During the coronavirus pandemic in 2020, the average purchase at convenience stores in the U.S. rose by nearly 10%, according to CSP Magazine. A new whitepaper on the future of convenience stores urges dealers to “preserve and amplify that neighborhood feel” as a strategy for sustaining and expanding their businesses in a post-COVID era.

The whitepaper, coauthored by James Owens, AIA, NCARB, Vice President at HFA, and Joseph Bona, Founding Partner and President, Bona Design Lab, offers wide-ranging advice that revolves around five points:

OMNICHANNEL INTEGRATION

The challenge ahead for c-stores is to maintain an elevated brand experience amid increasing technical complexity of convenience retailing in the omnichannel age. “The ultimate goal,” according to the authors, “is to create a customer journey that is so simple you hardly notice how it all came together.”

AE and design firms and their c-store clients need to ramp up their collaboration, the paper asserts, by including in-house and third-party experts in areas such as data science, branding, technology, and food service.

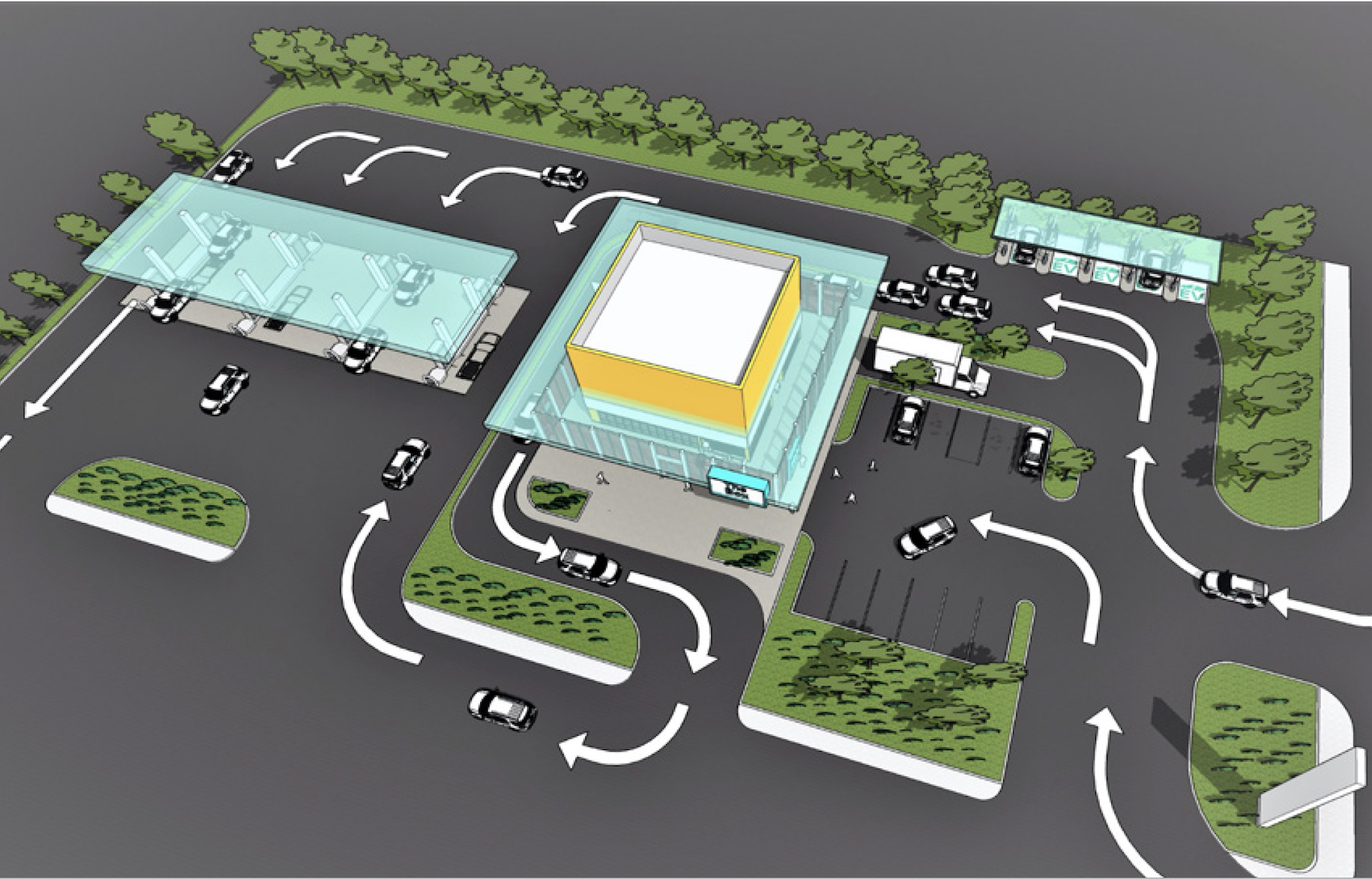

The AE focus lies primarily in maximizing the integration of different omnichannel solutions, such as drive-through lanes, click-and-collect parking spaces, contactless vending machines and more. The goal of c-store design, moving forward, “should be to promote more efficient site and in-store circulation,” the paper states.

Areas of opportunity could include reinforcing customer loyalty and spurring return visits by harmonizing site and store design with retailers’ marketing initiatives; and reducing labor costs and boosting convenience and loyalty by optimizing site and store design for contactless payment/vending machines and scan-and-go technologies. Maintaining separation between self-checkout stations and the traditional POS counter is an approach “that can help preserve the integrity of the traditional c-store experience, while making for a fast and efficient app-driven purchase.”

AE and design firms need to factor in that the installation and adoption of omnichannel solutions is likely to require square footage that otherwise might have been used for on-site inventory. Fortunately, the paper notes, new approaches to fulfillment (such as the emergence of third-party micro fulfillment center companies) promise to make it easier and cheaper for convenience stores to allocate less space for on-site storage.

REVOLUTIONIZING CONVENIENCE STORE FOOD SERVICE

The authors assert that any lines that once separated c-stores from elevated food retailing “should be erased forever.” They contend that whole c-store concepts are now emerging with elevated food service as their foundation. A recent example is UPop (short for Urban Provisions Offering Petroleum)—entrepreneur Paul Nair’s new high-end food and beverage market slated for a Georgia Arco gas station in Atlanta, with a curated selection of chef-driven prepared foods, beer, wine, and liquor.

