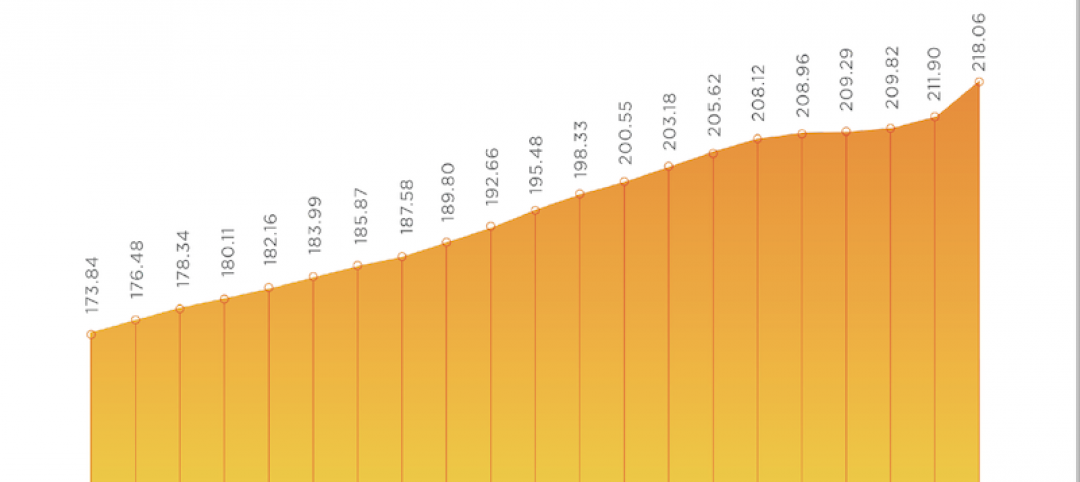

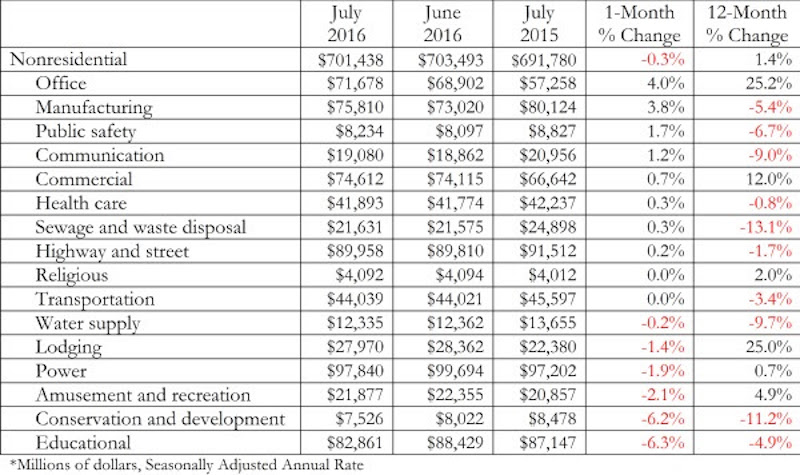

Nonresidential construction spending inched 0.3 percent lower in July largely due to a significant upward revision to June’s spending figure, according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors (ABC). Nonresidential spending totaled $701.4 billion on a seasonally adjusted annualized basis in July, the second highest month since November of 2008, right behind June, which was revised upward from $682 billion to $703.5 billion. Public nonresidential spending continued to falter, declining 3.2 percent for the month and 6.5 percent for the year.

Nonresidential construction spending has been suppressed over the last year or so with the primary factor being the lack of momentum in public spending. “This lack of public investment continues despite obvious deficiencies in water, road and other forms of infrastructure. The fact that all but two of the 12 public nonresidential public subsectors declined in July shows that the malaise is widespread,” says ABC Chief Economist Anirban Basu in a press release.

The second biggest factor deals with tightening commercial real estate standards that may have been brought on by growing regulatory pressures. “There is growing concern that key commercial real estate segments are in the process of being overbuilt, particularly in America’s largest cities, which are most likely to attract significant levels of foreign investment,” Basu says.

All is not negative, however, as the housing sector has begun to improve at a meaningful rate and the country continues to add a substantial number of jobs. Additionally, interest rates remain low.

Related Stories

Market Data | Jul 29, 2021

Construction employment lags or matches pre-pandemic level in 101 metro areas despite housing boom

Eighty metro areas had lower construction employment in June 2021 than February 2020.

Market Data | Jul 28, 2021

Marriott has the largest construction pipeline of U.S. franchise companies in Q2‘21

472 new hotels with 59,034 rooms opened across the United States during the first half of 2021.

Market Data | Jul 27, 2021

New York leads the U.S. hotel construction pipeline at the close of Q2‘21

Many hotel owners, developers, and management groups have used the operational downtime, caused by COVID-19’s impact on operating performance, as an opportunity to upgrade and renovate their hotels and/or redefine their hotels with a brand conversion.

Market Data | Jul 26, 2021

U.S. construction pipeline continues along the road to recovery

During the first and second quarters of 2021, the U.S. opened 472 new hotels with 59,034 rooms.

Market Data | Jul 21, 2021

Architecture Billings Index robust growth continues

AIA’s Architecture Billings Index (ABI) score for June remained at an elevated level of 57.1.

Market Data | Jul 20, 2021

Multifamily proposal activity maintains sizzling pace in Q2

Condos hit record high as all multifamily properties benefit from recovery.

Market Data | Jul 19, 2021

Construction employment trails pre-pandemic level in 39 states

Supply chain challenges, rising materials prices undermine demand.

Market Data | Jul 15, 2021

Producer prices for construction materials and services soar 26% over 12 months

Contractors cope with supply hitches, weak demand.

Market Data | Jul 13, 2021

ABC’s Construction Backlog Indicator and Contractor Confidence Index rise in June

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased modestly in June.

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.