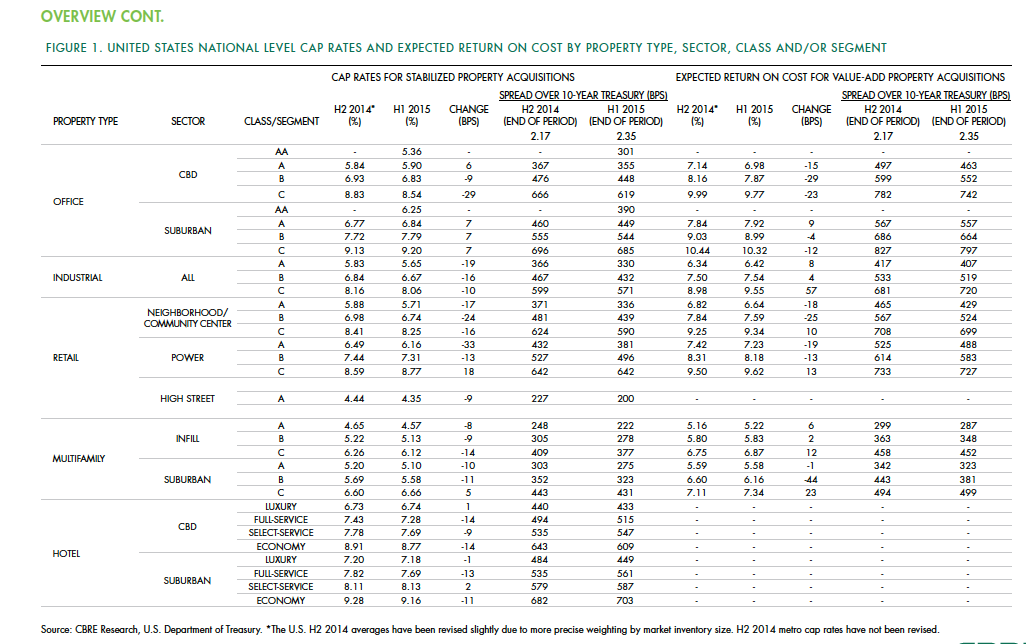

Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

| May 18, 2011

Lab personnel find comfort in former Winchester gun factory

The former Winchester Repeating Arms Factory in New Haven, Conn., is the new home of PepsiCo’s Biology Innovation Research Laboratory.

| May 16, 2011

Virtual tour: See U.S. Green Building Council’s new LEED Platinum HQ—and earn CE credits

A virtual tour of the U.S. Green Building Council's LEED Platinum HQ is available. The tour features embedded videos, audio podcasts, and information on building materials and products used throughout the space. By taking the virtual tour, professionals can earn GBCI Continuing Education hours for the LEED AP with specialty and LEED Green Associate credentials.

| May 11, 2011

DOE releases guide for 50% more energy-efficient office buildings

The U.S. Department of Energy today announced the release of the first in a new series of Advanced Energy Design Guides to aid in the design of highly energy efficient office buildings. The 50% AEDG series will provide a practical approach to commercial buildings designed to achieve 50% energy savings compared to the commercial building energy code used in many areas of the country.

| May 10, 2011

Google hires Ingenhoven Architects to design new Mountain View office

The current Googleplex is straining at the seams and yet the company is preparing its biggest hiring surge ever, so Google decided now’s the time to build its own office space—a first for the Internet giant. The company hired Ingenhoven Architects, a German firm that specializes in sustainable architecture, to create plans for what could be a 600,000-sf office.

| Apr 13, 2011

Office interaction was the critical element to Boston buildout

Margulies Perruzzi Architects, Boston, designed the new 11,460-sf offices for consultant Interaction Associates and its nonprofit sister organization, The Interaction Institute for Social Change, inside an old warehouse near Boston’s Seaport Center.

| Apr 13, 2011

Red Bull Canada HQ a mix of fluid spaces and high-energy design

The Toronto architecture firm Johnson Chou likes to put a twist on its pared-down interiors, and its work on the headquarters for Red Bull Canada is no exception. The energy drink maker occupies 12,300 sf on the top two floors of a three-story industrial building in Toronto, and the design strategy for its space called for leaving the base building virtually untouched while attention was turned to the interior architecture.

| Apr 13, 2011

Former department store gets new lease on life as MaineHealth HQ

The long-vacant Sears Roebuck building in Portland, Maine, was redeveloped into the corporate headquarters for MaineHealth. Consigli Construction and local firm Harriman Architects + Engineers handled the 14-month fast-track project, transforming the 89,000-sf, four-story facility for just $100/sf.

| Mar 29, 2011

Chicago’s Willis Tower to become a vertical solar farm

Chicago’s iconic Willis Tower (formerly the Sears Tower) is set to become a massive solar electric plant with the installation of a pilot solar electric glass project.

| Mar 29, 2011

Read up on Amazon.com's new green HQ

Phase IV of Amazon’s new headquarters in Seattle is nearly complete. The company has built 10 of the 11 buildings planned for its new campus in the South Lake Union neighborhood, and is on-track for a 2013 grand opening.

| Mar 11, 2011

Blockbuster remodel transforms Omaha video store into a bank

A former Hollywood Video store in Omaha, Neb., was renovated and repurposed as the SAC Federal Credit Union, Ames Branch. Architects at Leo A Daly transformed the outdated 5,000-sf retail space into a modern facility by wrapping the exterior in poplar siding and adding a new glass storefront that floods the interior with natural light.