The Building Owners and Managers Association (BOMA) International has identified the most expensive commercial real estate markets in the U.S. The data is drawn from the 2011 Experience Exchange Report (EER), which provides an annual analysis of the office building operating income and expense data compiled across approximately 940 million square feet of commercial office space in more than 6,500 buildings in 278 different markets. The 2011 report is based on operating income and expenses from 2010.

The most expensive U.S. cities, based on total rental income, include:

- New York, N.Y., $48.27 per square foot (psf)

- Washington, D.C., $42.63 psf

- San Mateo, Calif., $41.61 psf

- Santa Monica, Calif., $36.67 psf

- San Francisco, Calif., $34.86 psf

- Boston, Mass., $31.15 psf

- San Jose, Calif., $30.35 psf

- Los Angeles, Calif., $27.97 psf

- West Palm Beach, Fla., $27.71 psf

- Chicago, Ill., $25.20 psf

Total rental income includes rental income from office, retail, and other space, which includes storage areas. Amid the economic downturn in real estate markets, few markets demonstrated significant increases in rental income, suggesting that rental rates remain relatively stable and favorable for tenants seeking to pursue new leases or renegotiate existing ones. Among the most expensive cities, only New York and San Francisco showed increases in rental income.

Gauging most expensive cities on the basis of total operating and fixed expenses produces a slightly different list:

- New York, N.Y., $21.44 psf

- Washington, D.C., $16.86 psf

- Boston, Mass., $15.16 psf

- Morristown, N.J., $14.67 psf

- San Francisco, Calif., $14.43 psf

- Miami, Fla., $12.87 psf

- Santa Monica, Calif., $12.84 psf

- Plainfield, N.J., $12.83 psf

- Chicago, Ill. and Los Angeles, Calif., 12.49 psf

- Newark, N.J., $12.46 psf

Total operating expenses includes all expenses incurred to operate office buildings, including utilities, repairs/maintenance, cleaning, administrative, security and roads and grounds. Fixed expenses include real estate taxes, property taxes and insurance. In New York, average total operating plus fixed expenses were $21.44 per square foot (psf), while in Los Angeles, they averaged $12.96 psf. Operating expenses increased in most markets in the last year. Fixed expenses were volatile, which could be attributed in part to rising utility costs as well as rising real estate taxes. While many cash-constrained cities and municipalities are looking to real estate for tax revenue, many property owners are contesting tax assessments because asset values have decreased due to the economic downturn. BD+C

Related Stories

| Jan 4, 2011

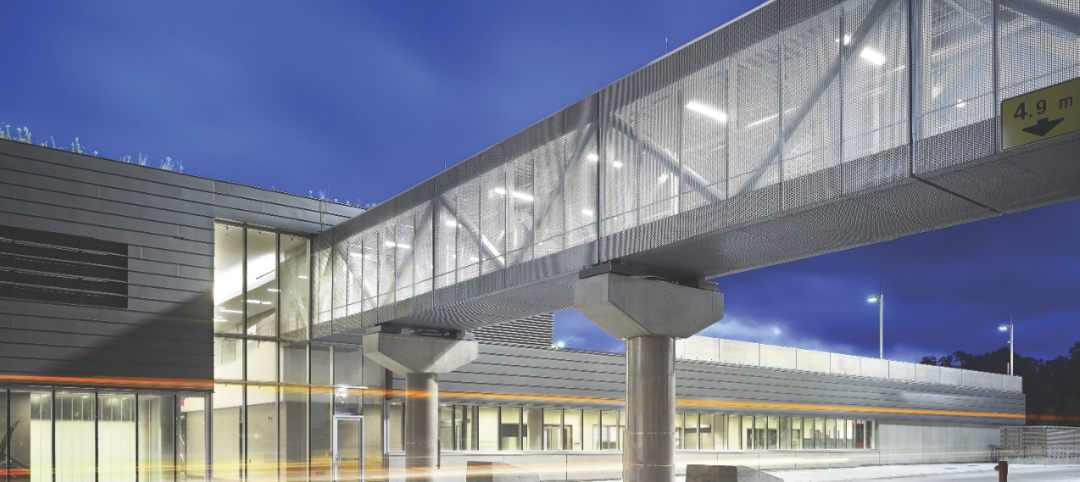

Product of the Week: Zinc cladding helps border crossing blend in with surroundings

