Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

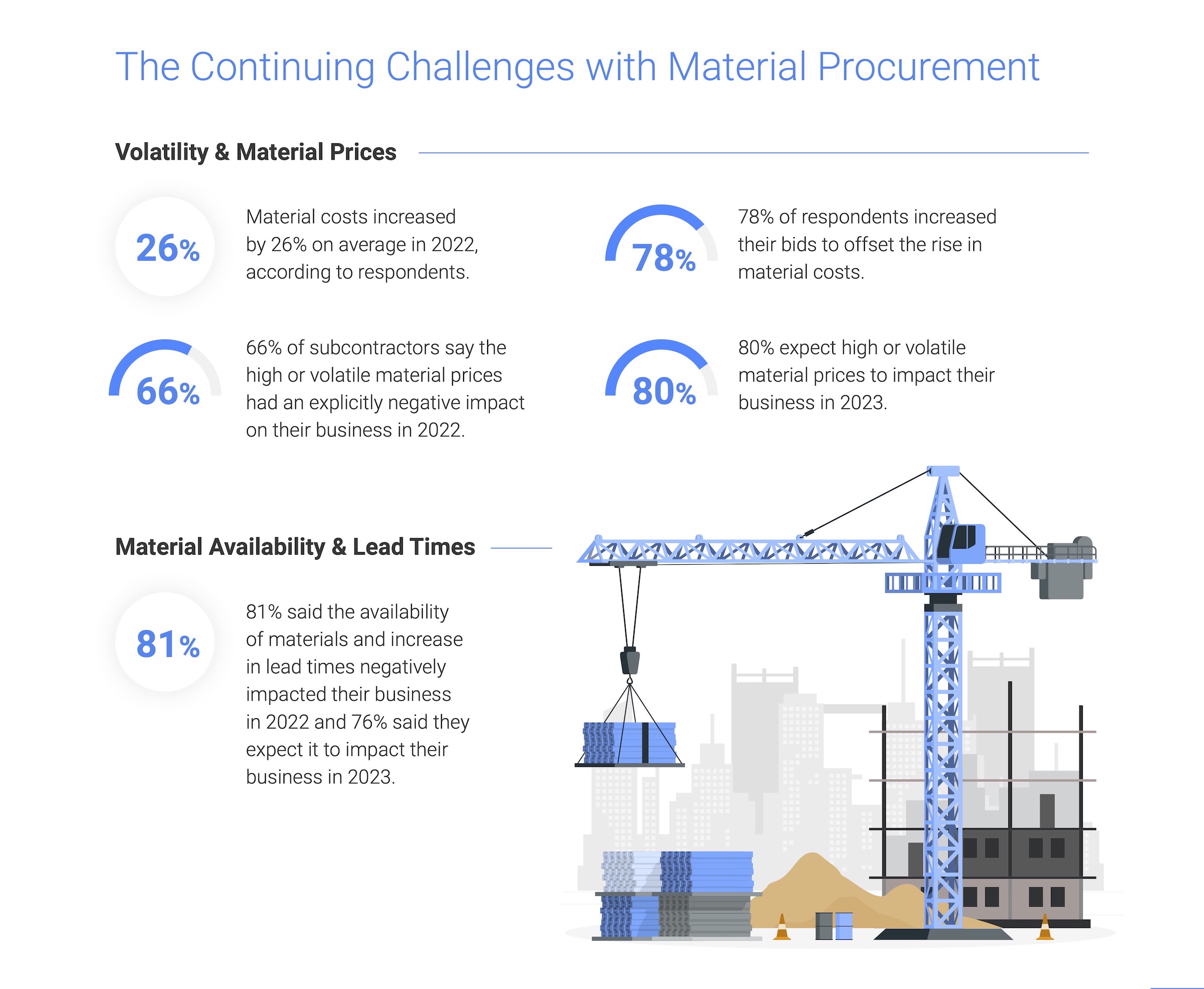

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

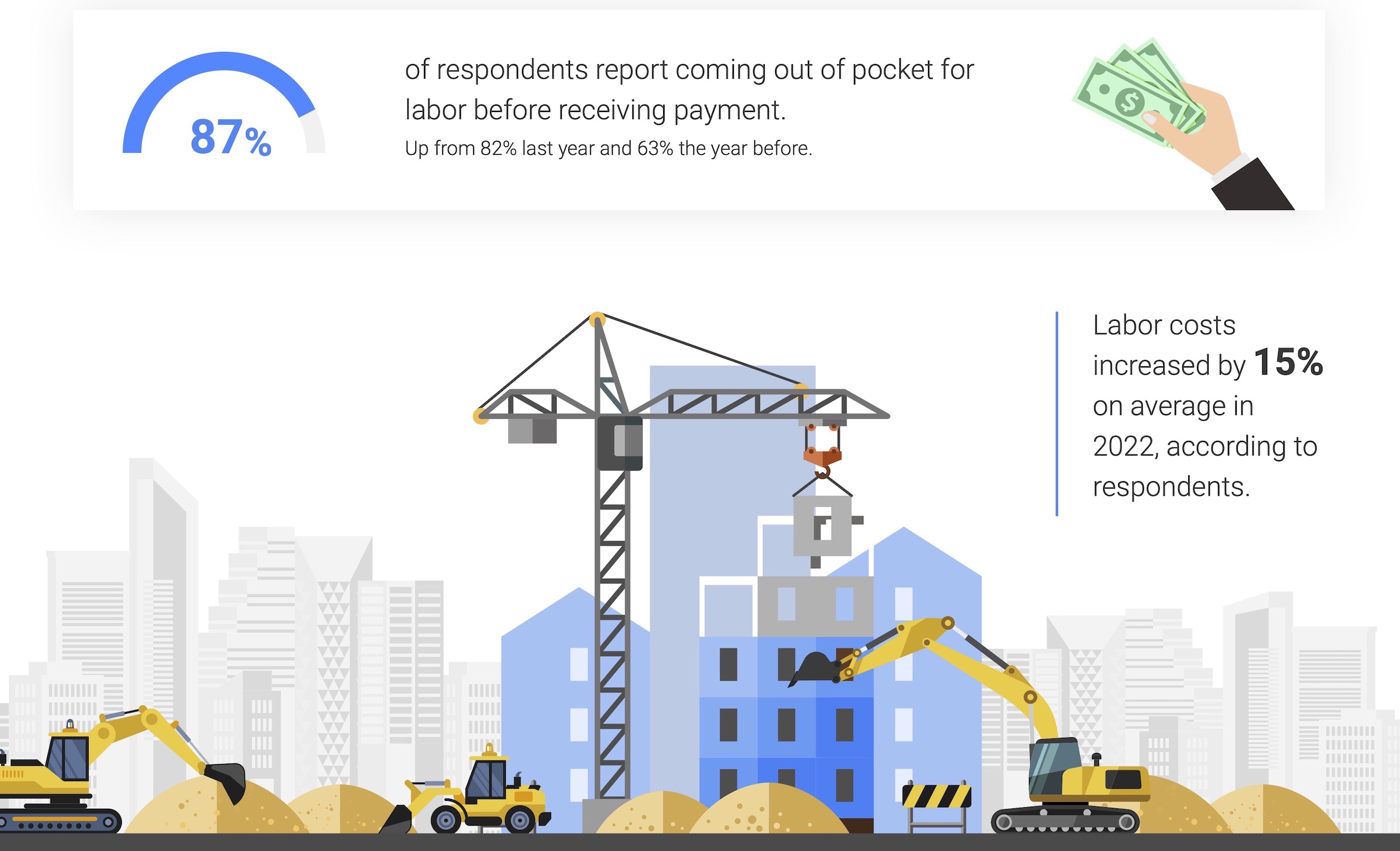

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

| Jan 10, 2011

Michael J. Alter, president of The Alter Group: ‘There’s a significant pent-up demand for projects’

Michael J. Alter, president of The Alter Group, a national corporate real estate development firm headquartered in Skokie, Ill., on the growth of urban centers, project financing, and what clients are saying about sustainability.

