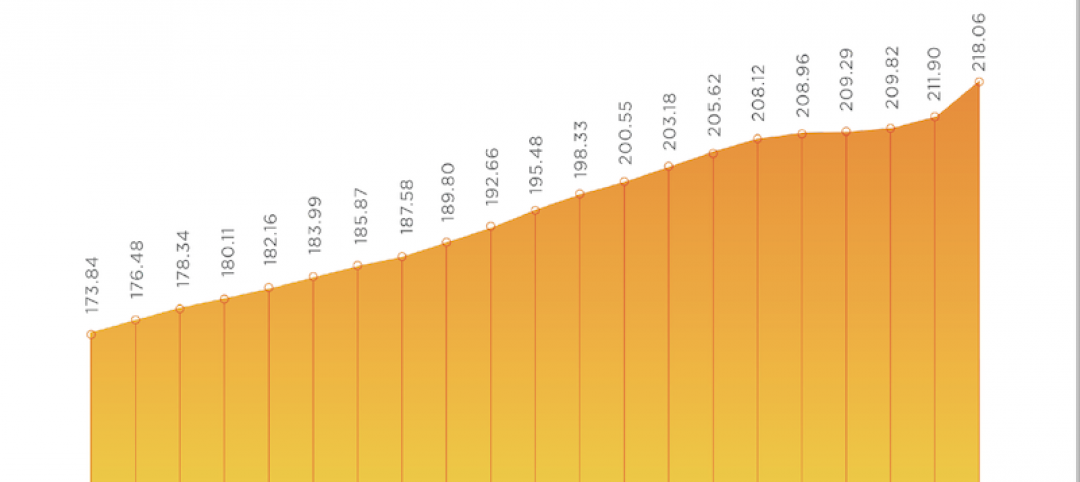

Today's Census Bureau release regarding nonresidential construction spending did not just offer good news about April, it also supplied upwardly revised spending data for both February and March.

Nonresidential spending expanded 3.2% on a monthly basis in April, and spending totaled $646.7 billion on a seasonally adjusted, annualized basis, according to the government's initial estimate. Nonresidential construction is up by a solid 8.8% over the past year, consistent with ABC's forecast of high single-digit growth.

The Census Bureau also revised March's nonresidential spending figure from $611.8 billion to $626.7 billion, and February's figure from $613.1 billion to $618.4 billion. Initial estimates suggested that nonresidential construction was sagging during the early months of the year; however, the new data indicate spending has expanded during each of the previous three months.

"There is a considerable amount of financial capital available to move construction projects forward and low interest rates certainly help. While the availability of substantial financial capital may eventually produce over-built private construction markets, for now the expectation is that progress will continue." —Anirban Basu, ABC Chief Economist

"The upbeat assessment of nonresidential construction in April has been rendered more meaningful by the upward revisions for prior months," said ABC Chief Economist Anirban Basu. "The presumption had been that nonresidential spending construction data would improve as we approached the summer, and the outlook ahead remains solid.

"There is a considerable amount of financial capital available to move construction projects forward and low interest rates certainly help," added Basu. "While the availability of substantial financial capital may eventually produce over-built private construction markets, for now the expectation is that progress will continue."

All but one nonresidential construction sector experienced spending increases in April:

• Manufacturing-related construction spending expanded 2.6% in April and is up a whopping 52.9% on a yearly basis.

• Office-related construction spending expanded 3.7% in April and is up 8.8% compared to the same time one year ago.

• Construction spending in the transportation category grew 1.6% on a monthly basis and has expanded 11.6% on an annual basis.

• Lodging-related construction spending was up 5.5% on a monthly basis and 17.6% on a year-over-year basis.

• Health care-related construction spending expanded 2.1% for the month and is up 2.6% compared to the same time last year.

• Spending in the water supply category expanded 0.7% from March and is up 0.8% on an annual basis.

• Public safety-related construction spending gained 2.3% on a monthly basis, but is down 5.6% on a year-over-year basis.

• Commercial construction spending expanded 2.7% in April and is up 17.5% on a year-over-year basis.

• Religious spending gained 3.3% for the month, but is down 7.8% compared to the same time last year.

• Sewage and waste disposal-related construction spending gained 0.5% for the month and has grown 14.9% on a 12-month basis.

• Power-related construction spending grew 2.5% for the month, but is 11.3% lower than the same time one year ago.

• Highway and street-related construction spending expanded 8.5% in April and is up 4.8% compared to the same time last year.<

• Conservation and development-related construction spending grew 3.7% for the month and is up 17.2% on a yearly basis.

