Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

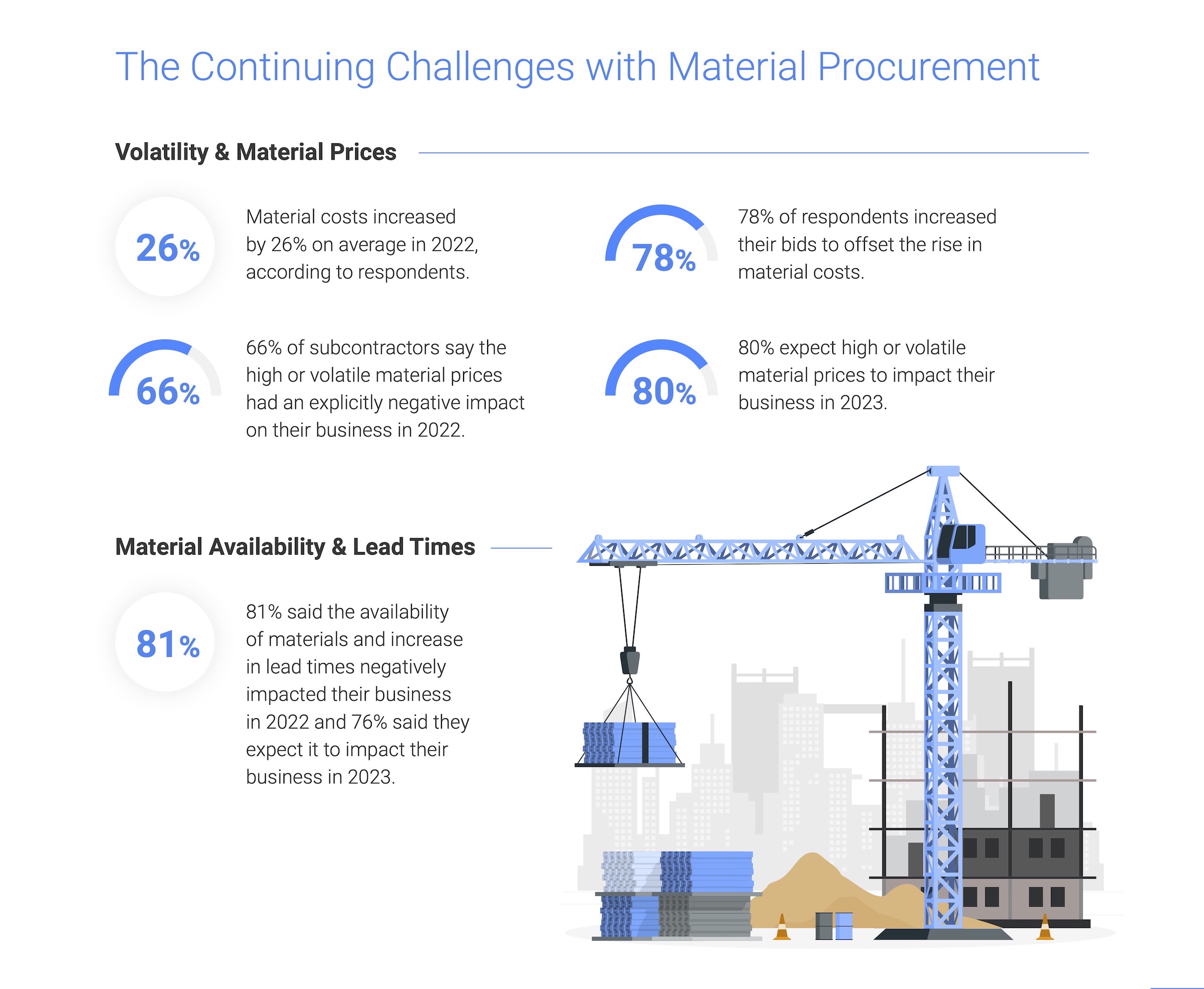

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

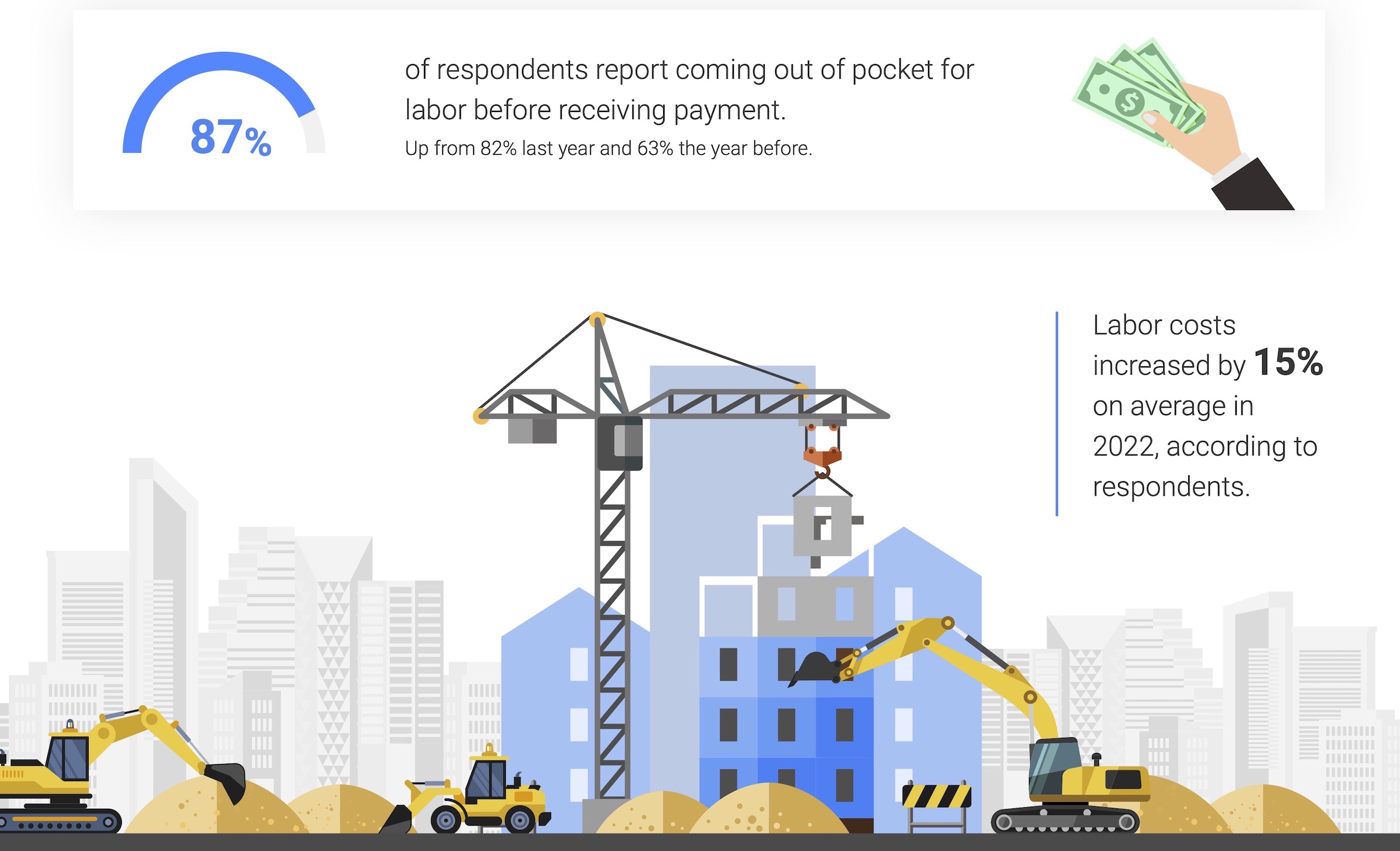

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

Giants 400 | Dec 2, 2020

2020 University Giants: Top architecture, engineering, and construction firms in the higher education sector

Gensler, AECOM, and Turner Construction top BD+C's rankings of the nation's largest university sector architecture, engineering, and construction firms, as reported in the 2020 Giants 400 Report.

Giants 400 | Dec 2, 2020

2020 Multifamily Sector Giants: Top architecture, engineering, and construction firms in the U.S. multifamily building sector

Clark Group, Humphreys & Partners Architects, and Kimley-Horn head BD+C's rankings of the nation's largest multifamily building sector architecture, engineering, and construction firms, as reported in the 2020 Giants 400 Report.

Giants 400 | Dec 2, 2020

2020 Airport Sector Giants: Top architecture, engineering, and construction firms in the U.S. airport facilities sector

AECOM, Hensel Phelps, and PGAL top BD+C's rankings of the nation's largest airport sector architecture, engineering, and construction firms, as reported in the 2020 Giants 400 Report.

Contractors | Dec 1, 2020

Abbott Construction to join the STO Building Group

Merger will expand both firms’ geographic reach and services.