C-stores need to harness their site and store designs to maximize results as they reopen their food programs. Key phrases here, the authors state, include “healthy,” “fresh,” “creatively packaged and merchandised,” “customizable,” “novel” and “surprising.”

The authors contend that c-stores are now Quick Service Restaurants (QSRs), with equivalent needs for preparation and storage space as well as back-of-house/kitchen equipment. In their partnerships with AE and design firms, c-store clients need to put food service strategies—down to specific menu items and the types of equipment required to produce them—front and center. This is true regardless of whether it’s a brand-new location or a retrofit of an existing store, the authors state.

This confluence of trends also points to the likelihood that packaged foods will be increasingly important in c-stores’ food service programs—certainly for the short term and possibly longer.

ANTICIPATE CULTURAL SHIFTS

The authors observe that the c-store customer’s purchasing habits are anything but monolithic. A shopper in “id mode” could pick up alcohol, tobacco or vaping products, while a more health-conscious person might buy a copy of Yoga Journal magazine, a lemon-kale smoothie, and a bottle of lavender aromatherapy oil.

The paper homes in on how the sale of cannabis—whose recreational use is legal in nearly 20 states—might eventually extend to c-stores. “Industry stakeholders are already laying the groundwork” for that possibility. C-stores have a long history of selling age-restricted products in a safe and compliant way. “Why shouldn’t cannabis be an option as well,” the authors ask?

Forward-thinking c-store clients and AE and design firms should be considering the specifics of how cannabis sales could work in different types of locations. Legal and risk-management experts are seminal to these discussions, which will involve questions such as how new federal laws could interact with state and local restrictions, or how far c-stores in different states will need to be from churches or schools if they begin to offer THC-containing products.

“C-store clients and their design and AE partners should redouble their efforts to stay informed about emerging consumer trends,“ the paper states more generally. “C-stores have always been affected by demographic shifts, product innovations and regulatory changes. This will continue as they further diversify their offerings to meet more of their consumers’ daily needs and wants.”

CAPITALIZING ON ELECTRIFICATION

The whitepaper's authors explore how charging stations for electric vehicles are likely to play a role in c-stores’ future. “Does the future theme of convenience retailing design include ‘electrify everything?’ We think so, but with plenty of caveats.”

