The U.S. economy’s performance slowed in the first quarter of 2017, but nonresidential fixed investment expanded at an impressive 9.4 percent seasonally adjusted annual rate, according to analysis of U.S. Bureau of Economic Analysis data recently released by Associated Builders and Contractors (ABC).

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year. Despite the subdued growth, GDP has now expanded in every quarter over the past three years. Fourth quarter 2016 growth was revised upward from a 1.9 percent annual rate of expansion to a 2.1 percent annual rate.

This represents the best quarter for nonresidential fixed investment, a category closely aligned with construction and other forms of business investment, since the end of 2013 and ends more than a year of tepid nonresidential fixed investment growth. Investment in structures, a subcomponent of nonresidential fixed investment, expanded 22.1 percent for the quarter after contracting by 1.9 percent in the fourth quarter of 2016. The other two subcomponents of nonresidential fixed investment—equipment and intellectual property products—expanded at a 9.1 percent rate and a 2.0 percent rate, respectively.

“It was expected that first quarter GDP would indicate that the U.S. economy remained unable to generate a high rate of growth,” said ABC Chief Economist Anirban Basu in a release. “Many economic actors appear to have adopted a cautious attitude in an environment characterized by a considerable amount of policy uncertainty. The decline in defense expenditures is likely to be a surprise to many given recent discussions about supposed vast increases in defense outlays.

“The investment in nonresidential structures during the first three months of the year is particularly remarkable in an environment otherwise characterized as generating little economic growth,” said Basu. “Rather than adopt a wait-and-see attitude, developers appear to have acted with conviction, taking advantage of growing confidence among investors and other market participants to forge ahead with planned projects. While the new presidential administration has yet to implement even a small fraction of its pro-business agenda, the development community continues to express confidence in the administration’s ability to create the conditions necessary for a much more vibrant U.S. economy.

“The expectation is that the balance of the year will be associated with much more rapid growth,” said Basu. “Consumer spending should pick up after a weak first quarter, given accelerating wage increases and elevated levels of job security. Business spending is also likely to expand briskly, particularly if the Trump administration is able to make meaningful progress on the corporate and personal income tax front.”

Related Stories

Market Data | Nov 9, 2021

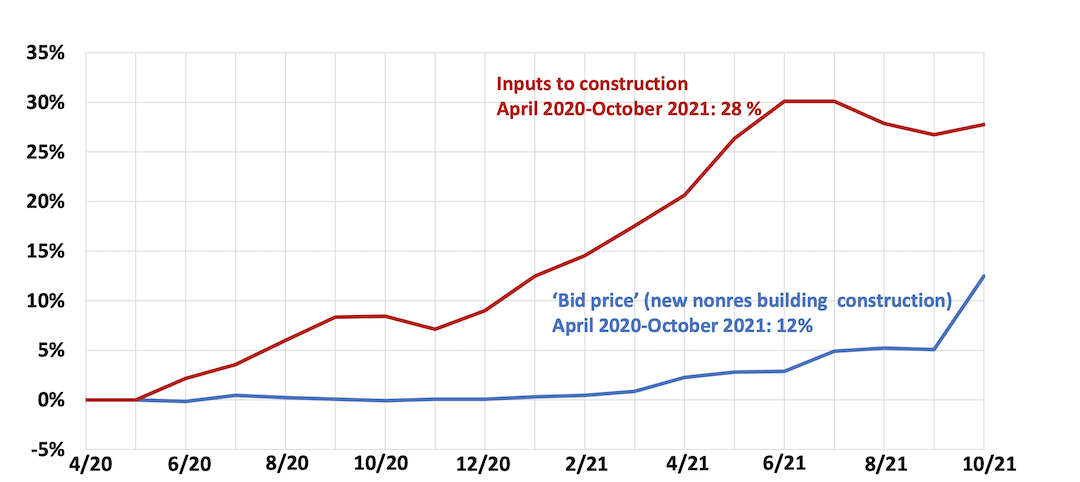

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.

Market Data | Oct 19, 2021

Demand for design services continues to increase

The Architecture Billings Index (ABI) score for September was 56.6.

Market Data | Oct 14, 2021

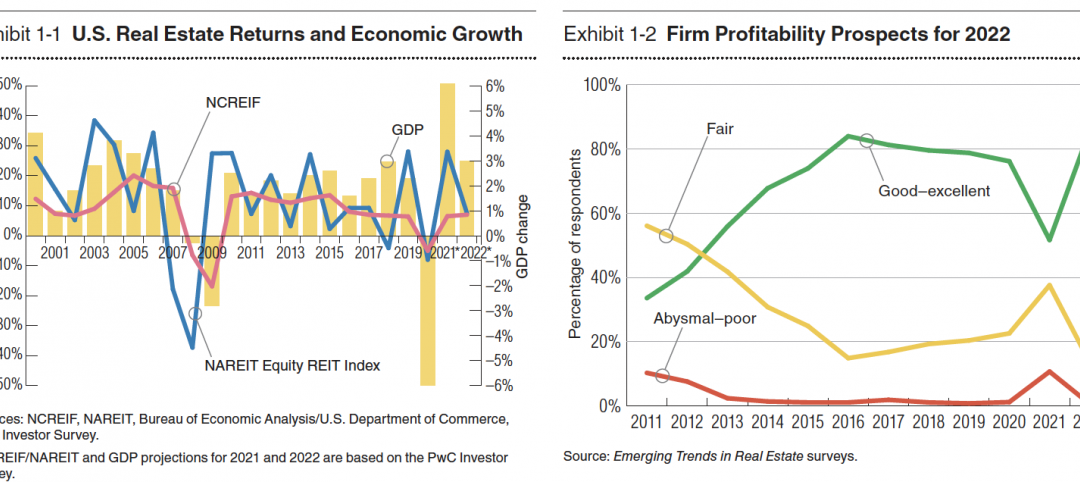

Climate-related risk could be a major headwind for real estate investment

A new trends report from PwC and ULI picks Nashville as the top metro for CRE prospects.