There is a new secret sauce at quick service restaurants (QSRs), but according to JLL research, you won’t find it in the food. The fight for market share has led Wendy’s, Chick-fil-A, and other QSRs to adapt new development strategies to compete with fast-casual restaurants that are threatening fast food’s traditional heavyweights.

“Everyone is trying to figure out who their customer is and what they can do to put themselves in a better position than their competitors,” said Steve Jones, Managing Director for JLL Retail Multi-site. “The customer is much more knowledgeable now than in the past. We have access to more intelligence and data, so it’s more important than ever that these restaurants know themselves, their brand and who their customer really is.”

“The traditional QSR dining experience encourages customers to get their food, eat, and leave. At Wendy’s, we’re changing that standard by making the environment in our dining rooms more inviting and comfortable.” —Bruce Allendorfer, Regional Director of Construction, Wendy’s

According to the JLL research, the millennial consumer base is becoming increasingly vital to QSRs. This consumer pool accounts for approximately 23% of annual restaurant spending—about 46 billion visits annually. With those visits come new expectations for atmosphere and fresh ingredients, which requires QSRs to invest in their facilities, brand experience, and technology, across both existing restaurants and new locations.

Fast-casual restaurants are slightly more expensive than QSR options, but offer customizable, health-conscious options offered in a hip environment that appeals to millennials. With this in mind, Wendy’s is evolving its customer experience to match the changing consumer landscape.

“The traditional QSR dining experience encourages customers to get their food, eat, and leave. At Wendy’s, we’re changing that standard by making the environment in our dining rooms more inviting and comfortable,” said Bruce Allendorfer, Regional Director of Construction for Wendy’s. “Customers stay longer and can make an event out of their visit.”

JLL worked with Wendy’s to implement its “image activation.” The new strategy started with store rebrands for the Ohio-based restaurant chain, which includes adding fireplaces, new seating options with lounge chairs and booths, Wi-Fi, flat-screen televisions, and digital menu boards. The goal wasn’t just to drive sales but to compete with the environments offered by Wendy’s fast-casual peers.

“Our customers are reacting positively to the re-imaging of Wendy’s. Sales are up and, more importantly, there are positive customer counts as well,” Allendorfer said. “Wendy’s is providing a quality experience for our customers in both the drive-through and the dining room.”

3 RETAIL DESIGN TACTICS FOR GROWING MARKET SHARE

The opportunity for QSRs is great. With a focus on three key areas, these restaurants can combat threats to their market share:

Rapid renovation: Reworking existing space to better serve high consumer expectations can change the entire experience of a restaurant. Changing the interior build out of the restaurants, remolding the ordering space, and re-creating the menu are all physical ways to make a QSR more competitive. Another more complex method is to create a franchising model to meet local market demand.

Technology: Technology enhancements go a long way to personalizing the consumer experience. For example, drive-through experiences can be upgraded by replacing the metal speaker box with a high-definition video communication platform, as done recently by a global coffee chain. GPS and beacon technologies offer incredible potential for creating new digital experiences for consumers, as well.

Facility Branding: Implementing a brand refresh can alter previous impressions and introduce a whole new demographic to a company. On average, organizations refresh their corporate brands once every seven to 10 years, but QSRs are doing so even more frequently.

Renovation, rebranding, and redevelopment come with their own challenges for QSRs. In 2013, sales for fast-casual chains grew by 11%, while QSRs have maintained revenue growth at about 1.2% annually because of flattening sales and an increase in the cost to produce. Efficiency has proved necessary for chains like Chick-fil-A, who see development projects balloon during expansion and renovation.

“The biggest challenge that Chick-fil-A was facing was a large increase in the number of projects we needed to manage within the reinvestment portfolio,” said John Mark Wood, a Program Manager from Chick-fil-A. “The budget went from approximately $30 million to $100 million in a span of one and a half to two years.”

Chick-fil-A worked with JLL to manage its reinvestment program. By adapting new development strategies like these, QSRs can stay diversified and contend with their fast-casual counterparts.

To download JLL’s special report on the state of the restaurant industry, visit here.

