Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

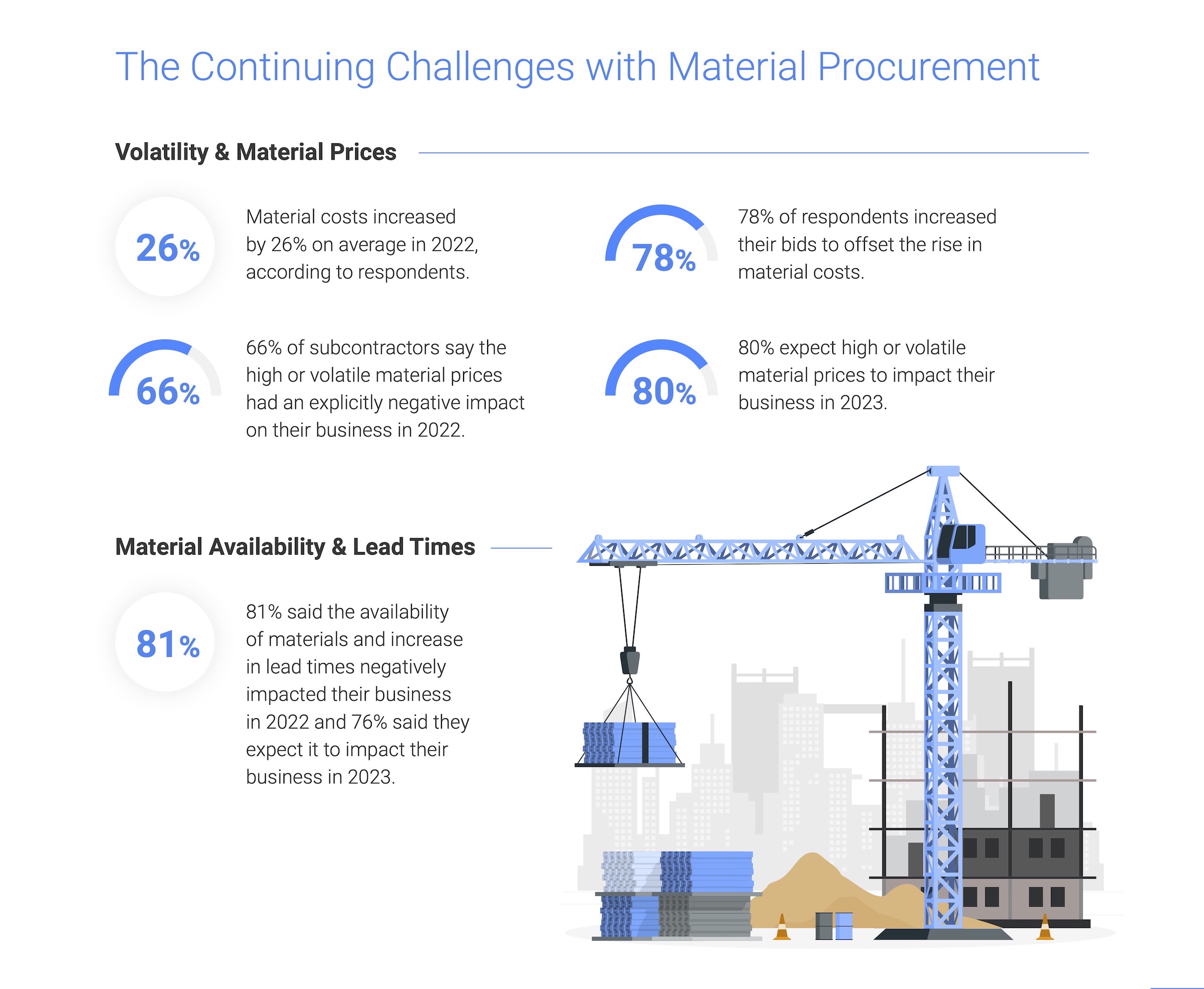

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

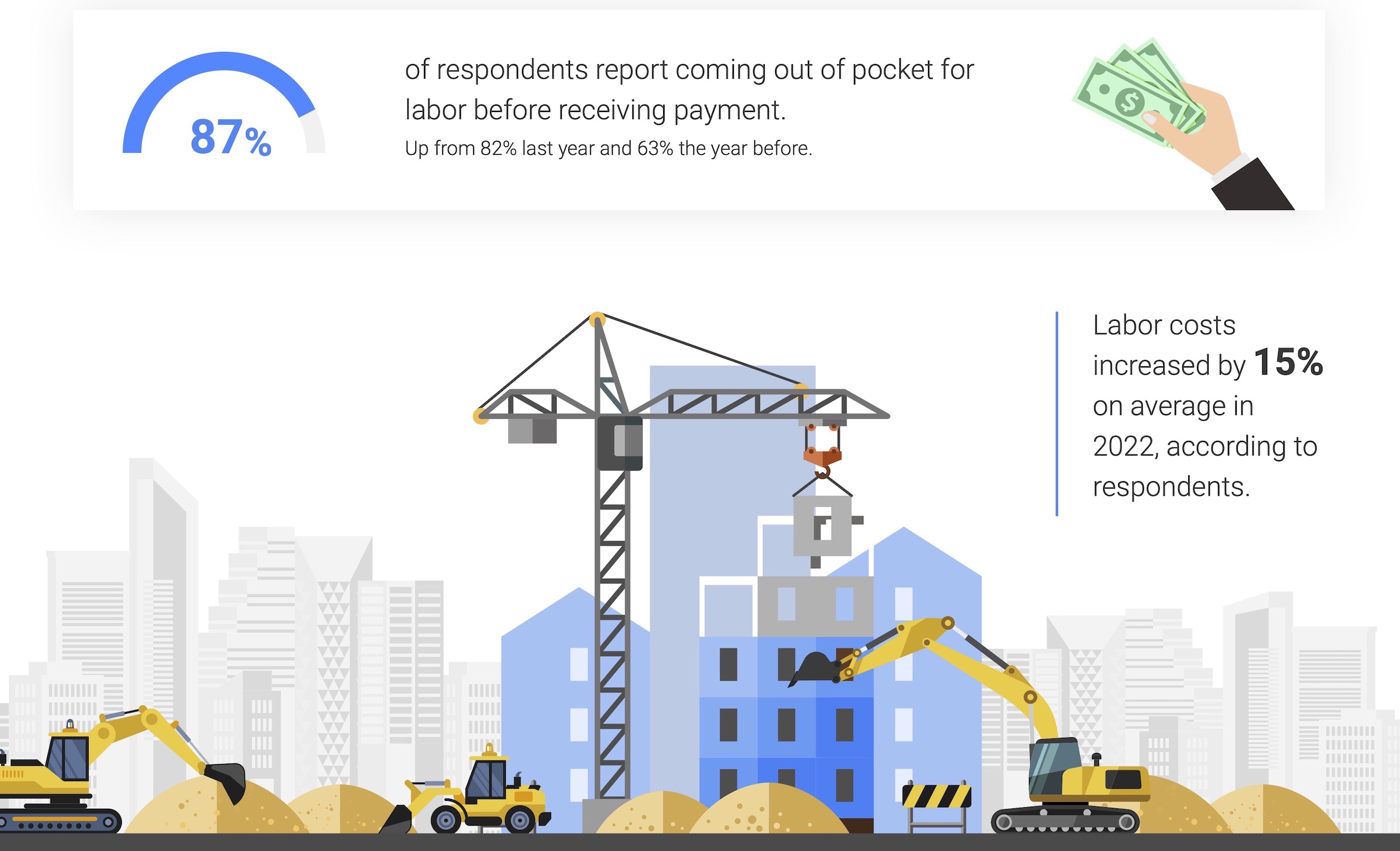

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

| May 22, 2013

Return of retail? Rent growth seen in recovering markets

Like digging a ditch with a spoon, retail demand driven by population growth has eaten away at the supply of available store space in the markets that have been slowest to recover from the downturn. Vacancy rates are reaching a point that will give at least some landlords in every market the clout to demand slightly higher rents.

| May 22, 2013

New ASTM standard enhances hollow structural sections

ASTM A1085 is a big step forward in simplifying HSS design and usage, thereby making it a more desirable option for HSS.

| May 22, 2013

Architecture billings take a step back in April, ending growth streak

For the first time in 10 months, the AIA's Architecture Billings Index slipped into negative territory, falling to 48.6 in April, down from 51.9 the previous month. This is the ABI's lowest mark since July 2012.

| May 21, 2013

Foster + Partners reveals plans for London residential towers

British firm Foster + Partners has unveiled plans for two residential skyscrapers as part of a mixed-use development in north London.

| May 21, 2013

7 tile trends for 2013: Touch-sensitive glazes, metallic tones among top styles

