The Single-Family Rentals in Build-to-Rent Communities report by Yardi Matrix shares an update of the SFR market in 2024. Overall, single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

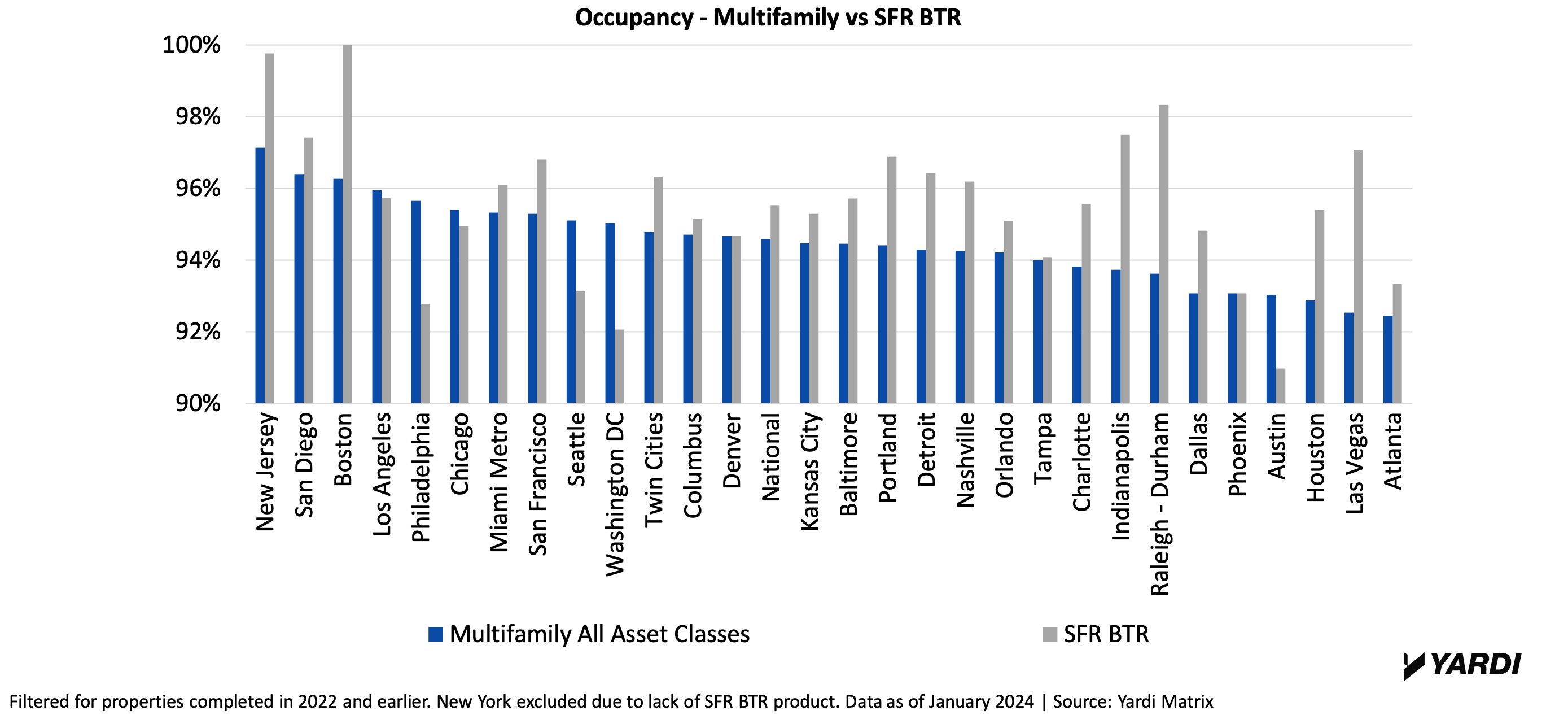

Over two-thirds of the top 30 metros have higher occupancy rates from single-family rentals in BTR communities than other multifamily assets.

4 Biggest Demand Drivers for Single-Family Rentals

But aside from price, what’s driving the demand? Four of the biggest demand drivers for single-family rentals are work-from-home professionals, household growth, the declining affordability of homeownership, and the demographics of Millennials and blue-collar workers.

