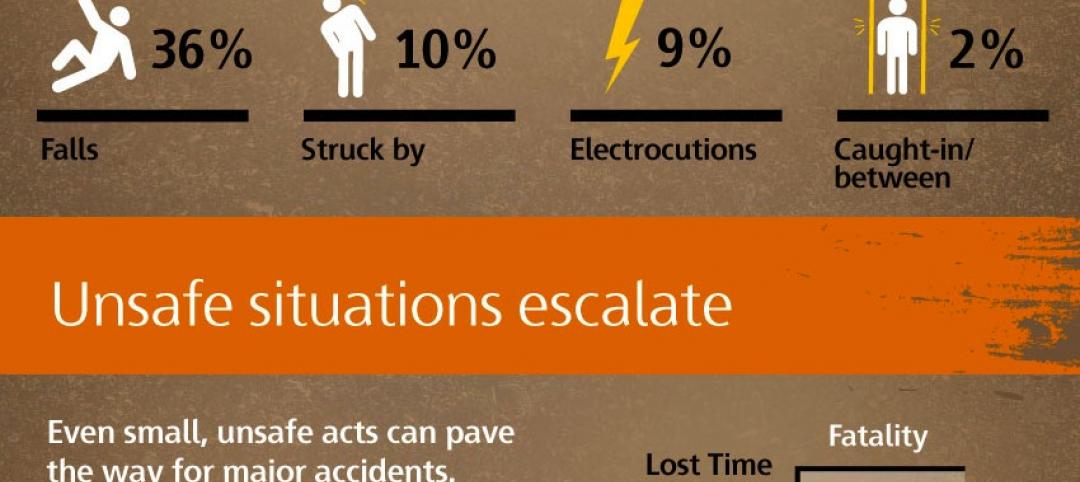

Infographic: 4 most common causes of construction site fatalities

In honor of Safety Week, Skanska put together this nifty infographic on how to prevent deadly harm in construction.

| Apr 30, 2014

House Appropriations Committee approves $3 billion cut for military construction

The Army would see the sharpest cuts on a percentage basis, with a $578 million, or 52% reduction in FY 2015.