Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

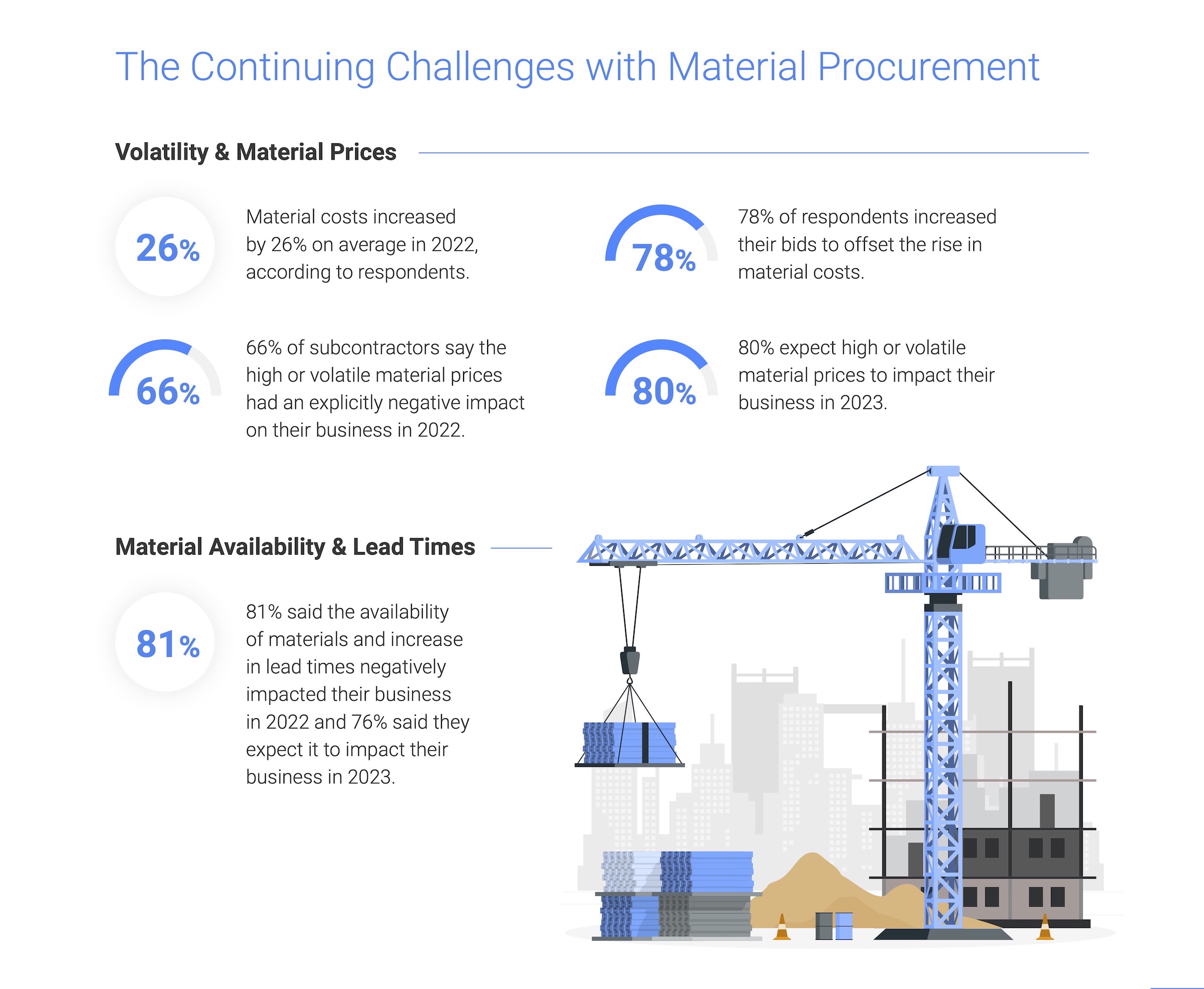

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

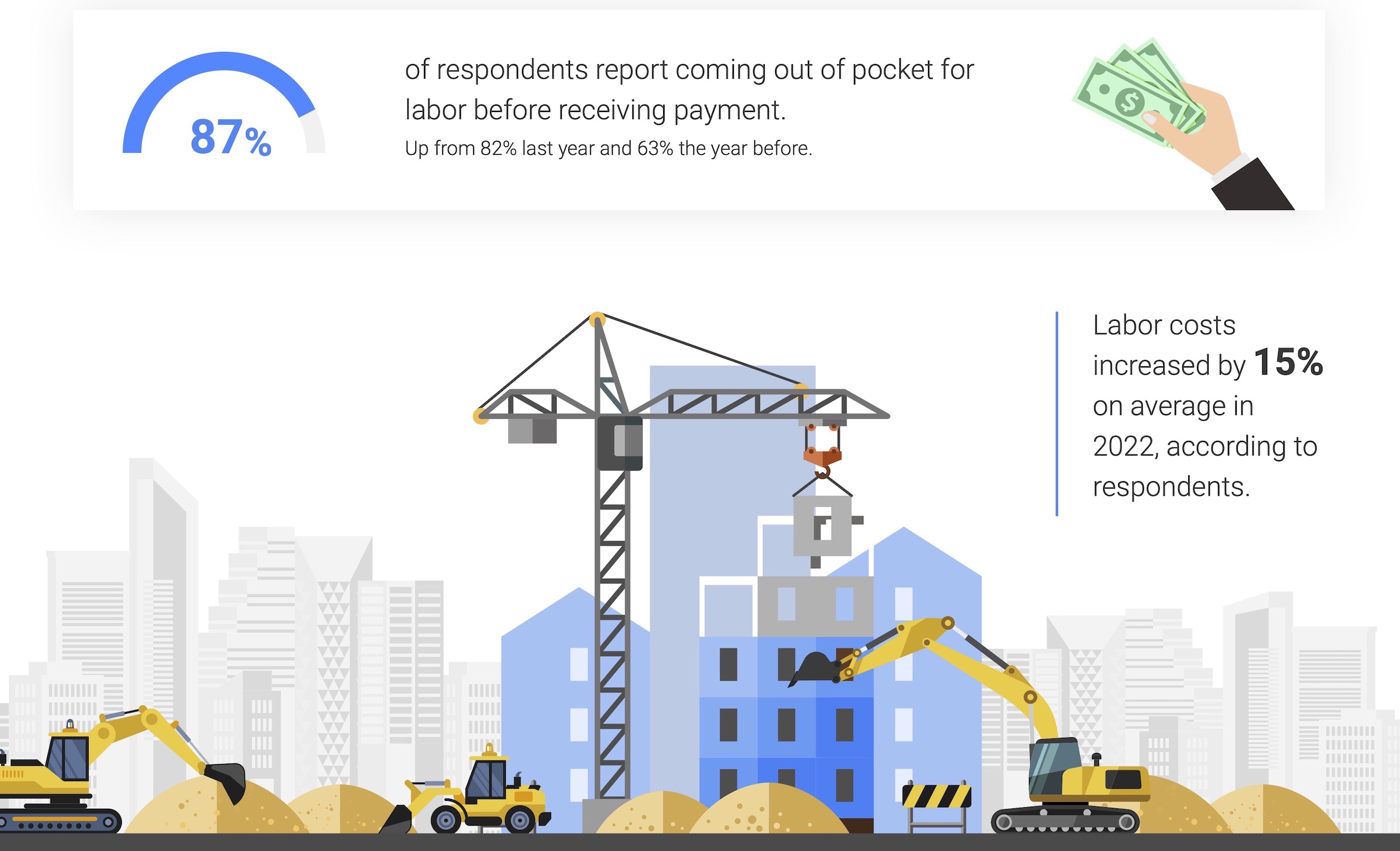

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

| Oct 5, 2011

GREENBUILD 2011: Roof hatch designed for energy efficiency

The cover features a specially designed EPDM finger-type gasket that ensures a positive seal with the curb to reduce air permeability and ensure energy performance.

| Oct 4, 2011

GREENBUILD 2011

Click here for the latest news and products from Greenbuild 2011, Oct. 4-7, in Toronto.

| Oct 4, 2011

GREENBUILD 2011: Methods, impacts, and opportunities in the concrete building life cycle

Researchers at the Massachusetts Institute of Technology’s (MIT) Concrete Sustainability Hub conducted a life-cycle assessment (LCA) study to evaluate and improve the environmental impact and study how the “dual use” aspect of concrete.

| Oct 4, 2011

GREENBUILD 2011: Johnsonite features sustainable products

Products include rubber flooring tiles, treads, wall bases, and more.

| Oct 4, 2011

GREENBUILD 2011: Nearly seamless highly insulated glass curtain-wall system introduced

Low insulation value reflects value of entire curtain-wall system.

| Oct 4, 2011

GREENBUILD 2011: Ready-to-use wood primer unveiled

Maintains strong UV protection, clarity even with application of lighter, natural wood tones.

| Oct 4, 2011

GREENBUILD 2011: Two new recycled glass products announced

The two collections offer both larger and smaller particulates.

| Oct 4, 2011

GREENBUILD 2011: Mythic Paint launches two new paint products

A high performance paint, and a combination paint and primer now available.

| Oct 3, 2011

Magellan Development Group opens Village Market in Chicago’s Lakeshore East neighborhood

Magellan Development Group and Hanwha Engineering & Construction are joint-venture development partners on the project. The Village Market was designed for Silver LEED certification by Loewenberg Architects and built by McHugh Construction.

| Sep 30, 2011

BBS Architects & Engineers completes welcoming center at St. Charles Resurrection Cemetery

The new structure serves as the cemetery's focal architectural point and center of operations.