Giants 400 | Nov 29, 2020

Top 85 Construction Management + Project Management Firms for 2020

Jacobs, CBRE, VCC, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential and multifamily buildings work, as reported in Building Design+Construction's 2020 Giants 400 Report.

Giants 400 | Nov 29, 2020

Top 135 Contractors for 2020

Turner, Whiting-Turner, and STO Building Group head the rankings of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2020 Giants 400 Report.

Architects | Nov 24, 2020

AEC Leaders share lessons from past downturns

Positions of passivity and cost-cutting run counter to the key lessons from AEC leaders who successfully navigated their firms through past market downturns.

Smart Buildings | Nov 20, 2020

The Weekly show: SPIRE smart building rating system, and pickleball court design tips

The November 19 episode of BD+C's The Weekly is available for viewing on demand.

Government Buildings | Nov 13, 2020

Tax shortfalls nip government projects in the bud

Federal contracts are proceeding, but states and cities are delaying, deferring, and looking for private investment.

AEC Tech | Nov 12, 2020

The Weekly show: Nvidia's Omniverse, AI for construction scheduling, COVID-19 signage

BD+C editors speak with experts from ALICE Technologies, Build Group, Hastings Architecture, Nvidia, and Woods Bagot on the November 12 episode of "The Weekly." The episode is available for viewing on demand.