The University of Southern California Lusk Center for Real Estate’s annual analysis of industrial and office real estate in Los Angeles County, Orange County and the Inland Empire shows signs of a slow market recovery.

The 10th Annual Casden Southern California Industrial and Office Forecast reveals that all three areas experienced job growth and increased demand for both property types in 2011. An analysis of each area’s submarkets found lower vacancy rates in 11 of 17 office submarkets and 11 of 14 industrial submarkets. On the rent side, four office submarkets and eight industrial submarkets experienced increases. Overall, declines were smaller than in the previous two years.

“Although Southern California is a long way from pre-crisis levels of economic health, the improved employment picture and profound turnaround in the industrial market are signs of a slow recovery,” said study author Tracey Seslen. “The office market is only slightly improved over last year and vacancy rates may continue to fall for many months before we see rents stabilize.”

As a result, while office demand is expected to grow over the next two years, office rents were down for the third straight year and will continue to decline. On the industrial side, all three markets are expected to see ongoing declines in vacancies and increases in rents over the next two years.

In particular, the Inland Empire’s industrial market – the top performer in 2011 with a 6.4% increase in rents and nearly 17 million square feet of net absorption – is expected to see more growth in the next two years, but the magnitude will depend on rail and port activity.

“Sovereign risk in Europe, geopolitical turmoil and the growing U.S. debt crisis are undermining consumer confidence. Port and rail traffic, particularly activity at the Port of Long Beach, is down and could hinder the positive outlook for industrial rents,” Seslen said. BD+C

Related Stories

Multifamily Housing | Jul 28, 2022

GM working to make EV charging accessible to multifamily residents

General Motors, envisioning a future where electric vehicles will be commonplace, is working to boost charging infrastructure for those who live in multifamily residences.

Urban Planning | Jul 28, 2022

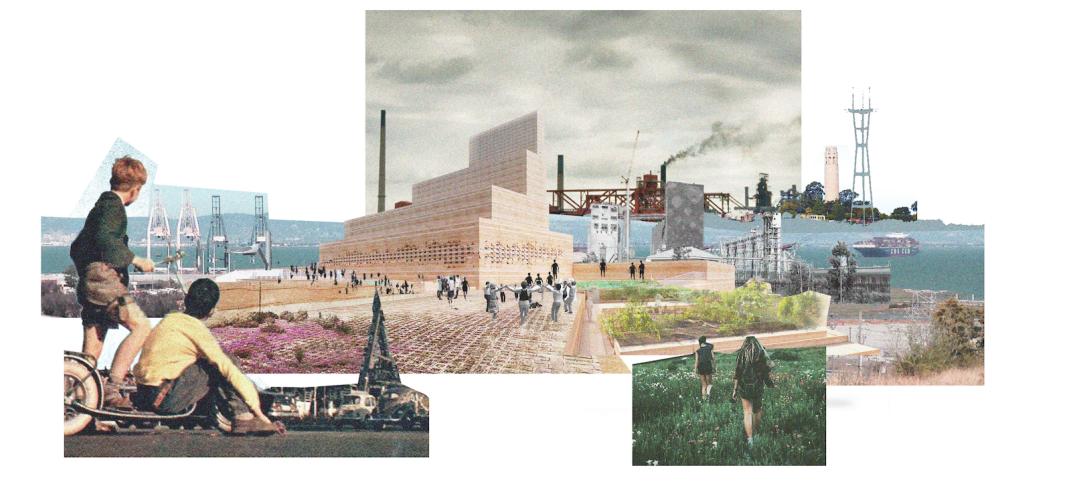

A former military base becomes a substation with public amenities

On the site of a former military base in the Hunters Point neighborhood of San Francisco, a new three-story substation will house critical electrical infrastructure to replace an existing substation across the street.

Hotel Facilities | Jul 28, 2022

As travel returns, U.S. hotel construction pipeline growth follows

According to the recently released United States Construction Pipeline Trend Report from Lodging Econometrics (LE), the total U.S. construction pipeline stands at 5,220 projects/621,268 rooms at the close of 2022’s second quarter, up 9% Year-Over-Year (YOY) by projects and 4% YOY by rooms.

Codes and Standards | Jul 27, 2022

Biden administration proposes drastic flood insurance reform

The Biden administration’s proposed major overhaul to the National Flood Insurance Program, or NFIP, would drastically alter how Americans protect homes and businesses against flooding.

Concrete | Jul 26, 2022

Consortium to set standards and create markets for low-carbon concrete

A consortium of construction firms, property developers, and building engineers have pledged to drive down the carbon emissions of concrete.

Green | Jul 26, 2022

Climate tech startup BlocPower looks to electrify, decarbonize the nation's buildings

The New York-based climate technology company electrifies and decarbonizes buildings—more than 1,200 of them so far.

Education Facilities | Jul 26, 2022

Malibu High School gets a new building that balances environment with education

In Malibu, Calif., a city known for beaches, surf, and sun, HMC Architects wanted to give Malibu High School a new building that harmonizes environment and education.

| Jul 26, 2022

Better design with a “brain break”

During the design process, there aren’t necessarily opportunities to implement “brain breaks,” brief moments to take a purposeful pause from the task at hand and refocus before returning to work.

Building Team | Jul 25, 2022

First Ismaili Center in the U.S. combines Islamic design with Texas influences

Construction has begun on the first Ismaili Center in the U.S. in Houston.

Codes and Standards | Jul 22, 2022

Office developers aim for zero carbon without offsets

As companies reassess their office needs in the wake of the pandemic, a new arms race to deliver net zero carbon space without the need for offsets is taking place in London, according to a recent Bloomberg report.