Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

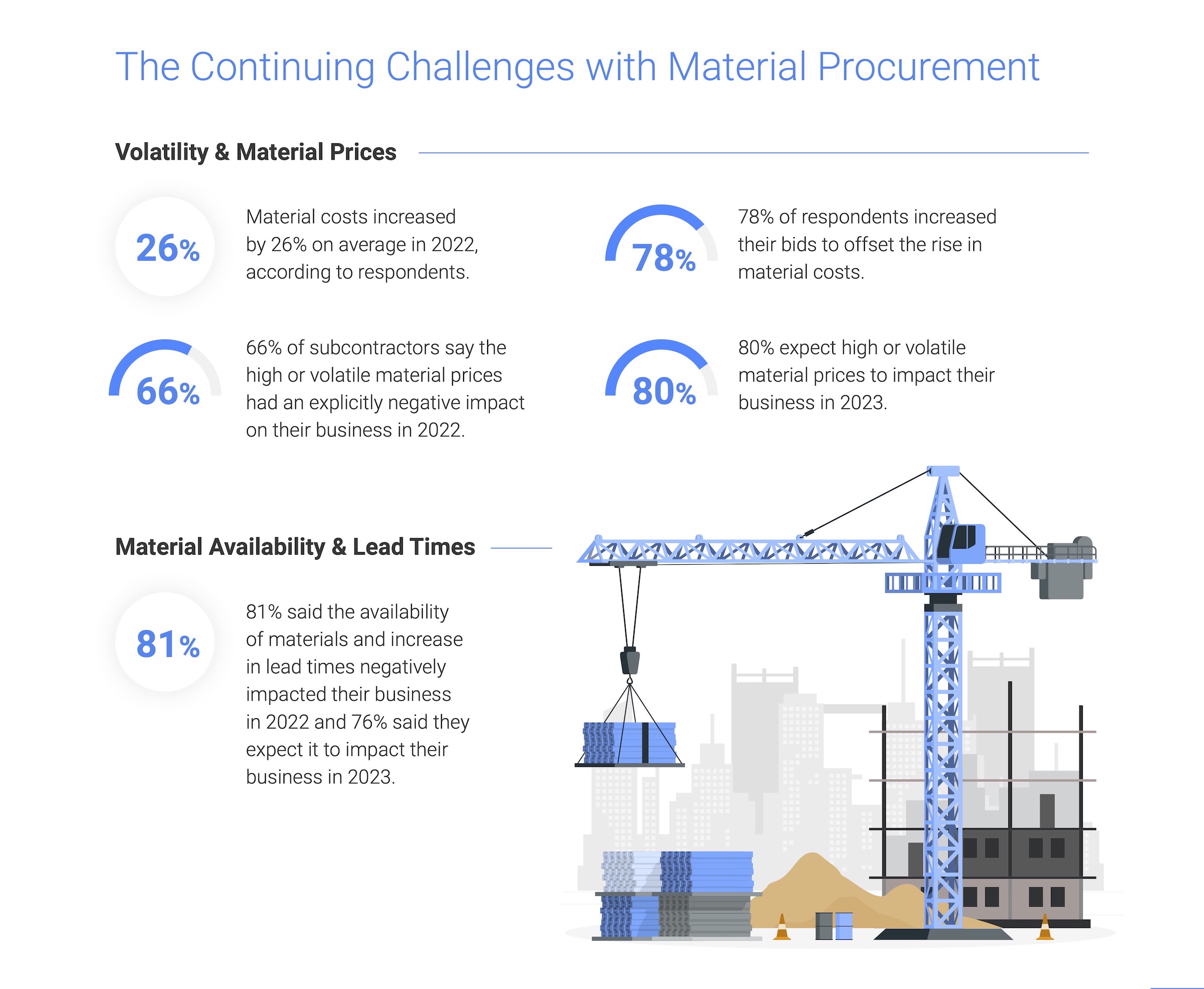

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

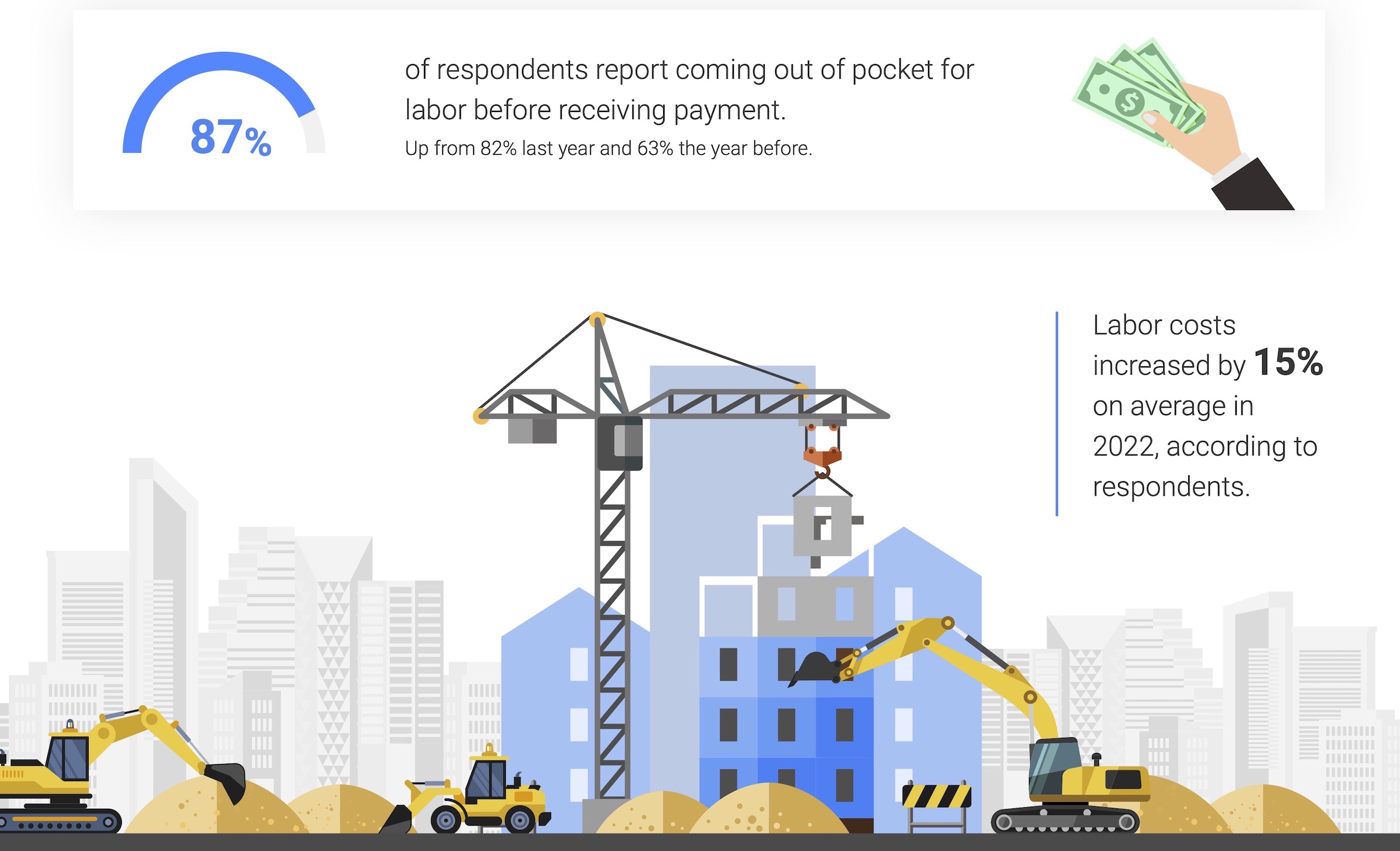

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

| Feb 2, 2012

Delk joins Gilbane Building Co.

Delk to focus on healthcare construction programs and highly complex higher education facilities for Gilbane Building Company’s Southwest region.

| Feb 2, 2012

Next phase of construction begins on Scripps Prebys Cardiovascular Institute

$456 million Institute will be comprehensive heart center for 21st Century.

| Feb 1, 2012

Increase notched in construction jobs, but unemployment rate still at 16%

AGC officials said that construction employment likely benefited from unseasonably warm weather across much of the country that extended the building season.

| Feb 1, 2012

Replacement windows eliminate weak link in the building envelope

Replacement or retrofit can help keep energy costs from going out the window.

| Feb 1, 2012

‘Augmented reality’ comes to the job site

A new software tool derived from virtual reality is helping Building Teams use the power of BIM models more effectively.

| Feb 1, 2012

New ways to work with wood

New products like cross-laminated timber are spurring interest in wood as a structural material.

| Feb 1, 2012

Blackney Hayes designs school for students with learning differences

The 63,500 sf building allows AIM to consolidate its previous two locations under one roof, with room to expand in the future.

| Feb 1, 2012

Two new research buildings dedicated at the University of South Carolina

The two buildings add 208,000 square feet of collaborative research space to the campus.

| Feb 1, 2012

List of Top 10 States for LEED Green Buildings released?

USGBC releases list of top U.S. states for LEED-certified projects in 2011.

| Feb 1, 2012

ULI and Greenprint Foundation create ULI Greenprint Center for Building Performance

Member-to-member information exchange measures energy use, carbon footprint of commercial portfolios.