For the past few years, several production and semi-custom home builders have ventured outside of their for-sale comfort zones to engage in construction for rental customers.

Toll Brothers, the industry’s 13th-largest builder, told analysts in October that it had plans for five joint-venture projects to build a total of 1,900 rental apartment units, and had another 2,500 apartments already in its production pipeline. The builder’s City Living division has a number of mid- and high-rise rental buildings either operating or under construction in New York, Philadelphia, and Washington D.C.

CEO Doug Yearley said Toll Brothers would contribute one-quarter of the total equity for the JVs. He referred to rental as a market “hedge” that is synergistic with Toll’s core business model.

For more on the multifamily housing sector, read BD+C's Special Report: "5 intriguing trends to track in the multifamily housing game"

In 2012-13, Lennar, the industry’s second-largest builder, launched Lennar Multifamily. Through August 31, this division had completed 19 rental communities, with another 16 under construction. Lennar uses third-party property managers to lease and manage its apartments.

These and other builders—notably Arbor Custom Homes in the Pacific Northwest, and Sares-Regis Group and MBK Homes in California—have delved deeper into metro areas facing severe shortages of rental units. In San Francisco alone, 90% of the 7,000 residential units under construction are rentals.

It’s important to note, however, that the majority of production builders with townhouses and condos in their portfolios still target buyers, not renters. One of these is San Francisco-based Trumark Urban, a division of Trumark Homes. As of late October, Trumark Urban had nine for-sale condo projects with 1,000 units in the works, seven of them in its hometown. Its total investment in these projects: $700 million.

Unlike other production builders that have dipped their toes in the apartment arena, Trumark has stuck with for-sale condos, and has nine such projects in development in California. Photo: ©Christopher Mayer Photography

Unlike other production builders that have dipped their toes in the apartment arena, Trumark has stuck with for-sale condos, and has nine such projects in development in California. Photo: ©Christopher Mayer Photography

Arden Hearing, Trumark Urban’s Managing Director, says condo customers run the gamut from Millennials to empty nesters and age groups in between––“anyone who values the urban fabric.”

For Amero, which broke ground in San Francisco in November 2013, Trumark Urban offered two- and three-bedroom condos from 1,000 to 2,500 sf, selling at $1,100 to $2,000 per sf. Amero offers what Hearing says is a world-class roof deck. There’s a bike-parking space for every tenant, and a bike shop that’s managed by the homeowners’ association.

Hearing says the firm can be selective about what amenities it offers in San Francisco because the neighborhood itself is the biggest amenity. “It’s transit oriented and walkable,” he says. “I bet there are 15 bars within a short walk of Amero.” No need for an on-site gym either: there are numerous fitness centers close by.

Trumark’s projects in Los Angeles, however, have more extensive on-premises amenities. A 150-unit downtown building, three blocks from the Staples Center, has a 6,000-sf pool deck with grilling, private rooms, and yoga studios.

Hearing says his company has avoided marketing its condos as “luxury” in San Francisco, “where that’s a four-letter word.” But that label might be unavoidable for a $150 million, 77-unit condo project that Trumark broke ground on in October in San Francisco’s toney Pacific Heights neighborhood.

Trumark Urban is currently looking for opportunities in Seattle, San Diego, and international markets. “We want to go where people want to live,” says Hearing.

Related Stories

Market Data | Feb 7, 2024

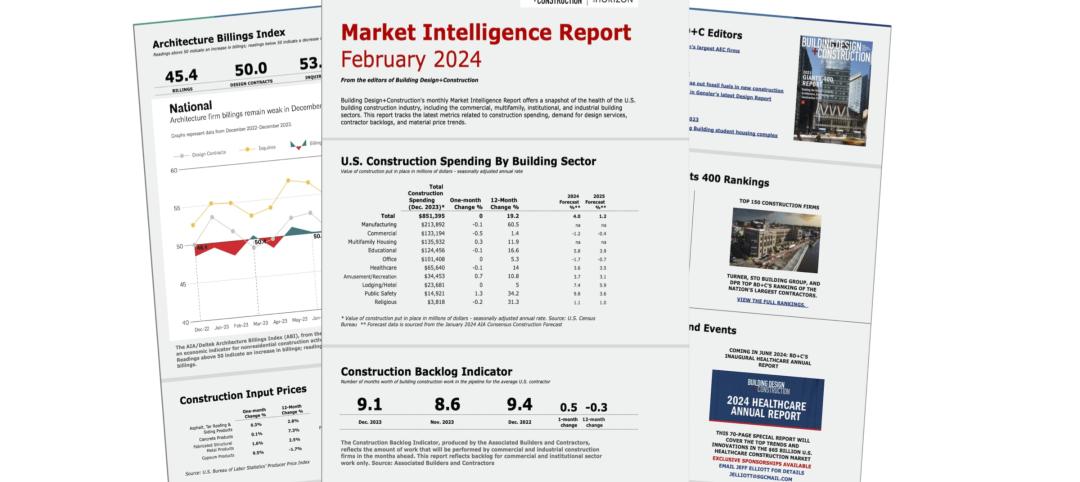

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Giants 400 | Feb 6, 2024

Top 80 Religious Facility Architecture Firms for 2023

Parkhill, FGM Architects, GFF, Gensler, and HOK top BD+C's ranking of the nation's largest religious facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Modular Building | Feb 6, 2024

Modular fire station allows for possible future reconfigurations

A fire station in Southern California leveraged prefab, modular construction for faster completion and future reconfiguration.

Giants 400 | Feb 5, 2024

Top 30 Entertainment Center, Cineplex, and Theme Park Architecture Firms for 2023

Gensler, JLL, Nelson Worldwide, AO, and Stantec top BD+C's ranking of the nation's largest entertainment center, cineplex, and theme park architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Urban Planning | Feb 5, 2024

Lessons learned from 70 years of building cities

As Sasaki looks back on 70 years of practice, we’re also looking to the future of cities. While we can’t predict what will be, we do know the needs of cities are as diverse as their scale, climate, economy, governance, and culture.

Giants 400 | Feb 5, 2024

Top 90 Shopping Mall, Big Box Store, and Strip Center Architecture Firms for 2023

Gensler, Arcadis North America, Core States Group, WD Partners, and MBH Architects top BD+C's ranking of the nation's largest shopping mall, big box store, and strip center architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Laboratories | Feb 5, 2024

DOE selects design-build team for laboratory focused on clean energy innovation

JE Dunn Construction and SmithGroup will construct the 127,000-sf Energy Materials and Processing at Scale (EMAPS) clean energy laboratory in Colorado to create a direct path from lab-scale innovations to pilot-scale production.

Architects | Feb 2, 2024

SRG Partnership joins CannonDesign to form 1,300-person design giant across 18 offices

SRG Partnership, a dynamic architecture, interiors and planning firm with studios in Portland, Oregon, and Seattle, Washington, has joined CannonDesign. This merger represents not only a fusion of businesses but a powerhouse union of two firms committed to making a profound difference through design.

Giants 400 | Feb 1, 2024

Top 90 Restaurant Architecture Firms for 2023

Chipman Design Architecture, WD Partners, Greenberg Farrow, GPD Group, and Core States Group top BD+C's ranking of the nation's largest restaurant architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Standards | Feb 1, 2024

Prioritizing water quality with the WELL Building Standard

In this edition of Building WELLness, DC WELL Accredited Professionals Hannah Arthur and Alex Kircher highlight an important item of the WELL Building Standard: water.