1. Renters working from home

Because more than half (52%) of full-time workers are now returning back to the office, hybrid work is becoming the norm. Single-family rentals are more accommodating to this shifting demographic than traditional apartments; SFR offers a quieter environment and more space inside the home for the hybrid worker.

2. Household formation growth during the pandemic

Demand is also driven by household formation growth during the pandemic as a result of:

- Employment/wage growth.

- Stimulus payments.

- Increased savings.

3. Declining homebuying affordability

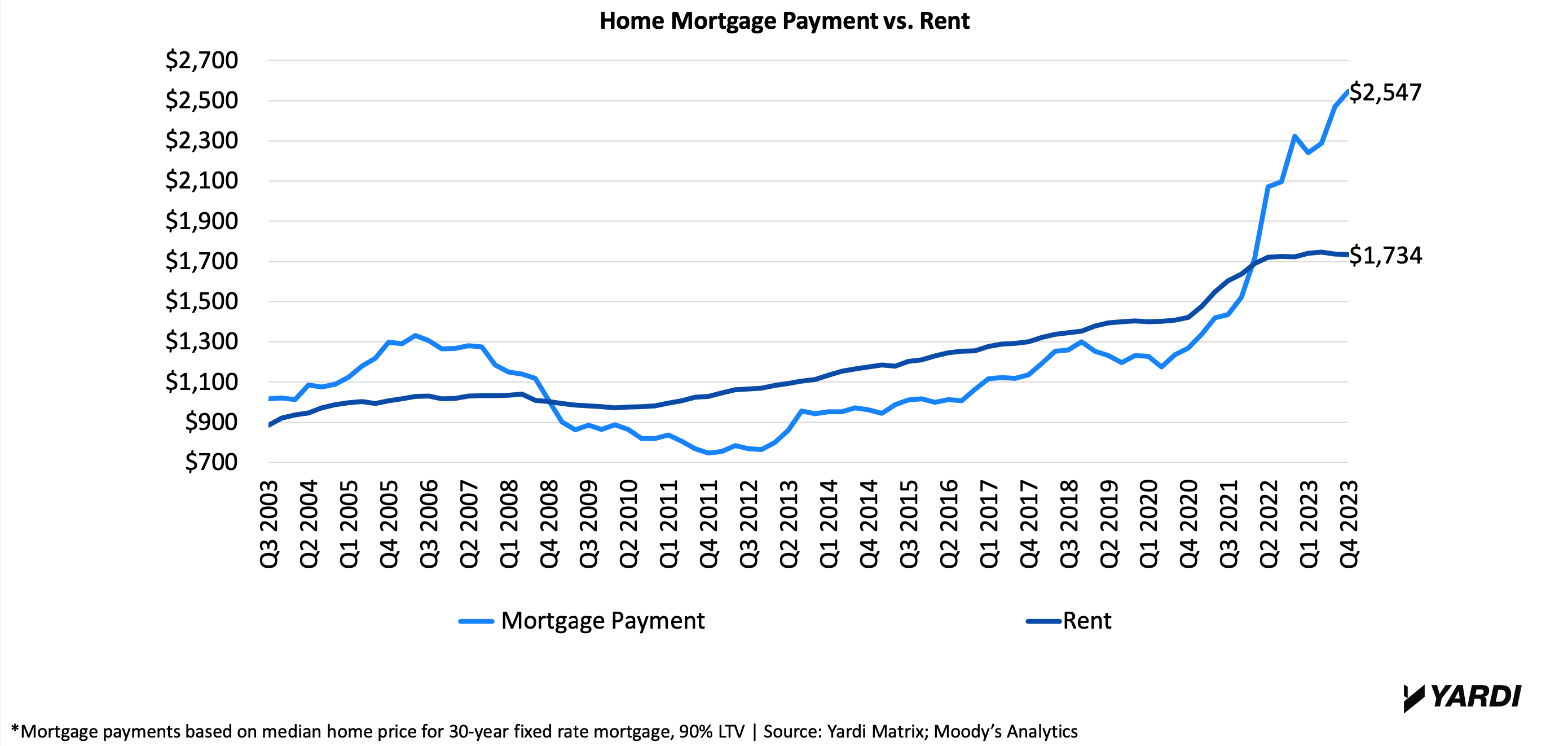

According to the Yardi Matrix report, 61% of renters in the largest metros are priced out of homebuying. The average home mortgage payment reached $2,547 at the end of 2023. Compare this to the average rent of $1,734 and renting looks like the better deal.

