National nonresidential construction spending fell 0.3% in September but remains historically elevated, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data released today. Total nonresidential spending stood at $767.1 billion on a seasonally adjusted, annualized rate in September, an increase of 8.9% on a year-ago basis.

Note that August’s estimate was revised almost a full percent higher from $762.7 billion to $769.1 billion, the highest level in the history of the series. Private nonresidential spending increased 0.1% in September while public nonresidential spending decreased 0.8% for the month.

“Virtually no weight should be placed upon the monthly decline in nonresidential construction spending that occurred in September,” said ABC Chief Economist Anirban Basu. “Rather, we should focus on the massive upward revision to August’s spending data. That revision finally aligns construction spending data with statistics on backlog, employment and other indicators of robust nonresidential construction spending. On a year-over-year basis, nonresidential construction is up nearly 9%, an impressive performance by any standard.

“Unlike previous instances of rapid construction growth, this one is led by a neatly balanced combination of private and public spending growth,” said Basu. “Among the leading sources of spending growth over the past year are water supply, transportation, lodging and office construction. This is not only consistent with an economy that continues to perform splendidly along multiple dimensions, but also with significantly improved state and local government finances, which has helped to support greater levels of infrastructure spending.

“Given healthy backlog and indications that the economy will continue to manifest momentum into 2019, contractors can expect to remain busy,” said Basu. “The most substantial challenges will continue to be rising workforce and input costs. That said, there are indications of softening business investment, which could serve to weaken U.S. economic growth after what is setting up to be a strong first half of 2019.”

Related Stories

Market Data | May 7, 2021

Construction employment stalls in April

Soaring costs, supply-chain challenges, and workforce shortages undermine industry's recovery.

Market Data | May 4, 2021

Nonresidential construction outlays drop in March for fourth-straight month

Weak demand, supply-chain woes make further declines likely.

Market Data | May 3, 2021

Nonresidential construction spending decreases 1.1% in March

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories.

Market Data | Apr 30, 2021

New York City market continues to lead the U.S. Construction Pipeline

New York City has the greatest number of projects under construction with 110 projects/19,457 rooms.

Market Data | Apr 29, 2021

U.S. Hotel Construction pipeline beings 2021 with 4,967 projects/622,218 rooms at Q1 close

Although hotel development may still be tepid in Q1, continued government support and the extension of programs has aided many businesses to get back on their feet as more and more are working to re-staff and re-open.

Market Data | Apr 28, 2021

Construction employment declines in 203 metro areas from March 2020 to March 2021

The decline occurs despite homebuilding boom and improving economy.

Market Data | Apr 20, 2021

The pandemic moves subs and vendors closer to technology

Consigli’s latest market outlook identifies building products that are high risk for future price increases.

Market Data | Apr 20, 2021

Demand for design services continues to rapidly escalate

AIA’s ABI score for March rose to 55.6 compared to 53.3 in February.

Market Data | Apr 16, 2021

Construction employment in March trails March 2020 mark in 35 states

Nonresidential projects lag despite hot homebuilding market.

Market Data | Apr 13, 2021

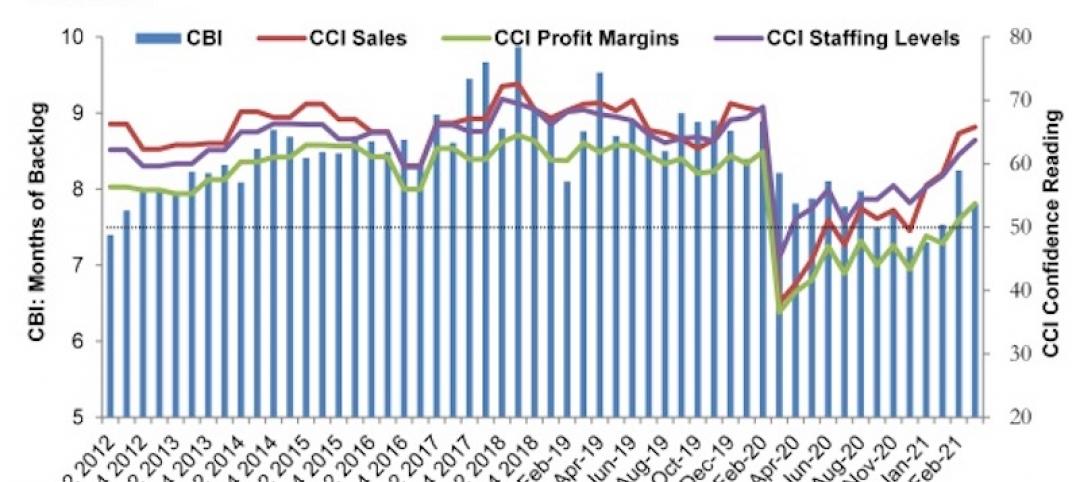

ABC’s Construction Backlog slips in March; Contractor optimism continues to improve

The Construction Backlog Indicator fell to 7.8 months in March.