BD+C: New Millennium recently announced that it was acquiring three plants from Commercial Metals Company. What is your strategy?

Gary Heasley: New Millennium is a little more than 10 years old. Our first plant was built in Butler, Ind., and in 2005, we launched our second plant, then made some acquisitions and expanded our presence in the eastern U.S. We had been planning to build a plant in the western U.S., but the economic crisis came forced us to shelve those plans.

This year, as our competitor, CMC, announced that they were exiting the joist and deck markets, we saw an opportunity to move that plan back to the forefront and expand coast to coast. We have customers that may be located in, say, Florida, who are building projects in California. That’s exactly the group we knew we couldn’t serve properly without a western presence. We went ahead with the acquisition, and we’re now ramping up those facilities. With these three new locations [Fallon, Nev., Hope, Ark., and Juarez, Mexico], we’ll better serve Texas, Arizona, New Mexico, California, all of the West and Southwest.

BD+C: When do you expect to be in production at these facilities?

GH: We’ll be hiring production crews in November. We have equipment from two plants in the East that we’ll be using to optimize the efficiencies and productivity of the three acquired plants. The communities are very excited to see us coming back, but we will ramp up gradually over time and add capacity as the market demands it.

Soon, customers in any state will be able to use us, and for many of them, we’ll be delivering product within the 500-mile radius to qualify for LEED. We’re seeing more and more requests for documentation to support LEED efforts.

BD+C: Why are you making a push to create BIM tools for your products?

GH: We saw BIM as an evolution design technology that is inevitably going to happen. Whether or not it becomes universally used, we saw that it was important to more and more customers. So we put a team on that and built our first Dynamic Joist steel joist BIM module for Tekla Structures. It’s now available on our website.

The response has been tremendous, and we’re already seeing projects designed with the tool, and getting great feedback on how it’s being used.

BD+C: How can your company help Building Teams on their projects?

GH: If we can be part of the design team early in the process, then we can bring our specialty joists to the project, either to make the project more efficient and cost effective, or to add an architectural element that would not have been available if the Building Team had just been thinking of joists in a conventional way.

For example, the other day I was in our shop and watched our team fabricate some joists with a very unique curved design. Those joists will add an architectural element to the building that could not have been achieved had we not been involved early in the project. If we are involved early, we can have an influence, in suggesting creative architectural elements, or in making sure the project is more efficiently designed. We find we can often save owners money when we have the opportunity to add value through engineering.

If you look at joists as a simple commodity, you’re not going to be able to take advantage of opportunities to use joist design to make the projects more architecturally interesting and cost-effective.

BD+C: Any other concerns in dealing with Building Teams?

GH: The RFI process. One of the real challenges we are facing now is getting RFIs answered by our customers, whether that’s the structural engineer, or the owner, or the architect—it could be anyone involved in the project, depending on the job. The RFIs come back so late that everything becomes a rush. It would be great if we could get responses back more quickly, so that we can optimize our engineering for your job and help the project team avoid delays. If RFIs are received late, engineering and fabrication can be pushed back to the point that there are problems with delivery schedules, and that’s obviously bad for everyone involved.

BD+C: How much of a factor is design-build in the steel joist industry?

GH: It’s relatively small today, but we expect it to grow as a share of the construction market, and we’re making sure that we’re in a position to be part of those teams, so we can add value to projects that are being built under the design-build model.

BD+C: What are you seeing in terms of demand for joists in this economy?

GH: The steel joist industry is essentially flat year over year from 2009. There was some slight improvement in the first half of 2010, but then we gave it all back as industry bookings slowed in July and August. It’s bumpy out there. Some months are good, some bad. In terms of an economic recovery, it’s going to be long and slow as financing markets improve, as vacancies are absorbed, and as companies are more comfortable making capital investments.

BD+C: And your thoughts on the nonresidential construction market?