Zinc panels provide natural-looking, durable cladding for an administrative building and toll canopies at the newly expanded Queenstown Plaza U.S.-Canada border crossing at the Niagara Gorge. Toronto’s Moriyama & Teshima Architects chose the zinc alloy panels for their ability to blend with the structures’ scenic surroundings, as well as for their low maintenance and sustainable qualities. The structures incorporate 14,000 sf of Rheinzink’s branded Angled Standing Seam and Reveal Panels in graphite gray.

| Jan 4, 2011

6 green building trends to watch in 2011

According to a report by New York-based JWT Intelligence, there are six key green building trends to watch in 2011, including: 3D printing, biomimicry, and more transparent and accurate green claims.

| Jan 4, 2011

LEED standards under fire in NYC

This year, for the first time, owners of 25,000 commercial properties in New York must report their buildings’ energy use to the city. However, LEED doesn’t measure energy use and costs, something a growing number of engineers, architects, and landlords insist must be done. Their concerns and a general blossoming of environmental awareness have spawned a host of rating systems that could test LEED’s dominance.

| Jan 4, 2011

LEED 2012: 10 changes you should know about

The USGBC is beginning its review and planning for the next version of LEED—LEED 2012. The draft version of LEED 2012 is currently in the first of at least two public comment periods, and it’s important to take a look at proposed changes to see the direction USGBC is taking, the plans they have for LEED, and—most importantly—how they affect you.

| Jan 4, 2011

California buildings: now even more efficient

New buildings in California must now be more sustainable under the state’s Green Building Standards Code, which took effect with the new year. CALGreen, the first statewide green building code in the country, requires new buildings to be more energy efficient, use less water, and emit fewer pollutants, among many other requirements. And they have the potential to affect LEED ratings.

| Jan 4, 2011

New Years resolutions for architects, urban planners, and real estate developers

Roger K. Lewis, an architect and a professor emeritus of architecture at the University of Maryland, writes in the Washington Post about New Years resolutions he proposes for anyone involved in influencing buildings and cities. Among his proposals: recycle and reuse aging or obsolete buildings instead of demolishing them; amend or eliminate out-of-date, obstructive, and overly complex zoning ordinances; and make all city and suburban streets safe for cyclists and pedestrians.

| Jan 4, 2011

An official bargain, White House loses $79 million in property value

One of the most famous office buildings in the world—and the official the residence of the President of the United States—is now worth only $251.6 million. At the top of the housing boom, the 132-room complex was valued at $331.5 million (still sounds like a bargain), according to Zillow, the online real estate marketplace. That reflects a decline in property value of about 24%.

| Jan 4, 2011

Luxury hotel planned for Palace of Versailles

Want to spend the night at the Palace of Versailles? The Hotel du Grand Controle, a 1680s mansion built on palace grounds for the king's treasurer and vacant since the French Revolution, will soon be turned into a luxury hotel. Versailles is partnering with Belgian hotel company Ivy International to restore the dilapidated estate into a 23-room luxury hotel. Guests can live like a king or queen for a while—and keep their heads.

| Jan 4, 2011

Grubb & Ellis predicts commercial real estate recovery

Grubb & Ellis Company, a leading real estate services and investment firm, released its 2011 Real Estate Forecast, which foresees the start of a slow recovery in the leasing market for all property types in the coming year.

| Jan 4, 2011

Furniture Sustainability Standard - Approved by ANSI and Released for Distribution

BIFMA International recently announced formal American National Standards Institute (ANSI) approval and release of the ANSI/BIFMA e3-2010 Furniture Sustainability Standard. The e3 standard represents a structured methodology to evaluate the "sustainable" attributes of furniture products and constitutes the technical criteria of the level product certification program.