Nonresidential fixed investment fell by 0.6% during the second quarter after expanding by 1.6% during the first quarter, according to the July 30 real gross domestic product (GDP) report by the Bureau of Economic Analysis (BEA).

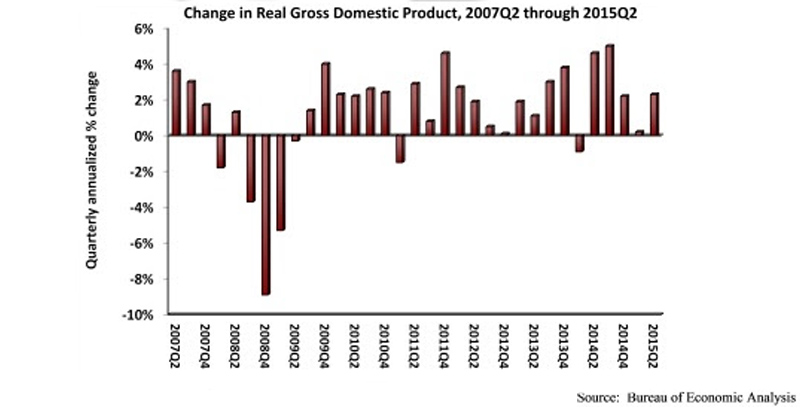

For the economy as a whole, real GDP expanded by 2.3% (seasonally adjusted annual rate) during the second quarter following a 0.6% increase during the year's first quarter. Note that the first quarter estimate for nonresidential fixed investment was revised upward from -3.4% annualized growth.

"In the first half of 2015, both the broader economy and nonresidential investment lost the momentum they had coming into the year," said Associated Builders and Contractors Chief Economist Anirban Basu. "Rather than indicating renewed progress in terms of achieving a more robust recovery, today's GDP release indicates that a variety of factors helped to stall investment in nonresidential structures. There are many viable explanations, including a weaker overall U.S. economy, a stronger U.S. dollar, decreased investment in structures related to the nation's energy sector, soft public spending, and uncertainty regarding monetary policy and other abstracts of public policy. While the expectation is that the second half of the year will be better, unfortunately not much momentum is being delivered by the year's initial six months.

"Perhaps the most salient facet of this GDP release was the revisions," said Basu. "The BEA revised the first quarter estimate upward from -0.2% to 0.6% annualized growth. This is not surprising; many economists insisted that the economy did not shrink in the first quarter. However, the BEA also downwardly revised growth figures from the fourth quarter of 2011 to the fourth quarter of 2014. Over that period, GDP increased at an average annual rate of 2.1%, 0.3 percentage points lower than previously thought. These revisions could be a function of the agency's ongoing effort to tackle residual seasonality, a pattern in which seasonal adjustments led to repeated first quarter slowdowns. It will take a few more quarters to understand the full impact of the improved seasonal adjustments."

Performance of key segments during the first quarter:

- Investment in nonresidential structures decreased at a 1.6% rate after decreasing at a 7.4% rate in the first quarter.

- Personal consumption expenditures added 1.99% to GDP after contributing 1.19% in the first quarter.

- Spending on goods grew 1.1% from the first quarter.

- Real final sales of domestically produced output – minus changes in private inventories – increased 2.5% for the second quarter after a 2.5% increase in the first quarter.

- Federal government spending decreased 1.1% in the second quarter after increasing by 1.1% in the first quarter.

- Nondefense spending decreased 0.5% after expanding by 1.2% in the previous quarter.

- National defense spending fell 1.5% after growing 1% in the first quarter.

- State and local government spending grew 2% during the second quarter after a decrease of 0.8% in the first.

To view the previous GDP report, click here.

Related Stories

Healthcare Facilities | Aug 28, 2015

Shhh!!! 6 ways to keep the noise down in new and existing hospitals

There’s a ‘decibel war’ going on in the nation’s hospitals. Progressive Building Teams are leading the charge to give patients quieter healing environments.

Mixed-Use | Aug 26, 2015

Innovation districts + tech clusters: How the ‘open innovation’ era is revitalizing urban cores

In the race for highly coveted tech companies and startups, cities, institutions, and developers are teaming to form innovation hot pockets.

Contractors | Aug 19, 2015

FMI's Nonresidential Construction Index Report: Recovery continues despite slow down

The Q3 NRCI dropped to 63.6 from the previous reading of 64.9 in Q2, painting a mixed picture of the state of the nonresidential construction sector.

Giants 400 | Aug 7, 2015

GOVERNMENT SECTOR GIANTS: Public sector spending even more cautiously on buildings

AEC firms that do government work say their public-sector clients have been going smaller to save money on construction projects, according to BD+C's 2015 Giants 300 report.

Giants 400 | Aug 7, 2015

K-12 SCHOOL SECTOR GIANTS: To succeed, school design must replicate real-world environments

Whether new or reconstructed, schools must meet new demands that emanate from the real world and rapidly adapt to different instructional and learning modes, according to BD+C's 2015 Giants 300 report.

Giants 400 | Aug 7, 2015

MULTIFAMILY AEC GIANTS: Slowdown prompts developers to ask: Will the luxury rentals boom hold?

For the last three years, rental apartments have occupied the hot corner in residential construction, as younger people gravitated toward renting to be closer to urban centers and jobs. But at around 360,000 annual starts, multifamily might be peaking, according to BD+C's 2015 Giants 300 report.

Giants 400 | Aug 7, 2015

UNIVERSITY SECTOR GIANTS: Collaboration, creativity, technology—hallmarks of today’s campus facilities

At a time when competition for the cream of the student/faculty crop is intensifying, colleges and universities must recognize that students and parents are coming to expect an education environment that foments collaboration, according to BD+C's 2015 Giants 300 report.

Giants 400 | Aug 7, 2015

RECONSTRUCTION AEC GIANTS: Restorations breathe new life into valuable older buildings

AEC Giants discuss opportunities and complications associated with renovation, restoration, and adaptive reuse construction work.

Giants 400 | Aug 6, 2015

BIM GIANTS: Robotic reality capture, gaming systems, virtual reality—AEC Giants continue tech frenzy

Given their size, AEC Giants possess the resources and scale to research and test the bevy of software and hardware solutions on the market. Some have created internal innovation labs and fabrication shops to tinker with emerging technologies and create custom software tools. Others have formed R&D teams to test tech tools on the job site.

Giants 400 | Aug 6, 2015

GIANTS 300 REPORT: Top 75 Healthcare Construction Firms

Turner, McCarthy, and Skanska top Building Design+Construction's 2015 ranking of the largest healthcare contractors and construction management firms in the U.S.