GH: We think that growth is going to be slow, but generally upward, not any dramatic change in the nonresidential market. We’ve run models at a number of different growth rates but it’s very difficult to predict such factors as the availability of financing. Right now, it’s about getting the job done every day in a very competitive market—watching our costs, productivity, and maintaining the highest level of customer service. BD+C

Related Stories

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

K-12 Schools | Apr 13, 2023

Creating a sense of place with multipurpose K-12 school buildings

Multipurpose buildings serve multiple program and functional requirements. The issue with many of these spaces is that they tend not to do any one thing well.

Healthcare Facilities | Apr 13, 2023

Urgent care facilities: Intentional design for mental and behavioral healthcare

The emergency department (ED) is the de-facto front door for behavior health crises, and yet these departments are understaffed, overwhelmed, and ill-equipped to navigate the layered complexities of highly demanding physical and behavioral health needs.

Office Buildings | Apr 13, 2023

L.A. headquarters for startup Califia Farms incorporates post-pandemic hybrid workplace design concepts

The new Los Angeles headquarters for fast-growing Califia Farms, a brand of dairy alternative products, was designed by SLAM with the post-Covid hybrid work environment in mind. Located in Maxwell Coffee House, a historic production facility built in 1924 that has become a vibrant mixed-use complex, the office features a café bordered by generous meeting rooms.

Urban Planning | Apr 12, 2023

Watch: Trends in urban design for 2023, with James Corner Field Operations

Isabel Castilla, a Principal Designer with the landscape architecture firm James Corner Field Operations, discusses recent changes in clients' priorities about urban design, with a focus on her firm's recent projects.

3D Printing | Apr 11, 2023

University of Michigan’s DART Laboratory unveils Shell Wall—a concrete wall that’s lightweight and freeform 3D printed

The University of Michigan’s DART Laboratory has unveiled a new product called Shell Wall—which the organization describes as the first lightweight, freeform 3D printed and structurally reinforced concrete wall. The innovative product leverages DART Laboratory’s research and development on the use of 3D-printing technology to build structures that require less concrete.

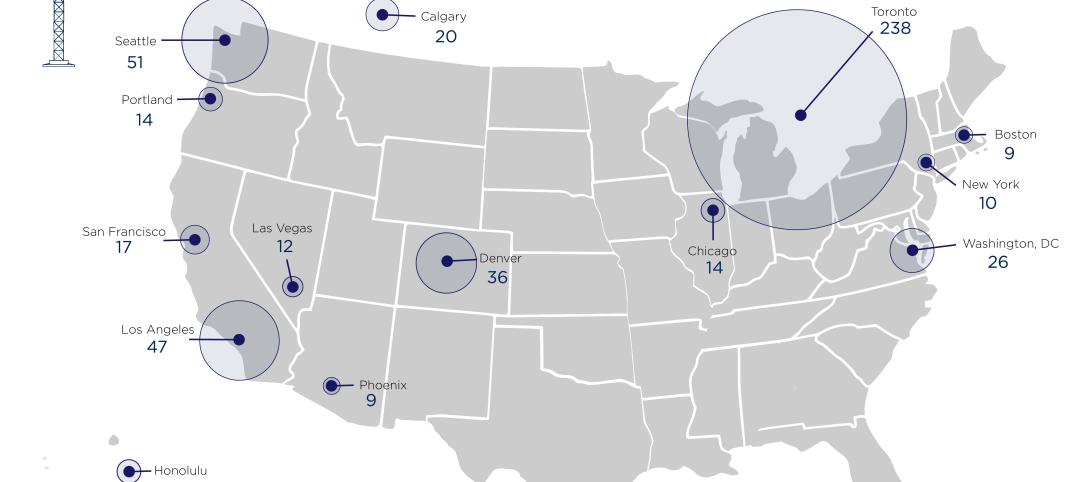

Market Data | Apr 11, 2023

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

University Buildings | Apr 11, 2023

Supersizing higher education: Tracking the rise of mega buildings on university campuses

Mega buildings on higher education campuses aren’t unusual. But what has been different lately is the sheer number of supersized projects that have been in the works over the last 12–15 months.