Unprecedented price increases for a wide range of goods and services used in construction pushed up contractors’ costs by a devastating 26.3% from June 2020 to June 2021, according to an analysis by the Associated General Contractors of America of government data released today. Association officials cautioned that rising materials prices are making it difficult for many construction firms to benefit from the re-opening of the economy, undermining the sector’s ability to add new, high-paying jobs.

“Contractors have been pummeled in the past year by cost increases, supply shortages, and transport bottlenecks,” said Ken Simonson, the association’s chief economist. “Meanwhile, falling demand for many types of projects meant contractors could not raise bid prices enough to recoup these expenses.”

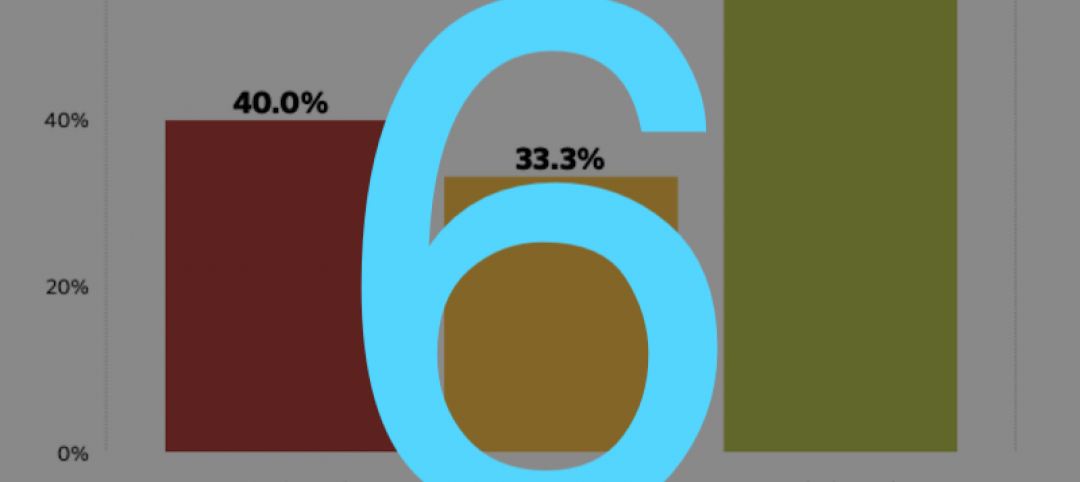

The producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—rose only 3.4% over the past 12 months. That was a small fraction of the 26.3% increase in the prices that producers and service providers such as distributors and transportation firms charged for construction inputs, Simonson noted.

There were double-digit percentage increases in the selling prices of materials used in every type of construction. The producer price index for lumber and plywood doubled from June 2020 to last month, although prices for lumber have declined since the index was computed. The index for steel mill products climbed 87.5%, while the index for copper and brass mill shapes rose 61.5% and the index for aluminum mill shapes increased 33.2%. The index for plastic construction products rose 21.8%. The index for gypsum products such as wallboard climbed 18.0%. The index for prepared asphalt and tar roofing and siding products climbed 12.1%, while the index for insulation materials rose 10.1%.

In addition to increases in materials costs, transportation and fuel costs also spiked. The index for truck transportation of freight jumped 15.4%. Fuel costs, which contractors pay directly to operate their own trucks and off-road equipment, as well as through surcharges on freight deliveries, have also jumped.

Association officials urged Congress and the Biden administration to act quickly to address rising materials prices. They repeated their calls for the president to remove tariffs on key construction materials, including steel and aluminum. They also urged Washington officials to explore other short-term steps needed to improve the supply chain for key construction materials.

“Construction firms will have a hard time adding new staff while they are paying more and more for many of the products they need to build projects,” said Stephen E. Sandherr, the association’s chief executive officer. “Washington officials can take steps that are likely to have an almost immediate impact on materials prices, but they need to act.”

View producer price index data. View chart of gap between input costs and bid prices.

Related Stories

Market Data | Jun 12, 2020

6 must reads for the AEC industry today: June 12, 2020

How will museums change in the face of COVID-19 and the patriarch of The Boldt Company dies.

Market Data | Jun 11, 2020

5 must reads for the AEC industry today: June 11, 2020

Istanbul opens largest base-isolated hospital in the world and AIA issues tools for reducing risk of COVID-19 transmission in buildings.

Market Data | Jun 10, 2020

6 must reads for the AEC industry today: June 10, 2020

Singapore's newest residential district and CannonDesign unveils COVID Shield.

Market Data | Jun 9, 2020

ABC’s Construction Backlog Indicator inches higher in May; Contractor confidence continues to rebound

Nonresidential construction backlog is down 0.8 months compared to May 2019 and declined year over year in every industry.

Market Data | Jun 9, 2020

6 must reads for the AEC industry today: June 9, 2020

OSHA safety inspections fall 84% and the office isn't dead.

Market Data | Jun 8, 2020

Construction jobs rise by 464,000 jobs but remain 596,000 below recent peak

Gains in may reflect temporary support from paycheck protection program loans and easing of construction restrictions, but hobbled economy and tight state and local budgets risk future job losses.

Market Data | Jun 5, 2020

7 must reads for the AEC industry today: June 5, 2020

The world's first carbon-fiber reinforced concrete building and what will college be like in the fall?

Market Data | Jun 4, 2020

7 must reads for the AEC industry today: June 4, 2020

Construction unemployment declines in 326 of 358 metro areas and is the show over for AMC Theatres?

Market Data | Jun 3, 2020

Construction employment declines in 326 out of 358 metro areas in April

Association says new transportation proposal could help restore jobs.

Market Data | Jun 3, 2020

6 must reads for the AEC industry today: June 3, 2020

5 ways to improve cleanliness of public restrooms and office owners are in no hurry for tenants to return.