Between 2011 and 2016, the U.S. population age 50 years or older grew by 10.5 million to more than 112 million. While the vast majority of older Americans owns homes, homeownership rates are lower than the past, and a significant number of adults drawing closer to retirement might not have the financial wherewithal to afford to either buy or rent where they want to live.

That is the primary concern expressed by the latest Joint Center for Housing Studies’ report “Housing America’s Older Adults 2018,” which releases today.

The study relies mostly on data up to 2016, and reiterates a common theme in many of the Joint Center’s past papers: that America’s affordable housing stock is woefully inadequate to address demographic and economic trends that continue to reshape this country, especially in light of other trends in healthcare and the social safety net.

There are 65 million older households in the U.S. The homeownership rate for those headed by someone 50 years or older is 76.2%, and 78.7% of households headed by someone 65 or older.

The Joint Center’s report notes that the majority of older households are white, and live in single-family homes. The demographic profile of older Americans, however, is likely to get more racially and ethnically diverse. And more older adults have been moving into multifamily housing, possibly because larger buildings are more likely to offer accessibility features.

More older households now consist of older unmarried adults who are doubling up, or living in multigenerational households. This is especially true among people age 65-79.

Perhaps The Joint Center’s greatest concern is the steady decline, since 2004, in the rate for households age 50–64, and an even sharper dip for adults approaching age 50. “Since this younger group is unlikely to match the homeownership rates of previous generations, many of these households will be unable to generate the same levels of wealth for retirement through equity building,” the report posits.

Nearly a quarter of households age 50 or older rent. Given that the median income of older renters ($28,000) is less than half that of older owners ($61,000), the decision to rent often comes out of necessity. Most of the 43% growth in the number of older renters since 2006 has, in fact, been among households earning under $30,000 per year.

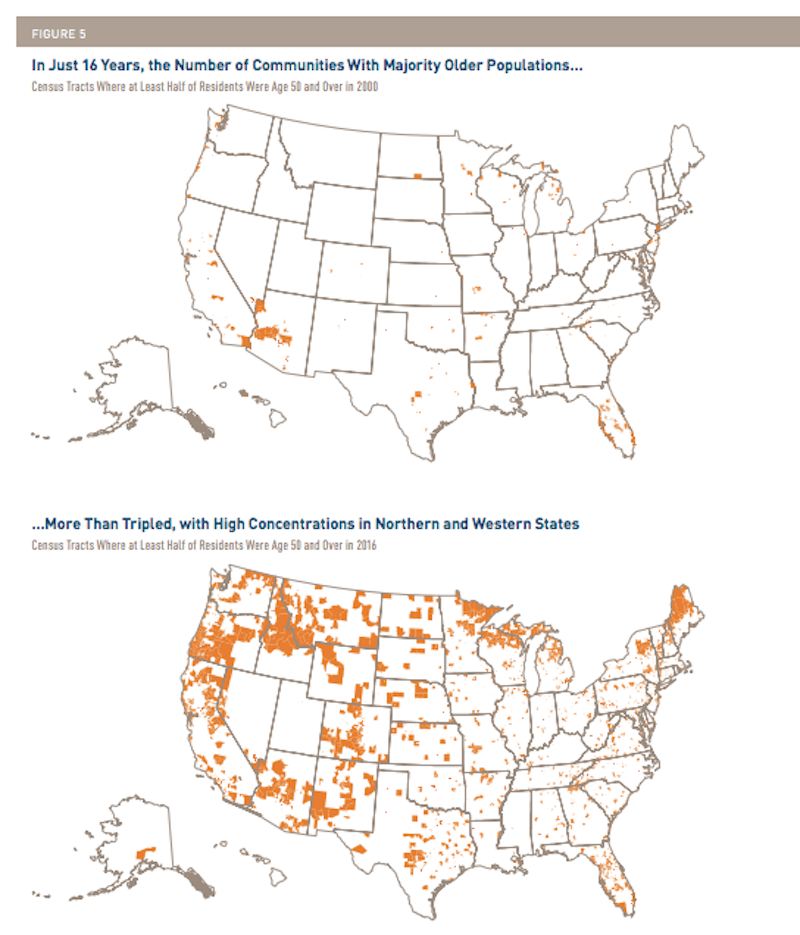

Where people reside is an important factor in this analysis. Although the number of people age 65 and over living in dense urban areas grew by nearly 800,000 between 2000 and 2016, the share of all older adults living in such neighborhoods actually fell. Meanwhile, the shares living in low-density metro tracts rose significantly, from 24% to 32%—an increase of more than six million. The growing presence of older adults in lower-density communities largely results from aging in place.

The implication here is that it might be harder for older adults to find the healthcare and services they require as they age.

More seniors at a financial precipice

The U.S. housing market is ill-prepared to cope with the explosion of seniors across the country, a sizable proportion of whom are nearing retirement facing financial uncertainty. Image: Joint Center for Housign Studies

The median homeowner aged 50–64 had a net worth of $292,000 in 2016—almost 60 times that of the same-age median renter. Even excluding home equity, the net worth of owner households aged 50–64 was still nearly 30 times higher than that of same-age renters, while the net worth of owners age 65 and over was more than 24 times higher.

This disparity might explain why more Americans are working past 65. Over the past three decades, the labor force participation rate rose 12.8 percentage points for 65–69 year olds, and 9.5 points for 70–74 year olds. In 2017, 8.3% of the population age 75 and over was either employed or actively looking for work—nearly double the share 30 years ago.

