The general contractor Swinerton has rolled out a new brand identity that reflects the businesses it has added or evolved into over the past several years.

The San Francisco-based company, which is celebrating its 130th anniversary this year, is probably best known as Swinerton Builders, a brand it started using in 2001. But over the past six or seven years, the company has diversified in different directions.

In 2008, it launched Swinerton Renewable Energy, which has grown to become the largest builder of solar power plants in the U.S., with $1.5 billion in revenue last year, and the third-largest in the world.

Swinerton Renewable Energy has served the company as a platform for international growth. Over the past four years, it has built nine solar power plants in Canada, and a 750-MW solar power plant in Mexico.

Within its renewable energy unit, which is based in San Diego, Swinerton launched SOLV in 2012, a division focused on operating and maintaining solar utility plants. SOLV is now the largest company of its kind, managing more than 6 MW of power, and with 150 employees dedicated to that business. Last year, GTM Research and SOLICHAMBA identified SOLV the top service provider in the global operations and maintenance market for the second consecutive year.

Swinerton's new logo shows an architect and contractor pointing “outside the box,” which emphasizes the company's expanding into new businesses and markets. Image: Swinerton

Seeking better profit on work

Swinerton isn’t walking away from general contracting work; far from it. “We’re still a commercial GC at heart,” says Jeff Hoopes, a 34-year company vet who has been its CEO and Chairman since 2013. Under his leadership, Swinerton has expanded its reach beyond the western states by opening offices in Atlanta five years ago, Raleigh two years ago, and Charlotte last fall.

One of Swinerton’s larger current projects is Oceanwide Center, which it’s building in joint venture with the GC Webcor. When completed in 2021, Oceanwide’s two towers in San Francisco Transit Center district will include 265 residential units, a five-story-tall 26,000-sf public square, and a 169-key Waldorf Astoria hotel.

But it’s tough making money as a contractor, Hoopes laments. The industry averages only about 1% of a project’s revenue for contracting fees. “We’re looking at five times that” from the new businesses that Swinerton has moved into, Hoopes says.

So the company has been pulling away from government contracting projects, primarily because Congress has been inconsistent about funding them properly. Conversely, Swinerton is doing more co-investing with developer clients on projects like a 300-unit housing complex in Houston it recently worked on.

Hoopes says his company has also been transitioning into more self-perform work. It has 850 employees in California alone who do drywall. Swinerton designs and builds parking structures. And it wants to get into concrete pouring, and to either start up or purchase an electrical contractor. “We want to control more of every job,” says Hoopes.

Swinerton currently has around 2,000 “craft” workers in the field, along with 1,950 salaried employees, and 500-1,000 who work in the renewable energy business. When asked if, like many other GCs, his company has had trouble finding workers, Hoopes says that trades “want to work for a GC … because we’re employee owned, have good benefits, and offer career opportunities.”

Swinerton is 50% employee owned and 50% management owned. Its status as an ESOP is one of the reasons why Hoopes says he’s more concerned about growing Swinerton’s bottom line than he is about increasing its revenue, which nonetheless hit $4 billion last year and is projected to increase to $4.5 billion in 2018.

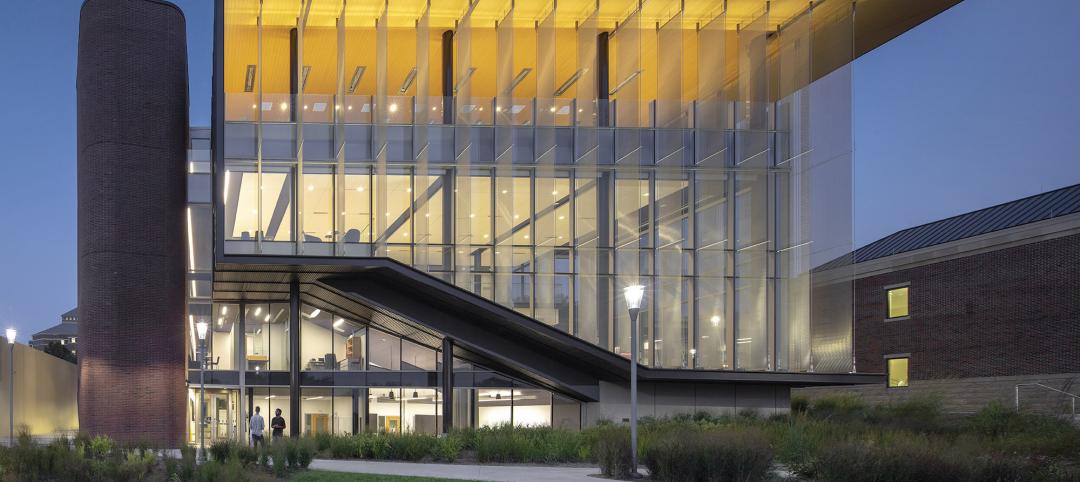

Swinerton is still committed to commercial building. One of its major projects is Oceanwide Center in San Francisco. Image: Swinerton