| Jan 7, 2011

BIM on Target

By using BIM for the design of its new San Clemente, Calif., store, big-box retailer Target has been able to model the entire structural steel package, including joists, in 3D, chopping the timeline for shop drawings from as much as 10 weeks down to an ‘unheard of’ three-and-a-half weeks.

| Jan 7, 2011

How Building Teams Choose Roofing Systems

A roofing survey emailed to a representative sample of BD+C’s subscriber list revealed such key findings as: Respondents named metal (56%) and EPDM (50%) as the roofing systems they (or their firms) employed most in projects. Also, new construction and retrofits were fairly evenly split among respondents’ roofing-related projects over the last couple of years.

| Jan 7, 2011

Total construction to rise 5.1% in 2011

Total U.S. construction spending will increase 5.1% in 2011. The gain from the end of 2010 to the end of 2011 will be 10%. The biggest annual gain in 2011 will be 10% for new residential construction, far above the 2-3% gains in all other construction sectors.

| Jan 7, 2011

Mixed-Use on Steroids

Mixed-use development has been one of the few bright spots in real estate in the last few years. Successful mixed-use projects are almost always located in dense urban or suburban areas, usually close to public transportation. It’s a sign of the times that the residential component tends to be rental rather than for-sale.

| Jan 4, 2011

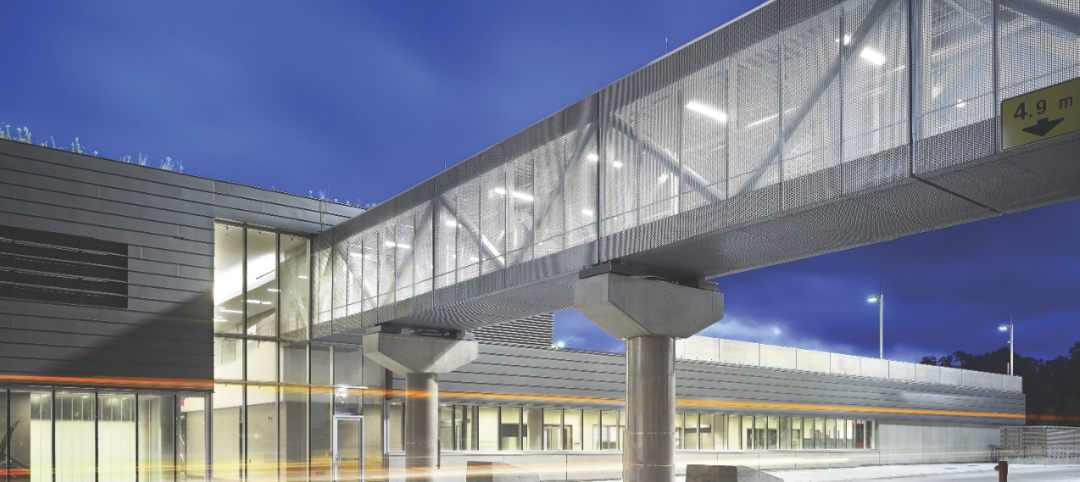

Product of the Week: Zinc cladding helps border crossing blend in with surroundings

Zinc panels provide natural-looking, durable cladding for an administrative building and toll canopies at the newly expanded Queenstown Plaza U.S.-Canada border crossing at the Niagara Gorge. Toronto’s Moriyama & Teshima Architects chose the zinc alloy panels for their ability to blend with the structures’ scenic surroundings, as well as for their low maintenance and sustainable qualities. The structures incorporate 14,000 sf of Rheinzink’s branded Angled Standing Seam and Reveal Panels in graphite gray.

| Jan 4, 2011

6 green building trends to watch in 2011

According to a report by New York-based JWT Intelligence, there are six key green building trends to watch in 2011, including: 3D printing, biomimicry, and more transparent and accurate green claims.

| Jan 4, 2011

LEED 2012: 10 changes you should know about

The USGBC is beginning its review and planning for the next version of LEED—LEED 2012. The draft version of LEED 2012 is currently in the first of at least two public comment periods, and it’s important to take a look at proposed changes to see the direction USGBC is taking, the plans they have for LEED, and—most importantly—how they affect you.