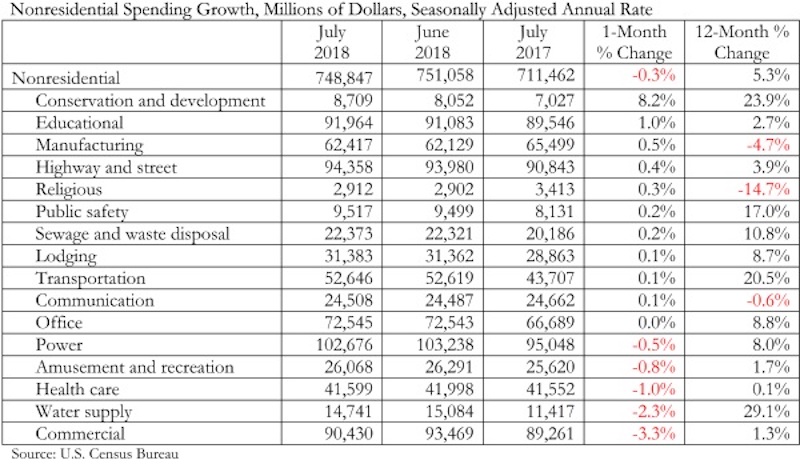

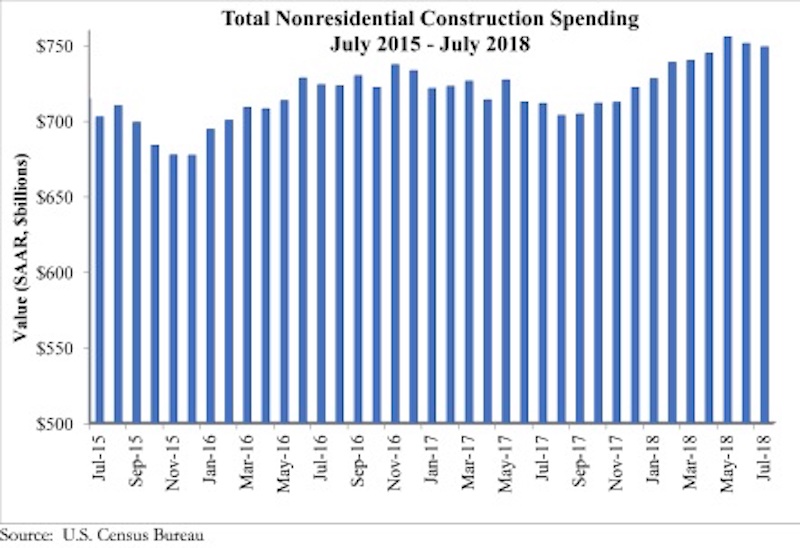

National nonresidential construction spending declined 0.3% in July, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data recently released. Total nonresidential spending stood at $748.8 billion on a seasonally adjusted, annualized rate in July, an increase of 5.3% from the same time last year. Private nonresidential spending fell 1% in July, while public nonresidential spending expanded 0.7%.

“Construction spending dynamics have reversed almost completely during the past 12 to 18 months,” said ABC Chief Economist Anirban Basu. “Earlier in the cycle, private construction expanded briskly, driven in part by abundantly available financing at very low interest rates. While private construction volumes continue to be elevated, they are no longer expanding at quite the same rate. For instance, construction spending on lodging and office space barely budged for the month, while commercial construction, such as fulfillment and shopping centers, fell 3.3%.

“By contrast, nonresidential construction segments associated with large public components, including conservation and development, education, highway and street, public safety, and sewage and waste disposal all experienced an uptick in spending in July,” said Basu. “Many states are now running budget surpluses for the first time in years, in part due to surging capital gains tax collections. One result is that more public projects are moving forward. As evidence, construction spending in the water supply category is up 29% on a year-over-year basis, conservation and development (e.g. flood control) by 24%, transportation by nearly 21%, public safety-related spending by 17% and sewage and waste disposal by 11%.

“The implication is that the economy’s strong performance is increasingly translating into infrastructure spending, even in the absence of a federal infrastructure package,” said Basu. “Given recent economic and financial market performance, there is every reason to believe that state and local government finances, though still fragile in many instances, will continue to improve. That strongly suggests public construction spending will continue to progress during the months ahead. In constrast, private construction spending growth is more likely to remain constrained for a number of reasons, including recent increases in private borrowing costs and concerns that segments in certain communities are now overbuilt or approaching overbuilt status.”

Related Stories

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.

Hotel Facilities | Jan 13, 2016

Hotel construction should remain strong through 2017

More than 100,000 rooms could be delivered this year alone.

Market Data | Jan 6, 2016

Census Bureau revises 10 years’ worth of construction spending figures

The largest revisions came in the last two years and were largely upward.

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.

Market Data | Jan 5, 2016

Nonresidential construction spending falters in November

Only 4 of 16 subsectors showed gains

Market Data | Dec 15, 2015

AIA: Architecture Billings Index hits another bump

Business conditions show continued strength in South and West regions.

Market Data | Dec 7, 2015

2016 forecast: Continued growth expected for the construction industry

ABC forecasts growth in nonresidential construction spending of 7.4% in 2016 along with growth in employment and backlog.