As the affordability of buying a home decreases, single-family rentals are prime for Millennials and blue-collar workers who would like to buy a house, but can’t.

4. Specific demographics

Those averaging a salary of $60,000 to $70,000 a year, individuals aged 24 to 40, and Millennials/blue-collar workers are largely driving the demand for single-family rentals in built-to-rent communities.

SFR development trends indicate that flexible designs and lot size by location are based on consumer preferences. For example, young singles and couples prefer pet-friendly units, while young families prefer large common areas.

RELATED: Multifamily rent remains flat at $1,710 in January

Development Trends

The four biggest single-family rental development trends as of 2024 include:

- Amenities. On-site maintenance and community areas are the most popular. Better parking, storage, privacy, and yard space is also highly desired.

- Smart home technology. This has become a “must” and will likely be standard soon, according to Yardi. Developers should plan for future demand such as electric vehicle charging in garages.

- Homes designed for frequent moving. Single-family rentals are using resilient materials like laminate faux wood flooring to maintain a durable, sleek look. Units are designed with wider hallways to accommodate the moving of furniture in and out of the home.

- Flexibility. Target demographics and location influence the design of build-to-rent communities. While younger renters would prefer pet-friendly units and large common areas, older singles and couples prefer an attached garage.

Click here to view the full Yardi Matrix Single-Family Rentals in Build-to-Rent Communities report.

Related Stories

| Jul 28, 2014

Reconstruction Sector Engineering Firms [2014 Giants 300 Report]

Jacobs, URS, and Wiss, Janney, Elstner top Building Design+Construction's 2014 ranking of the largest reconstruction engineering and engineering/architecture firms in the U.S.

| Jul 28, 2014

Reconstruction Sector Architecture Firms [2014 Giants 300 Report]

Stantec, HDR, and HOK top Building Design+Construction's 2014 ranking of the largest reconstruction architecture and architecture/engineering firms in the U.S.

| Jul 23, 2014

Architecture Billings Index up nearly a point in June

AIA reported the June ABI score was 53.5, up from a mark of 52.6 in May.

| Jul 22, 2014

Herzog & de Meuron unveil curvy concrete condo in Manhattan

Herzog & de Meuron have released renderings of their new $250 million New York building, a 12-story condominium with 88 luxury apartments.

| Jul 21, 2014

Economists ponder uneven recovery, weigh benefits of big infrastructure [2014 Giants 300 Report]

According to expert forecasters, multifamily projects, the Panama Canal expansion, and the petroleum industry’s “shale gale” could be saving graces for commercial AEC firms seeking growth opportunities in an economy that’s provided its share of recent disappointments.

| Jul 18, 2014

Contractors warm up to new technologies, invent new management schemes [2014 Giants 300 Report]

“UAV.” “LATISTA.” “CMST.” If BD+C Giants 300 contractors have anything to say about it, these new terms may someday be as well known as “BIM” or “LEED.” Here’s a sampling of what Giant GCs and CMs are doing by way of technological and managerial innovation.

| Jul 18, 2014

Top Construction Management Firms [2014 Giants 300 Report]

Jacobs, Barton Malow, Hill International top Building Design+Construction's 2014 ranking of the largest construction management and project management firms in the United States.

| Jul 18, 2014

Top Contractors [2014 Giants 300 Report]

Turner, Whiting-Turner, Skanska top Building Design+Construction's 2014 ranking of the largest contractors in the United States.

| Jul 18, 2014

Engineering firms look to bolster growth through new services, technology [2014 Giants 300 Report]

Following solid revenue growth in 2013, the majority of U.S.-based engineering and engineering/architecture firms expect more of the same this year, according to BD+C’s 2014 Giants 300 report.

| Jul 18, 2014

Top Engineering/Architecture Firms [2014 Giants 300 Report]

Jacobs, AECOM, Parsons Brinckerhoff top Building Design+Construction's 2014 ranking of the largest engineering/architecture firms in the United States.