The Trump Administration’s plans for infrastructure investment, regulatory reform, and tax relief have ignited a burst of enthusiasm among U.S. engineering firm leaders, propelling the American Council of Engineering Companies’ Engineering Business Index (EBI) to its largest ever quarterly increase.

The 4th Quarter 2016 (Q4/2016) EBI surged 5.1 points to 66.5, up from the 61.4 score of Q3/2016. The previous largest increase was 1.5 points between the Q1/2014 and Q2/2014 surveys. Any score above 50 signifies that the market is growing The EBI is a leading indicator of America’s economic health based on the business performance and projections of engineering firms responsible for developing the nation’s transportation, water, energy, and industrial infrastructure. The Q4/2016 survey of 317 engineering firm leaders was conducted November 31 to December 20.

Survey results show firm leader market expectations for one year from today rose a hefty 8.8 points to 72.1, the largest quarter-over-quarter increase since the EBI’s inception in January 2014. Expectations for both short- and long-term profitability also climbed. Firm leader optimism for improved profitability over the next six months rose 3.6 points to 69.0; increased to 72.9 for one year from now; and climbed 2.9 points to 70.5 for three years from now.

“We finally have a president who understands business!” says one respondent. “We’re looking forward to some significant tax relief with the new Administration,” says another.

The boost in firm leader optimism extends across almost the entire engineering marketplace. In public markets, transportation showed the strongest increase, up an eye-catching 9.5 points to 73.7.

All other public market sectors rose: Water and Wastewater (up 7.5, to 70.5), Education (up 3.2 to 58.2) Health Care (up 0.3, to 56.1), and Environmental (up 1.1 to 55.4). A new public sector category, Buildings, debuted at 65.2. Among the private client markets, firm leaders were most bullish about the Industrial/Manufacturing sector, which leaped up 12.5 points to 70.7. Four key private sector markets also climbed: Energy and Power (up 8.8, to 69.2), Land Development (up 8.2, to 68.4.), Buildings (up 4.1 to 67.0), and Education (up 5.2, to 58.5).

For the complete Quarter 4, 2016 Engineering Business Index, go to www.acec.org.

Related Stories

Market Data | Aug 4, 2020

7 must reads for the AEC industry today: August 4, 2020

Construction spending decreases for fourth consecutive month and 100% affordable housing development breaks ground in Mountain View.

Market Data | Aug 3, 2020

Construction spending decreases for fourth consecutive month in June

Association officials warn further contraction is likely unless federal government enacts prompt, major investment in infrastructure as state and local governments face deficits.

Market Data | Aug 3, 2020

6 must reads for the AEC industry today: August 3, 2020

The future is a number game for retail and restaurants and 5 reasons universities are renovating student housing.

Market Data | Jul 31, 2020

5 must reads for the AEC industry today: July 31, 2020

Vegas's newest resort and casino is packed with contactless technology and Mariott, Hilton, and IHG dominate the U.S. hotel construction pipeline.

Market Data | Jul 30, 2020

Marriott, Hilton, and IHG continue to dominate the U.S. hotel construction pipeline at Q2’20 close

Hilton’s Home2 Suites and IHG’s Holiday Inn Express continue to be the most prominent brands in the U.S. pipeline.

Market Data | Jul 30, 2020

7 must reads for the AEC industry today: July 30, 2020

Millennium Tower finally has a fix and construction costs decrease for the first time in 10 years.

Market Data | Jul 29, 2020

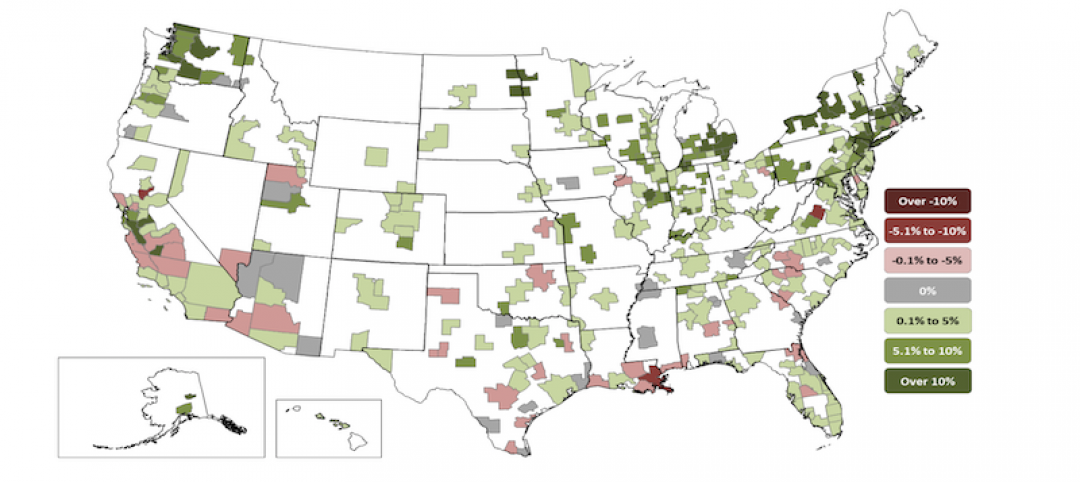

62% of metros shed construction jobs from June 2019 to June 2020 as Association calls for new infrastructure funding, other relief steps

New York City and Brockton-Bridgewater-Easton, Mass. have worst 12-month losses, while Austin and Walla Walla, Wash. top job gainers.

Market Data | Jul 29, 2020

6 must reads for the AEC industry today: July 29, 2020

The world's first net-zero airport and California utility adopts climate emergency declaration.

Market Data | Jul 28, 2020

For the fourth consecutive quarter, Los Angeles leads the U.S. hotel construction pipeline at the close of Q2’ 20

New York City continues to have the greatest number of projects under construction, with 106 projects/18,354 rooms.

Market Data | Jul 28, 2020

6 must reads for the AEC industry today: July 28, 2020

St. Petersburg Pier reconstruction completes and post-pandemic workplace design will not be the same for all.