Today's Census Bureau release regarding nonresidential construction spending did not just offer good news about April, it also supplied upwardly revised spending data for both February and March.

Nonresidential spending expanded 3.2% on a monthly basis in April, and spending totaled $646.7 billion on a seasonally adjusted, annualized basis, according to the government's initial estimate. Nonresidential construction is up by a solid 8.8% over the past year, consistent with ABC's forecast of high single-digit growth.

The Census Bureau also revised March's nonresidential spending figure from $611.8 billion to $626.7 billion, and February's figure from $613.1 billion to $618.4 billion. Initial estimates suggested that nonresidential construction was sagging during the early months of the year; however, the new data indicate spending has expanded during each of the previous three months.

"There is a considerable amount of financial capital available to move construction projects forward and low interest rates certainly help. While the availability of substantial financial capital may eventually produce over-built private construction markets, for now the expectation is that progress will continue." —Anirban Basu, ABC Chief Economist

"The upbeat assessment of nonresidential construction in April has been rendered more meaningful by the upward revisions for prior months," said ABC Chief Economist Anirban Basu. "The presumption had been that nonresidential spending construction data would improve as we approached the summer, and the outlook ahead remains solid.

"There is a considerable amount of financial capital available to move construction projects forward and low interest rates certainly help," added Basu. "While the availability of substantial financial capital may eventually produce over-built private construction markets, for now the expectation is that progress will continue."

All but one nonresidential construction sector experienced spending increases in April:

• Manufacturing-related construction spending expanded 2.6% in April and is up a whopping 52.9% on a yearly basis.

• Office-related construction spending expanded 3.7% in April and is up 8.8% compared to the same time one year ago.

• Construction spending in the transportation category grew 1.6% on a monthly basis and has expanded 11.6% on an annual basis.

• Lodging-related construction spending was up 5.5% on a monthly basis and 17.6% on a year-over-year basis.

• Health care-related construction spending expanded 2.1% for the month and is up 2.6% compared to the same time last year.

• Spending in the water supply category expanded 0.7% from March and is up 0.8% on an annual basis.

• Public safety-related construction spending gained 2.3% on a monthly basis, but is down 5.6% on a year-over-year basis.

• Commercial construction spending expanded 2.7% in April and is up 17.5% on a year-over-year basis.

• Religious spending gained 3.3% for the month, but is down 7.8% compared to the same time last year.

• Sewage and waste disposal-related construction spending gained 0.5% for the month and has grown 14.9% on a 12-month basis.

• Power-related construction spending grew 2.5% for the month, but is 11.3% lower than the same time one year ago.

• Highway and street-related construction spending expanded 8.5% in April and is up 4.8% compared to the same time last year.<

• Conservation and development-related construction spending grew 3.7% for the month and is up 17.2% on a yearly basis.

• Amusement and recreation-related construction spending improved 2.5% on a monthly basis and is up 23.3% from the same time last year.

• Education-related construction spending gained 3.2% for the month and is up 0.4% on a year-over-year basis.

Spending declined in only one nonresidential construction subsector in April:

• Communication-related construction spending fell 5.9% for the month and is down 5.5% for the year.

To view the previous spending report, click here.

Related Stories

Giants 400 | Oct 24, 2019

Top 80 Retail Construction Firms for 2019

PCL, VCC, Whiting-Turner, Shawmut, and W.E. O'Neil top the rankings of the nation's largest retail sector contractors and construction management firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Contractors | Oct 24, 2019

Get them while they’re young: programs that promote the construction industry target students

Turner uses one of its jobsites in Nashville to immerse middle-school teachers in the ins and outs of building.

Contractors | Oct 17, 2019

Are contractors collecting what they need to make better decisions?

Research focused on five key types of data: project progress, manhours, productivity, safety, and equipment management.

Architects | Oct 11, 2019

SMPS report tracks how AEC firms are utilizing marketing technology tools

With thousands of MarTech tools and apps on the market, design and construction firms are struggling to keep up.

Healthcare Facilities | Oct 4, 2019

Heart failure clinics are keeping more patients out of emergency rooms

An example of this building trend recently opened at Beaumont Hospital near Ann Arbor, Mich.

Giants 400 | Oct 3, 2019

Top 10 Convention Center Sector Construction Firms for 2019

Lendlease, Turner, Clark, and Webcor top the rankings of the nation's largest convention center sector contractors and construction management firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Giants 400 | Oct 3, 2019

Top 65 Cultural Sector Construction Firms for 2019

Whiting-Turner, Turner, PCL, Clark Group, and Gilbane top the rankings of the nation's largest cultural facility sector contractors and construction management firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Giants 400 | Oct 3, 2019

2019 Cultural Facility Giants Report: New libraries are all about community

The future of libraries is less about being quiet and more about hands-on learning and face-to-face interactions. This and more cultural sector trends from BD+C's 2019 Giants 300 Report.

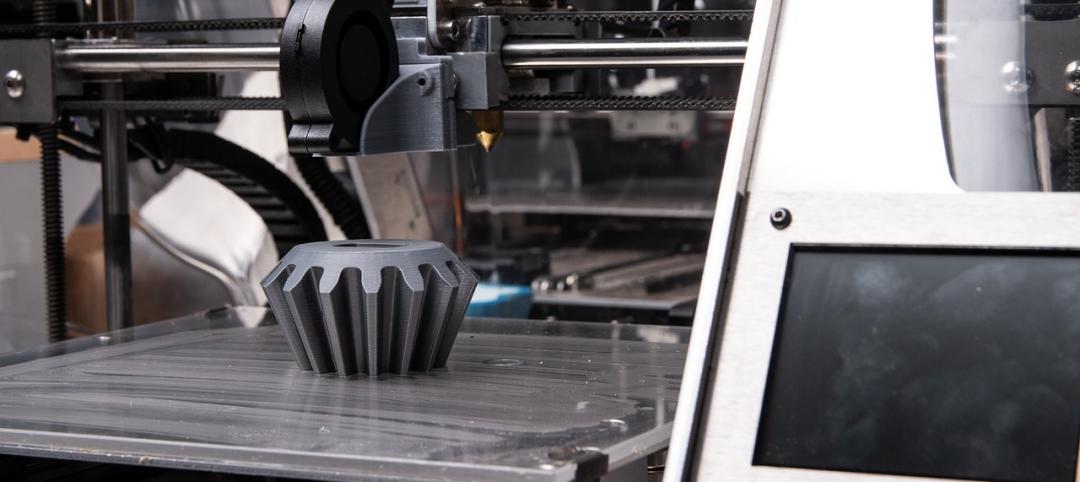

3D Printing | Sep 17, 2019

Additive manufacturing goes mainstream in the industrial sector

More manufacturers now include this production process in their factories.

Codes and Standards | Sep 12, 2019

Illinois law sets maximum retainage on private projects

The change is expected to give contractors bigger checks earlier in project timeline.