Still exploring new territories

To that end, Swinerton, with 15 offices and 11 practices, is looking at opening offices in New York and Chicago. It is also getting into the business of turning animal waste into energy. In July its plant on 42 acres in Warsaw, N.C., will be fully funded. That plant—which Swinerton owns in partnership with Carbon Cycle Energy—is set up to convert 4,200 tons of solid and liquid biodegradable materials per day to 6,500 dekatherms of biomethane gas. At full capacity, this plant will generate more than 1 billion cubic meters of pipeline-quality gas over the length of its 15-year contract with Duke Energy. That would be enough to power 32,000 houses.

Swinerton also has waste conversion plants in Phoenix and Missouri.

As part of its rebranding, Swinerton has made changes at its philanthropic arm, The Swinerton Foundation, which it started in 2002. The Foundation is transitioning from a private to a public nonprofit organization, and its new focus areas are equitable education, resilient communities, and workplace development.

Related Stories

University Buildings | Feb 7, 2023

Kansas City University's Center for Medical Education Innovation can adapt to changes in medical curriculum

The Center for Medical Education Innovation (CMEI) at Kansas City University was designed to adapt to changes in medical curriculum and pedagogy. The project program supported the mission of training leaders in osteopathic medicine with a state-of-the-art facility that leverages active-learning and simulation-based training.

Giants 400 | Feb 6, 2023

2022 Reconstruction Sector Giants: Top architecture, engineering, and construction firms in the U.S. building reconstruction and renovation sector

Gensler, Stantec, IPS, Alfa Tech, STO Building Group, and Turner Construction top BD+C's rankings of the nation's largest reconstruction sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Transit Facility Giants: Top architecture, engineering, and construction firms in the U.S. transit facility sector

Walsh Group, Skanska USA, HDR, Perkins and Will, and AECOM top BD+C's rankings of the nation's largest transit facility sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Telecommunications Facility Sector Giants: Top architecture, engineering, and construction firms in the U.S. telecommunications facility sector

AECOM, Alfa Tech, Kraus-Anderson, and Stantec head BD+C's rankings of the nation's largest telecommunications facility sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Religious Sector Giants: Top architecture, engineering, and construction firms in the U.S. religious facility construction sector

HOK, Parkhill, KPFF, Shawmut Design and Construction, and Wiss, Janney, Elstner head BD+C's rankings of the nation's largest religious facility sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Justice Facility Sector Giants: Top architecture, engineering, and construction firms in the U.S. justice facility/public safety sector

Stantec, DLR Group, Turner Construction, STO Building Group, AECOM, and Dewberry top BD+C's rankings of the nation's largest architecture, engineering, and construction firms for justice facility/public safety buildings work, including correctional facilities, fire stations, jails, police stations, and prisons, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Parking Structure Giants: Top architecture, engineering, and construction firms in the U.S. parking structure sector

Choate Parking Consultants, Walker Consultants, Kimley-Horn, PCL, and Balfour Beatty top BD+C's rankings of the nation's largest parking structure sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Market Data | Feb 6, 2023

Nonresidential construction spending dips 0.5% in December 2022

National nonresidential construction spending decreased by 0.5% in December, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $943.5 billion for the month.

Giants 400 | Feb 3, 2023

Top Workplace/Interior Fitout Architecture, Engineering, and Construction Firms for 2022

Gensler, Interior Architects, AECOM, STO Building Group, and CBRE top the ranking of the nation's largest workplace/interior fitout architecture, engineering, and construction firms, as reported in Building Design+Construction's 2022 Giants 400 Report.

Multifamily Housing | Feb 3, 2023

HUD unveils report to help multifamily housing developers overcome barriers to offsite construction

The U.S. Department of Housing and Urban Development, in partnership with the National Institute of Building Sciences and MOD X, has released the Offsite Construction for Housing: Research Roadmap, a strategic report that presents the key knowledge gaps and research needs to overcome the barriers and challenges to offsite construction.