Related Stories

Sponsored | Coatings | May 14, 2015

Prismatic coatings accent the new Altara Center

This multi-use campus will contain a university, sports facilities, medical center, and world-class shopping

Retail Centers | May 13, 2015

To succeed, malls must appeal to shopper lifestyles

Malls and shopping centers are more effective as destinations when their tenant mix appeals to customers’ lifestyles beyond shopping and includes fitness centers, gourmet cooking shops, and sustainable-product options.

Mixed-Use | May 5, 2015

Miami ‘innovation district’ will have 6.5 million sf of dense, walkable space

Designing a neighborhood from the ground-up, developers aim to create a dense, walkable district that fulfills what is lacking from Miami’s current auto-dependent layout.

Sponsored | Daylighting | Apr 8, 2015

Bigger, brighter daylighting in Byerly's supermarket

More natural light was needed, but the project team wanted it to be diffused across large areas of the store.

Mixed-Use | Apr 7, 2015

$100 billion 'city from scratch' taking shape in Saudi Arabia

The new King Abdullah Economic City was conceived to diversify the kingdom's oil-dependent economy by focusing more in its shipping industry.

Mixed-Use | Mar 13, 2015

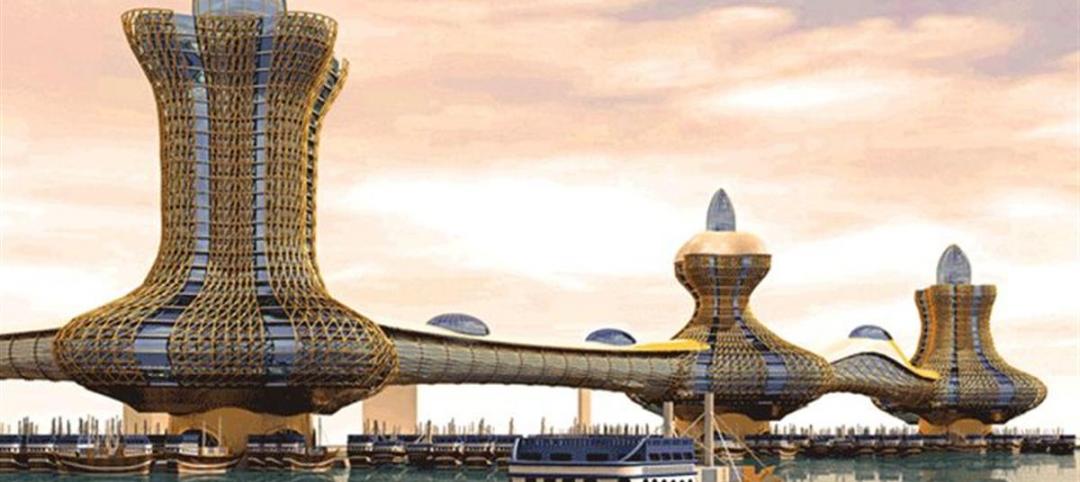

Dubai announces mega waterfront development Aladdin City

Planned on 4,000 acres in the Dubai Creek area, the towers will be covered in gold lattice and connected via air-conditioned bridges.

High-rise Construction | Mar 12, 2015

Foster and Partners designs 'The One' in Toronto

Developer Sam Mizrahi worked with Foster and Partners and Core Architects to design Toronto's tallest skyscraper aside from the CN Tower, The One, which will house a luxury shopping mall and condos.

Retail Centers | Mar 10, 2015

Retrofit projects give dying malls new purpose

Approximately one-third of the country’s 1,200 enclosed malls are dead or dying. The good news is that a sizable portion of that building stock is being repurposed.

Retail Centers | Mar 10, 2015

Orlando's Skyscraper to be world's tallest roller coaster

The Skyscraper is expected to begin construction later this year, and open in 2016. It will stand at 570 feet.

Codes and Standards | Mar 5, 2015

Charlotte, N.C., considers rule for gender-neutral public bathrooms

A few other cities, including Philadelphia, Austin, Texas, and Washington D.C., already have gender-neutral bathroom regulations.