The medical office and industrial sectors will drive what is expected to be moderate growth in the commercial real estate market this year, predict the real estate advisory teams of Transwestern and Devencore located in 43 U.S. and Canadian metros.

The biggest potential impediments to that growth could be rising build-out costs and regulations on how medical tenants can use space.

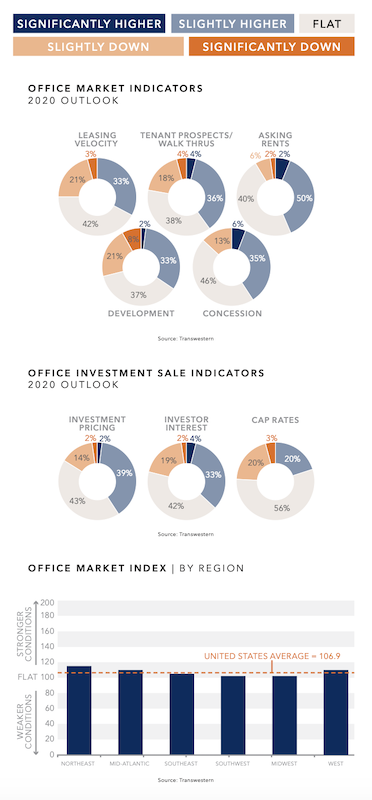

The survey (which can be downloaded from here) finds that conditions for the U.S. office market, while expected to improve, might still be down slightly from the previous year’s outlook. The Northeast, Mid-Atlantic, and West regions are expected to exhibit the strongest office demand. Two fifths of the survey’s respondents expect overall leasing velocity and tenant prospects to be flat this year, as tenants require more time to finalize their decisions.

Brokers and analysts are concerned about ebbing consumer confidence, given the upcoming elections and uncertain economy. Optimists, though, anticipate pockets of demand from tech and medical tenants. Brokers also expect tenant densification (measured by leased space per employee) to continue but at a decelerating pace from last year.

“Tenants are getting creative with space efficiency, with many opting to densify space in order to upgrade quality,” the survey observes.

Flat to slightly better conditions could prevail in most markets this year. Charts: Transwestern and Devencore

This trend might explain why respondents expect development pipelines to be only flat or slightly higher this year, with some markets showing signs of oversupply and rising construction costs. However, tenant leasing will remain intensely competitive, with concession packages staying at least even with 2019 or a bit higher, according to 81% of survey respondents.

About the same percentage think investment interest and pricing will be flat or rise slightly in 2020, and nearly three-fifths (56%) foresee flat capitalization.

The survey also looks at the markets for medical offices, industrial, and Canada’s office market. Its findings include the following:

•The medical office sector will “handsomely” outperform in 2020, with leasing activity, tenant walk throughs, asking rents and development all expected to be higher this year.

•Half of the respondents expect conditions for industrial to be healthy, albeit with slight deceleration in leasing velocity. And while brokers see some overbuilding occurring in markets like Houston and Dallas-Fort Worth, “generally, low supply, coupled with high demand from ecommerce, is forecasted to drive the market.”

•With the exception of Alberta, Canada’s major provinces—Ontario, British Columbia, and Quebec—should see leasing velocity and tenant prospects pick up this year. However, tenants are now taking anywhere from seven to 12 months to sign midsized deals.

Related Stories

Market Data | Mar 17, 2020

Construction spending to grow modestly in 2020, predicts JLL’s annual outlook

But the coronavirus has made economic forecasting perilous.

Market Data | Mar 16, 2020

Grumman/Butkus Associates publishes 2019 edition of Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Mar 12, 2020

New study from FMI and Autodesk finds construction organizations with the highest levels of trust perform twice as well on crucial business metrics

Higher levels of trust within organizations and across project teams correlate with increased profit margins, employee retention and repeat business that can all add up to millions of dollars of profitability annually.

Market Data | Mar 11, 2020

The global hotel construction pipeline hits record high at 2019 year-end

Projects currently under construction stand at a record 991 projects with 224,354 rooms.

Market Data | Mar 6, 2020

Construction employment increases by 43,000 in February and 223,000 over 12 months

Average hourly earnings in construction top private sector average by 9.9% as construction firms continue to boost pay and benefits in effort to attract and retain qualified hourly craft workers.

Market Data | Mar 4, 2020

Nonresidential construction spending attains all-time high in January

Private nonresidential spending rose 0.8% on a monthly basis and is up 0.5% compared to the same time last year.

Market Data | Feb 21, 2020

Construction contractor confidence remains steady

70% of contractors expect their sales to increase over the first half of 2020.

Market Data | Feb 20, 2020

U.S. multifamily market gains despite seasonal lull

The economy’s steady growth buoys prospects for continued strong performance.

Market Data | Feb 19, 2020

Architecture billings continue growth into 2020

Demand for design services increases across all building sectors.

Market Data | Feb 5, 2020

Construction employment increases in 211 out of 358 metro areas from December 2018 to 2019

Dallas-Plano-Irving, Texas and Kansas City have largest gains; New York City and Fairbanks, Alaska lag the most as labor shortages likely kept firms in many areas from adding even more workers.