The number of EVs on U.S. roads could reach 18.7 million by 2030, up from 1 million at the end of 2018, and the global number is predicted to reach 245 million by 2030, more than 30 times today’s level. As EVs become more commonplace, c-store clients will face a raft of business decisions, many of which affect sites, stores and the customer experience. These include:

• Whether to install EV chargers at all

• How many to install

• The role, if any, of third-party providers in defraying costs

• How to integrate EV charging into digital pay/loyalty ecosystems.

As AE and design firms prototype various EV-centric concepts with their c-store clients, it makes sense to bring in technologists, energy analysts and policy experts.

Apps hold powerful potential to drive visits to c-stores that maintain EV charging stations—indeed, a variety of apps (including some offered by third-party EV charging companies) already steer drivers to sites that offer EV charging. C-stores could easily benefit by integrating their own promotions into these offerings.

As c-store visitors wait for their on-site EV charges to finish, this could translate into a greater overall need for space and/or the reallocation of space on existing sites. Convenience retail clients and their AE and design firms will likely need to take a more flexible approach to store prototypes—supersized sites with two dozen EV charging stations, mid-sized models with just a few, and mini-stores with one or none. A modular approach to design could drive greater prototype flexibility.

RETURNING TO THE CORNER MARKET

During the pandemic, as consumers became more wary of crowded places, they started shopping more at stores in their neighborhoods. And as the world draws closer to a post-pandemic era, many c-store leaders are now refocusing on giving customers the social interaction they’ve been missing, and on making sure their stores convey a strong sense of local identity. “It’s a smart play that stands to strengthen their efforts to maintain market share and loyalty amid channel blurring and ecommerce commoditization,” the authors state.

Their firms have been consulting with clients on a range of potential ways to accentuate “that neighborhood feel.” None of these approaches conflicts with ongoing efforts to ramp up tech offerings or to configure site plans that function efficiently in terms of operations, logistics and traffic/pedestrian flow.

The paper offers some “final words” on strengthening community connections, which include:

•Use products and their names, ingredients, and flavor profiles to add a local touch;

•Offer opportunities touch and feel merchandise;

•Leverage interior design; and

•Get more creative with outside spaces.

Related Stories

| Jan 11, 2014

Getting to net-zero energy with brick masonry construction [AIA course]

When targeting net-zero energy performance, AEC professionals are advised to tackle energy demand first. This AIA course covers brick masonry's role in reducing energy consumption in buildings.

Smart Buildings | Jan 7, 2014

9 mega redevelopments poised to transform the urban landscape

Slowed by the recession—and often by protracted negotiations—some big redevelopment plans are now moving ahead. Here’s a sampling of nine major mixed-use projects throughout the country.

| Dec 31, 2013

Top 10 blog posts from 2013

BD+C editors and our contributors posted hundreds of blogs in 2013. Here's a recap of the most popular topics. They include valuable lessons from one of the first BIM-related lawsuits and sage advice from AEC legend Arthur Gensler.

| Dec 20, 2013

Can energy hogs still be considered efficient buildings? Yes, say engineers at Buro Happold

A new tool from the engineering firm Buro Happold takes into account both energy and economic performance of buildings for a true measure of efficiency.

| Dec 13, 2013

Safe and sound: 10 solutions for fire and life safety

From a dual fire-CO detector to an aspiration-sensing fire alarm, BD+C editors present a roundup of new fire and life safety products and technologies.

| Dec 10, 2013

16 great solutions for architects, engineers, and contractors

From a crowd-funded smart shovel to a why-didn’t-someone-do-this-sooner scheme for managing traffic in public restrooms, these ideas are noteworthy for creative problem-solving. Here are some of the most intriguing innovations the BD+C community has brought to our attention this year.

| Nov 27, 2013

Retail renaissance: What's next?

The retail construction category, long in the doldrums, is roaring back to life. Send us your comments and projects as we prepare coverage for this exciting sector.

| Nov 27, 2013

Exclusive survey: Revenues increased at nearly half of AEC firms in 2013

Forty-six percent of the respondents to an exclusive BD+C survey of AEC professionals reported that revenues had increased this year compared to 2012, with another 24.2% saying cash flow had stayed the same.

| Nov 27, 2013

Wonder walls: 13 choices for the building envelope

BD+C editors present a roundup of the latest technologies and applications in exterior wall systems, from a tapered metal wall installation in Oklahoma to a textured precast concrete solution in North Carolina.

| Nov 26, 2013

Construction costs rise for 22nd straight month in November

Construction costs in North America rose for the 22nd consecutive month in November as labor costs continued to increase, amid growing industry concern over the tight availability of skilled workers.