The Associated General Contractors of America today announced that the Trump administration released new guidance that now allows firms with 500 or fewer employees to qualify for the new Paycheck Protection Program Loans. Association officials noted that the administration released the new guidance after the association raised concerns over the weekend that many firms that employ 500 or fewer employees appeared to be excluded from the program.

“Administration officials have done the right thing and revised their guidance to allow, as Congress intended, for firms that employ 500 or fewer people to qualify for the Paycheck Protection Program loans,” said Stephen E. Sandherr, the Association’s chief executive officer. “This change means the program is now more likely to help smaller firms continue to operate and retain staff.”

On April 2, the Small Business Administration issued an “interim final rule” to the effect that a business must have 500 or fewer employees and fall below the agency’s small business size standards—which for construction businesses are generally determined by an average annual income threshold, not number of employees threshold—in order to qualify for the new Paycheck Protection Program. Congress, however, declared that the program shall be open to all businesses that have 500 or fewer employees or fall below those size standards. Over the weekend, AGC of America alerted the Trump Administration to the problem, and late last night the U.S. Department of Treasury released new guidance about the Paycheck Protection Program loans that now allows firms with 500 or fewer employees to qualify.

Specifically, the new guidance includes the following:

Question: Does my business have to qualify as a small business concern (as defined in section 3 of the Small Business Act, 15 U.S.C. 632) in order to participate in the PPP?

Answer: No. In addition to small business concerns, a business is eligible for a PPP loan if the business has 500 or fewer employees whose principal place of residence is in the United States, or the business meets the SBA employee-based size standards for the industry in which it operates (if applicable).

The new guidance also states that “[b]orrowers . . . may rely on the guidance provided in this document as SBA’s interpretation of the CARES Act” and its interim final rule. At the time it posted this guidance, the Treasury Department also notified the association of its action. Here is a copy of that notice.

The new Treasury Department guidance appears to clear the way for construction firms that employ 500 or fewer people to qualify for the new Paycheck Protection Program loans. They added that the association will work with administration officials to ensure that the Small Business Administration’s regulations and guidance are harmonized with this new Treasury guidance.

Related Stories

Coronavirus | Aug 27, 2020

8 must reads for the AEC industry today: August 27, 2020

Extended-stay hotels are the lodging sector's safest bet, and industrial real estate faces short-term decline.

Coronavirus | Aug 25, 2020

Co-living firm Common issues RFP for the future home office and work hub

Common, the U.S.’s largest co-living company, recently released an RFP for a “Remote Work Hub” to blend work and life from the ground up.

Coronavirus | Aug 25, 2020

Video: 5 building sectors to watch amid COVID-19

RCLCO's Brad Hunter reveals the winners and non-winners of the U.S. real estate market during the coronavirus pandemic.

Coronavirus | Aug 25, 2020

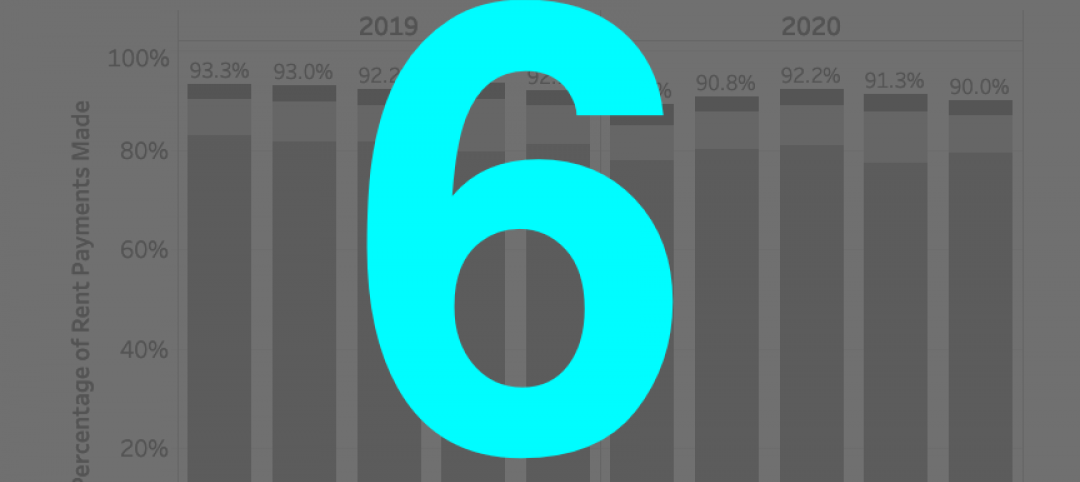

6 must reads for the AEC industry today: August 26, 2020

Big-box retailers’ profits surge, and rent payment tracker finds 90% of apartment households paying rent.

Coronavirus | Aug 25, 2020

7 must reads for the AEC industry today: August 25, 2020

Medical office buildings get a boost by demand and capital, and why the COVID-19 pandemic is increasing the need for telemedicine.

University Buildings | Aug 20, 2020

Student housing in the COVID-19 era

Student housing remains a vital part of the student and campus experience.

Coronavirus | Aug 17, 2020

Covid-19 and campus life: Where do we go from here?

Campus communities include international, intergenerational, and varied health-risk populations.

Coronavirus | Aug 10, 2020

Reimagining multifamily spaces in the COVID era

Multifamily developments pose unique challenges and opportunities.

Coronavirus | Aug 3, 2020

Exploring the airborne transmission of the coronavirus and strategies for mitigating risk

Health authorities say it’s important to understand the dangers of microdroplets. How might indoor ventilation need to change?