The medical office and industrial sectors will drive what is expected to be moderate growth in the commercial real estate market this year, predict the real estate advisory teams of Transwestern and Devencore located in 43 U.S. and Canadian metros.

The biggest potential impediments to that growth could be rising build-out costs and regulations on how medical tenants can use space.

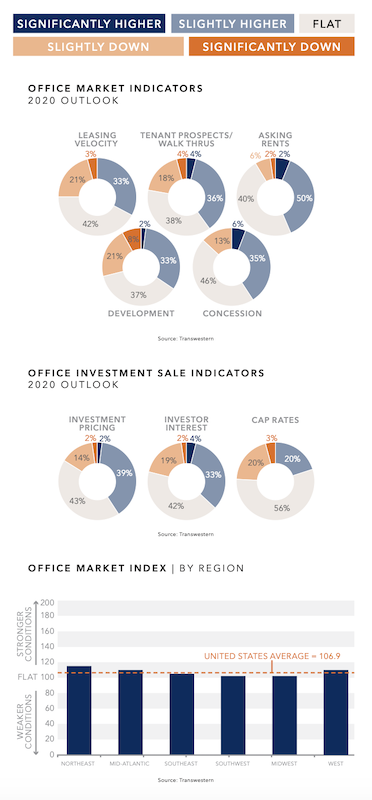

The survey (which can be downloaded from here) finds that conditions for the U.S. office market, while expected to improve, might still be down slightly from the previous year’s outlook. The Northeast, Mid-Atlantic, and West regions are expected to exhibit the strongest office demand. Two fifths of the survey’s respondents expect overall leasing velocity and tenant prospects to be flat this year, as tenants require more time to finalize their decisions.

Brokers and analysts are concerned about ebbing consumer confidence, given the upcoming elections and uncertain economy. Optimists, though, anticipate pockets of demand from tech and medical tenants. Brokers also expect tenant densification (measured by leased space per employee) to continue but at a decelerating pace from last year.

“Tenants are getting creative with space efficiency, with many opting to densify space in order to upgrade quality,” the survey observes.

Flat to slightly better conditions could prevail in most markets this year. Charts: Transwestern and Devencore

This trend might explain why respondents expect development pipelines to be only flat or slightly higher this year, with some markets showing signs of oversupply and rising construction costs. However, tenant leasing will remain intensely competitive, with concession packages staying at least even with 2019 or a bit higher, according to 81% of survey respondents.

About the same percentage think investment interest and pricing will be flat or rise slightly in 2020, and nearly three-fifths (56%) foresee flat capitalization.

The survey also looks at the markets for medical offices, industrial, and Canada’s office market. Its findings include the following:

•The medical office sector will “handsomely” outperform in 2020, with leasing activity, tenant walk throughs, asking rents and development all expected to be higher this year.

•Half of the respondents expect conditions for industrial to be healthy, albeit with slight deceleration in leasing velocity. And while brokers see some overbuilding occurring in markets like Houston and Dallas-Fort Worth, “generally, low supply, coupled with high demand from ecommerce, is forecasted to drive the market.”

•With the exception of Alberta, Canada’s major provinces—Ontario, British Columbia, and Quebec—should see leasing velocity and tenant prospects pick up this year. However, tenants are now taking anywhere from seven to 12 months to sign midsized deals.

Related Stories

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

Contractors | Nov 1, 2023

Nonresidential construction spending increases for the 16th straight month, in September 2023

National nonresidential construction spending increased 0.3% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.

Market Data | Oct 23, 2023

New data finds that the majority of renters are cost-burdened

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic.

Contractors | Oct 19, 2023

Crane Index indicates slowing private-sector construction

Private-sector construction in major North American cities is slowing, according to the latest RLB Crane Index. The number of tower cranes in use declined 10% since the first quarter of 2023. The index, compiled by consulting firm Rider Levett Bucknall (RLB), found that only two of 14 cities—Boston and Toronto—saw increased crane counts.

Market Data | Oct 2, 2023

Nonresidential construction spending rises 0.4% in August 2023, led by manufacturing and public works sectors

National nonresidential construction spending increased 0.4% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.09 trillion.

Giants 400 | Sep 28, 2023

Top 100 University Building Construction Firms for 2023

Turner Construction, Whiting-Turner Contracting Co., STO Building Group, Suffolk Construction, and Skanska USA top BD+C's ranking of the nation's largest university sector contractors and construction management firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all university/college-related buildings except student residence halls, sports/recreation facilities, laboratories, S+T-related buildings, parking facilities, and performing arts centers (revenue for those buildings are reported in their respective Giants 400 ranking).

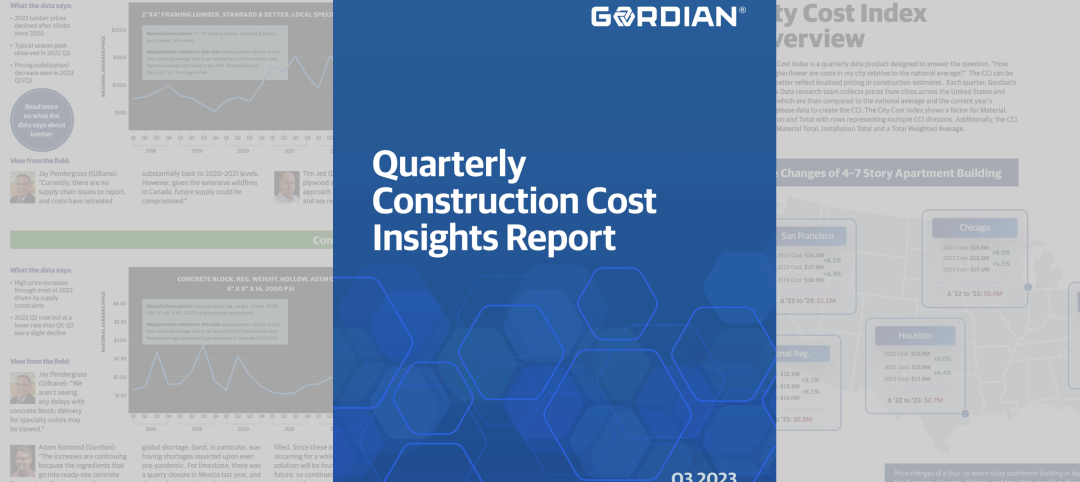

Construction Costs | Sep 28, 2023

U.S. construction market moves toward building material price stabilization

The newly released Quarterly Construction Cost Insights Report for Q3 2023 from Gordian reveals material costs remain high compared to prior years, but there is a move towards price stabilization for building and construction materials after years of significant fluctuations. In this report, top industry experts from Gordian, as well as from Gilbane, McCarthy Building Companies, and DPR Construction weigh in on the overall trends seen for construction material costs, and offer innovative solutions to navigate this terrain.

Data Centers | Sep 21, 2023

North American data center construction rises 25% to record high in first half of 2023, driven by growth of artificial intelligence

CBRE’s latest North American Data Center Trends Report found there is 2,287.6 megawatts (MW) of data center supply currently under construction in primary markets, reaching a new all-time high with more than 70% already preleased.

Contractors | Sep 12, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of August 2023

Associated Builders and Contractors' Construction Backlog Indicator declined to 9.2 months in August, down 0.1 month, according to an ABC member survey conducted from Aug. 21 to Sept. 6. The reading is 0.5 months above the August 2022 level.

Contractors | Sep 11, 2023

Construction industry skills shortage is contributing to project delays

Relatively few candidates looking for work in the construction industry have the necessary skills to do the job well, according to a survey of construction industry managers by the Associated General Contractors of America (AGC) and Autodesk.