Tile of Spain consultant and ceramic tile expert Ryan Fasan presented his "What's Trending in Tile" roundup at the Coverings 2013 show in Atlanta earlier this month. Here's an overview of Fasan's emerging tile trends for 2013.

| May 20, 2013

4 emerging trends in parking structure design

Survey of parking professionals reveals how technology is transforming the parking industry.

| May 20, 2013

Jones Lang LaSalle: All U.S. real estate sectors to post gains in 2013—even retail

With healthier job growth numbers and construction volumes at near-historic lows, real estate experts at Jones Lang LaSalle see a rosy year for U.S. commercial construction.

| May 17, 2013

First look: HKS' multipurpose stadium for Minnesota Vikings

The Minnesota Sports Facilities Authority (MSFA), the Minnesota Vikings and HKS Sports & Entertainment Group have unveiled the design of the State’s new multi? purpose stadium in Minneapolis, a major milestone in getting the $975 million stadium built on time and on budget.

| May 17, 2013

5 things AEC pros need to know about low-e glass

Low-emissivity glasses are critical to making today’s buildings brighter, more energy-efficient, and more sustainable. Here are five tips to help AEC professionals understand the differences among low-e glasses and their impact on building performance.

| May 17, 2013

LEED v4 has provision to reduce water use in cooling towers

The next version of the U.S. Green Building Council's LEED rating system will expand water-savings targets to appliances, cooling towers, commercial kitchen equipment, and other areas.