Nonresidential construction spending in April declined for the fifth-straight month to a two-year low as demand waned for numerous public and private project categories in the face of lengthening production and delivery times for materials, along with fast-rising prices for many items, according to an analysis of new federal construction spending data by the Associated General Contractors of America. Officials with the association urged the President and Congress to boost infrastructure investments, remove tariffs on key materials and take steps to address production and deliver backups for key construction supplies.

“Both public and private nonresidential spending overall continued to shrink in April, despite a pickup in a few spending categories from March,” said Ken Simonson, the association’s chief economist. “Ever-growing delays and uncertainty regarding backlogs and delivery times for key materials, as well as shortages and record prices, are likely to make even more project owners hesitant to commit to new work.”

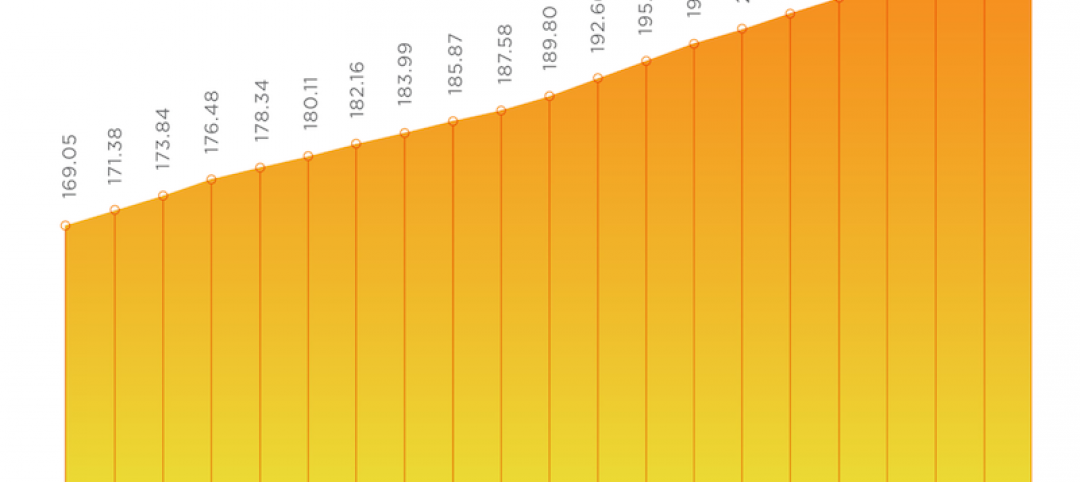

Construction spending in April totaled $1.52 trillion at a seasonally adjusted annual rate, an increase of 0.2% from the pace in March and 9.8% higher than the pandemic-depressed rate in April 2020. As has been true for the past several months, the year-over-year gain was limited to residential construction, Simonson noted. That segment climbed 1.0% for the month and 29.5% year-over-year. Meanwhile, combined private and public nonresidential spending declined 0.5% from March—the fifth consecutive monthly decrease—and 3.9% over 12 months, to the lowest annual rate since December 2018.

Private nonresidential construction spending fell 0.5% from March to April and 4.8% since April 2020, with year-over-year decreases in 10 out of 11 subsegments. The largest private nonresidential category, power construction, plunged 7.1% year-over-year and 1.8% from March to April. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—retreated 1.3% year-over-year despite a gain of 0.4% for the month. Manufacturing construction rose 0.6% from a year earlier and 0.4% from March. Office construction decreased 1.6 percent year-over-year but edged up 0.2 percent in April.

Public construction spending slipped 2.2% year-over-year and 0.6% for the month. Among the largest segments, highway and street construction declined 2.7% from a year earlier, although spending rose 0.6% for the month. Public educational construction decreased 4.0% year-over-year and 0.5% in April. Spending on transportation facilities fell1.9% over 12 months and 1.2% in April.

Association officials cautioned that a recent Commerce Department announcement that it intends to double the current tariff levels on Canadian lumber would further undermine nonresidential construction activity. They said the Biden administration should instead remove tariffs on lumber, steel and aluminum and work to ease production and shipping delays. Boosting infrastructure funding, which leaders of both parties have proposed, will also help, the construction officials added.

“The last thing construction workers need is for the Biden administration to double tariffs on lumber,” said Stephen E. Sandherr, the association’s chief executive officer. “Instead of making it even harder to build, the administration needs to ease supply backups, remove tariffs and pass a bipartisan infrastructure bill.”

Related Stories

Market Data | Jan 19, 2021

2021 construction forecast: Nonresidential building spending will drop 5.7%, bounce back in 2022

Healthcare and public safety are the only nonresidential construction sectors that will see growth in spending in 2021, according to AIA's 2021 Consensus Construction Forecast.

Market Data | Jan 13, 2021

Atlanta, Dallas seen as most favorable U.S. markets for commercial development in 2021, CBRE analysis finds

U.S. construction activity is expected to bounce back in 2021, after a slowdown in 2020 due to challenges brought by COVID-19.

Market Data | Jan 13, 2021

Nonres construction could be in for a long recovery period

Rider Levett Bucknall’s latest cost report singles out unemployment and infrastructure spending as barometers.

Market Data | Jan 13, 2021

Contractor optimism improves as ABC’s Construction Backlog inches up in December

ABC’s Construction Confidence Index readings for sales, profit margins, and staffing levels increased in December.

Market Data | Jan 11, 2021

Turner Construction Company launches SourceBlue Brand

SourceBlue draws upon 20 years of supply chain management experience in the construction industry.

Market Data | Jan 8, 2021

Construction sector adds 51,000 jobs in December

Gains are likely temporary as new industry survey finds widespread pessimism for 2021.

Market Data | Jan 7, 2021

Few construction firms will add workers in 2021 as industry struggles with declining demand, growing number of project delays and cancellations

New industry outlook finds most contractors expect demand for many categories of construction to decline.

Market Data | Jan 5, 2021

Barely one-third of metros add construction jobs in latest 12 months

Dwindling list of project starts forces contractors to lay off workers.

Market Data | Jan 4, 2021

Nonresidential construction spending shrinks further in November

Many commercial projects languish, even while homebuilding soars.

Market Data | Dec 29, 2020

Multifamily transactions drop sharply in 2020, according to special report from Yardi Matrix

Sales completions at end of Q3 were down over 41 percent from the same period a year ago.