• Amusement and recreation-related construction spending improved 2.5% on a monthly basis and is up 23.3% from the same time last year.

• Education-related construction spending gained 3.2% for the month and is up 0.4% on a year-over-year basis.

Spending declined in only one nonresidential construction subsector in April:

• Communication-related construction spending fell 5.9% for the month and is down 5.5% for the year.

To view the previous spending report, click here.

Related Stories

Coronavirus | Jul 20, 2021

5 leadership lessons for a post-pandemic world from Shawmut CEO Les Hiscoe

Les Hiscoe, PE, CEO of Shawmut, a $1.5 billion construction management company headquartered in Boston, offers a 5-point plan for dealing with the Covid pandemic.

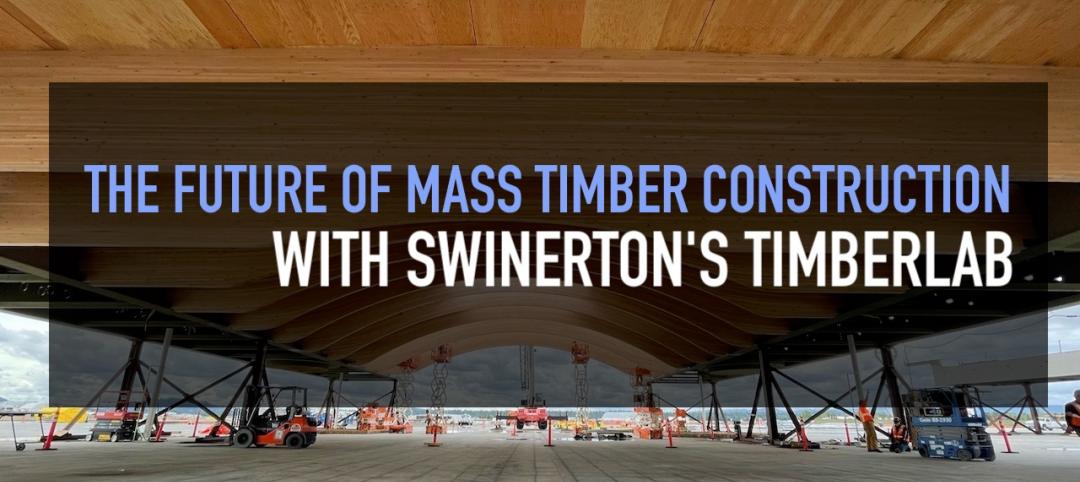

Wood | Jul 16, 2021

The future of mass timber construction, with Swinerton's Timberlab

In this exclusive for HorizonTV, BD+C's John Caulfield sat down with three Timberlab leaders to discuss the launch of the firm and what factors will lead to greater mass timber demand.

Multifamily Housing | Jul 15, 2021

Economic rebound leads to record increase in multifamily asking rents

Across the country, multifamily rents have skyrocketed. Year-over-year rents are up by double digits in nine of the top 30 markets, while national YoY rent growth is up 6.3%. Emerging from the pandemic, a perfect storm of migration, enhanced government stimulus and a hot housing market, among other factors, has enabled this extremely strong growth.

AEC Business Innovation | Jul 11, 2021

Staffing, office changes at SCB, SmithGroup, RKTB, Ryan Cos., Jacobsen, Boldt, and Adolfson & Peterson

AEC firms take strategic action as construction picks up steam with Covid openings.

K-12 Schools | Jul 9, 2021

LPA Architects' STEM high school post-occupancy evaluation

LPA Architects conducted a post-occupancy evaluation, or POE, of the eSTEM Academy, a new high school specializing in health/medical and design/engineering Career Technical Education, in Eastvale, Calif. The POE helped LPA, the Riverside County Office of Education, and the Corona-Norco Unified School District gain a better understanding of which design innovations—such as movable walls, flex furniture, collaborative spaces, indoor-outdoor activity areas, and a student union—enhanced the education program, and how well students and teachers used these innovations.

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Industrial Facilities | Jul 2, 2021

A new approach to cold storage buildings

Cameron Trefry and Kate Lyle of Ware Malcomb talk about their firm's cold storage building prototype that is serving a market that is rapidly expanding across the supply chain.

Contractors | Jul 1, 2021

Nonres construction spending down again in May

And the industry is still beset with labor and materials issues that could impede future growth

Multifamily Housing | Jun 30, 2021

A post-pandemic ‘new normal’ for apartment buildings

Grimm + Parker’s vision foresees buildings with rentable offices and refrigerated package storage.