National nonresidential construction spending was down 0.1% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $844.5 billion for the month.

Spending was down on a monthly basis in 10 of the 16 nonresidential subcategories. Private nonresidential spending was up by 0.2%, while public nonresidential construction spending was down 0.5% in February.

"Nonresidential spending decreased in February despite inflationary pressures that should have driven it higher," said ABC Chief Economist Anirban Basu. "True, nonresidential spending is up 6.2% year over year, but given the significance of construction materials inflation, spending has almost certainly declined in real terms.

"Moreover, the Russia-Ukraine war has spawned further materials price increases, which in turn raises the risk that project owners will decide to postpone or cancel projects,” said Basu. “ABC’s Construction Confidence Index indicates that a growing number of contractors expect to trim their margins during the year ahead in order to induce purchasers to continue to move forward. The spread of an omicron subvariant in China has started to interfere with production there, which translates to additional supply chain disruptions.

"As if that were not enough, the risk of recession is rising," said Basu. "While there is evidence of ongoing momentum, a recent increase in interest rates coupled with hawkish statements from the Federal Reserve imply that credit conditions will become more challenging this year. The question is whether the Federal Reserve can slow economic growth in order to counter inflation without driving the economy into recession.

“The recent inversion of the yield curve is viewed by many economists as a leading indicator of recession,” said Basu. “Since the early 1980s, most rate tightening cycles have ended in recession. For contractors that largely work on private construction projects, this suggests risk of weakening backlog at some point later this year or in 2023. For those largely focused on public work, the economics are more favorable, since federal infrastructure outlays will be elevated for approximately the next five years."

Related Stories

Industry Research | Apr 9, 2021

BD+C exclusive research: What building owners want from AEC firms

BD+C’s first-ever owners’ survey finds them focused on improving buildings’ performance for higher investment returns.

Market Data | Feb 24, 2021

2021 won’t be a growth year for construction spending, says latest JLL forecast

Predicts second-half improvement toward normalization next year.

Healthcare Facilities | Feb 18, 2021

The Weekly show, Feb 18, 2021: What patients want from healthcare facilities, and Post-COVID retail trends

This week on The Weekly show, BD+C editors speak with AEC industry leaders from JLL and Landini Associates about what patients want from healthcare facilities, based on JLL's recent survey of 4,015 patients, and making online sales work for a retail sector recovery.

Market Data | Jan 19, 2021

2021 construction forecast: Nonresidential building spending will drop 5.7%, bounce back in 2022

Healthcare and public safety are the only nonresidential construction sectors that will see growth in spending in 2021, according to AIA's 2021 Consensus Construction Forecast.

AEC Tech | Feb 13, 2020

Exclusive research: Download the final report for BD+C's Giants 300 Technology and Innovation Study

This survey of 130 of the nation's largest architecture, engineering, and construction firms tracks the state of AEC technology adoption and innovation initiatives at the AEC Giants.

Office Buildings | Feb 11, 2020

Forget Class A: The opportunity is with Class B and C office properties

There’s money to be made in rehabbing Class B and Class C office buildings, according to a new ULI report.

Industry Research | Dec 13, 2019

Attention building design experts: BD+C editors need your input for our 2020 Color Trends Survey

The 2020 Color Trends research project will assess leading and emerging trends and drivers related to the use of color on commercial, institutional, and multifamily building projects.

Architects | Sep 11, 2019

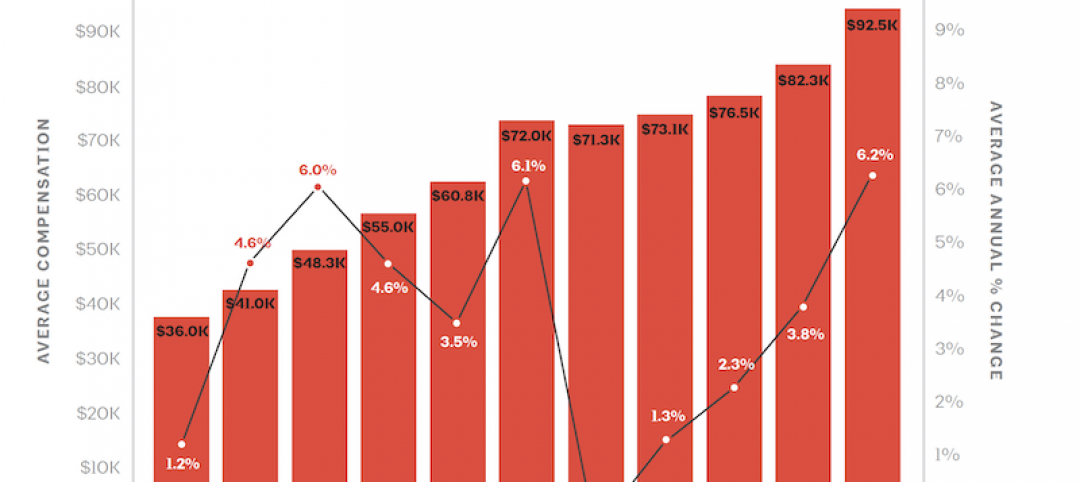

Buoyed by construction activity, architect compensation continues to see healthy gains

The latest AIA report breaks down its survey data by 44 positions and 28 metros.

Industry Research | Aug 29, 2019

Construction firms expect labor shortages to worsen over the next year

A new AGC-Autodesk survey finds more companies turning to technology to support their jobsites.