Another round of steep price increases and supply-chain disruptions are wreaking hardships on contractors, driving up construction costs and slowing projects, according to an analysis by the Associated General Contractors of America of government data released today. The data comes a day after the association released a new survey showing materials delays and price increases are affecting most contractors. Association officials urged the Biden administration to end a range of trade tariffs in place, including for Canadian lumber, that are contributing to the price increases, and to help uncork supply-chain bottlenecks.

“Both today’s producer price index report and our survey results show escalating materials costs and lengthening delivery times are making life difficult for contractors and their customers, including hospitals, schools, and other facilities needed to get the economy back on track,” said Ken Simonson, the association’s chief economist. “Project owners and budget officials should anticipate that projects will cost more and have longer—perhaps uncertain—completion times, owing to these circumstances that contractors cannot control.”

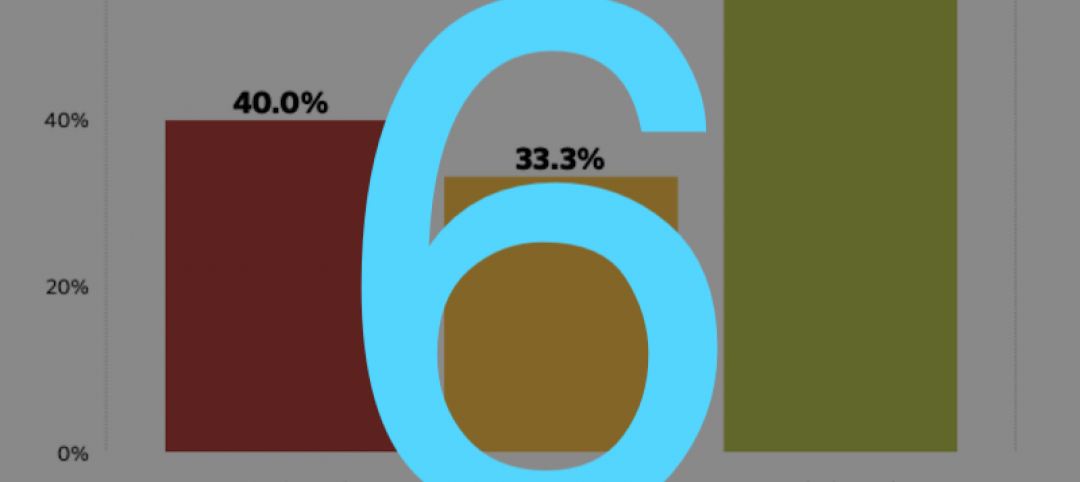

Prices for materials and services used in construction and contractors’ bid prices both declined at the beginning of the pandemic but have diverged sharply since last April, Simonson said. A government index that measures the selling price for materials and services used in new nonresidential construction jumped 1.9% from January to February and 12.8% since April 2020. Meanwhile, the producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—increased only 0.3% last month and 0.5% in the 10 months since April.

“The nearly 1500 contractors who responded to our survey overwhelmingly reported rising costs, shortages, and delays in receiving needed materials, parts, and supplies,” Simonson added. “Eighty-five% of respondents said their costs for these items have risen in the past year, and a majority—58%—reported projects were taken longer than before the pandemic struck. This situation will intensify the cost squeeze apparent in the producer price index data.”

Association officials called on the president to remove tariffs on key construction materials, including steel and lumber. They also urged Washington officials to look at ways to address supply chain problems by making it easier for Canadian materials to enter the country and exploring regulatory measures to increase shipping capacity. They noted that construction firms are already absorbing the costs associated with protecting workers from the pandemic, and that materials price spikes and shipping delays are making it harder for firms to cope.

“Contractors are caught between a pandemic market that isn’t willing to pay more for projects and materials prices that continue to spike even as delivery schedules become less reliable,” said Stephen E. Sandherr, the association’s chief executive officer. “Construction firms won’t be able to thrive if rising materials prices continue to shrink already pressured profit margins.”

View producer price index data. View chart of gap between input costs and bid prices. View AGC’s survey.

Related Stories

Market Data | Jun 10, 2020

6 must reads for the AEC industry today: June 10, 2020

Singapore's newest residential district and CannonDesign unveils COVID Shield.

Market Data | Jun 9, 2020

ABC’s Construction Backlog Indicator inches higher in May; Contractor confidence continues to rebound

Nonresidential construction backlog is down 0.8 months compared to May 2019 and declined year over year in every industry.

Market Data | Jun 9, 2020

6 must reads for the AEC industry today: June 9, 2020

OSHA safety inspections fall 84% and the office isn't dead.

Market Data | Jun 8, 2020

Construction jobs rise by 464,000 jobs but remain 596,000 below recent peak

Gains in may reflect temporary support from paycheck protection program loans and easing of construction restrictions, but hobbled economy and tight state and local budgets risk future job losses.

Market Data | Jun 5, 2020

7 must reads for the AEC industry today: June 5, 2020

The world's first carbon-fiber reinforced concrete building and what will college be like in the fall?

Market Data | Jun 4, 2020

7 must reads for the AEC industry today: June 4, 2020

Construction unemployment declines in 326 of 358 metro areas and is the show over for AMC Theatres?

Market Data | Jun 3, 2020

Construction employment declines in 326 out of 358 metro areas in April

Association says new transportation proposal could help restore jobs.

Market Data | Jun 3, 2020

6 must reads for the AEC industry today: June 3, 2020

5 ways to improve cleanliness of public restrooms and office owners are in no hurry for tenants to return.

Market Data | Jun 2, 2020

Architects, health experts release strategies, tools for safely reopening buildings

AIA issues three new and enhanced tools for reducing risk of COVID-19 transmission in buildings.

Market Data | Jun 2, 2020

5 must reads for the AEC industry today: June 2, 2020

New Luxembourg office complex breaks ground and nonresidential construction spending falls.