It’s a good thing they’re working because more than two-fifths of owners 65 or older still have mortgages to pay off. Between 1989 and 2016, the loan-to-vale rations doubled to 51% for mortgage holders aged 50-64, and tripled to 39% for those age 65 or older.

The number of households age 65 and over with housing cost burdens continues to climb. In 2016, 9.7 million households in this age group—nearly a third—spent more than 30% of their incomes for housing. About 4.9 million were severely burdened, paying at least half their incomes for housing

Although the cost-burdened share of 50–64 year olds did decline a fraction of a point to 19.9% in 2014–2016, a total of 10.2 million households in this age group still faced at least moderate cost burdens, and nearly half of those households had severe burdens.

Social Security payments accounted for 69% of the income for the median older household in 2016. But between 2006 and 2016, Social Security payments rose just 6% in real terms while the median rent for households age 65 and over climbed at twice that rate. Looking ahead, the ability of many older adults to afford their housing will be closely tied to the fate of the Social Security program.

The financial precariousness of older Americans is exacerbated by healthcare concerns and costs that might limit their housing options. In 2016, 26% of households age 50 and over included a member with at least one vision, hearing, cognitive, self-care, mobility, or independent living difficulty. Difficulty climbing stairs or walking is the most common disability, affecting 17% of these households. Minority households are more likely than same-age white households to have at least one difficulty, although differences narrow over time.

Consider these statistics in light of the fact that few homes in the U.S. are accessible to people with mobility problems, particularly those requiring a wheelchair.

The good news is that that some older owners have come to grips with their possible debilities. The American Housing Survey shows that among owners age 65 and over who reported home-improvement spending in 2016–2017, 11% indicated that at least one of their projects was related to accessibility. Households in the 55-and-over age group already account for more than half of home improvement spending, and Joint Center projections suggest they will drive more than three-quarters of the growth in renovation spending in 2015–2025.

But renters, as well as owners with little wealth, may require government assistance to make their homes more accessible.

As if all this weren’t daunting enough, the Joint Center states that climate change doesn’t bode well for older adults who are much more at risk from extreme weather events and natural disasters than younger age groups.

The report’s outlook is another warning shot: Many households currently in their 50s and early 60s are not financially prepared for retirement, with lower homeownership rates than their predecessors and meager gains in income and wealth. In addition, many older adults live in low-density areas and in single-family homes, which adds to the pressures on their communities to provide new housing and transportation options for households in need. And as the baby boomers begin to turn 80 in the decade ahead, growing numbers of households will require affordable, accessible housing as well as supportive services.

State and local governments, as well as the private and nonprofit sectors, all have roles to play in developing more affordable and suitable housing for older households. Families and individuals also have a responsibility to plan for the future and to advocate for more age-friendly housing and communities. But given the current and growing scale of need, addressing the challenges of housing America’s older adults must also be a federal priority.

Related Stories

Giants 400 | Jan 8, 2024

Top 60 Senior Living Facility Construction Firms for 2023

Whiting-Turner, Ryan Companies US, Weis Builders, Suffolk Construction, and W.E. O'Neil Construction top BD+C's ranking of the nation's largest senior living facility general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 8, 2024

Top 40 Senior Living Facility Engineering Firms for 2023

Kimley-Horn, Olsson, Tetra Tech, EXP, and IMEG head BD+C's ranking of the nation's largest senior living facility engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 8, 2024

Top 80 Senior Living Facility Architecture Firms for 2023

Perkins Eastman, Hord Coplan Macht, Lantz-Boggio Architects, Ryan Companies US, and Moseley Architects top BD+C's ranking of the nation's largest senior living facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

MFPRO+ News | Jan 8, 2024

Canada turns to 1940s strategy to speed up housing construction

To address a severe housing shortage, Prime Minister Justin Trudeau’s administration has begun a housing construction strategy pioneered in the years after World War 2. The government aims to use a catalog of pre-approved home designs to reduce the cost and time to construct homes.

MFPRO+ News | Jan 4, 2024

Bjarke Ingels's curved residential high-rise will anchor a massive urban regeneration project in Greece

In Athens, Greece, Lamda Development has launched Little Athens, the newest residential neighborhood at the Ellinikon, a multiuse development billed as a smart city. Bjarke Ingels Group's 50-meter Park Rise building will serve as Little Athens’ centerpiece.

MFPRO+ News | Jan 2, 2024

New York City will slash regulations on housing projects

New York City Mayor Eric Adams is expected to cut red tape to make it easier and less costly to build housing projects in the city. Adams would exempt projects with fewer than 175 units in low-density residential areas and those with fewer than 250 units in commercial, manufacturing, and medium- and high-density residential areas from environmental review.

MFPRO+ News | Dec 22, 2023

Document offers guidance on heat pump deployment for multifamily housing

ICAST (International Center for Appropriate and Sustainable Technology) has released a resource guide to help multifamily owners and managers, policymakers, utilities, energy efficiency program implementers, and others advance the deployment of VHE heat pump HVAC and water heaters in multifamily housing.

Giants 400 | Dec 20, 2023

Top 100 Apartment and Condominium Construction Firms for 2023

Clark Group, Suffolk Construction, Summit Contracting Group, and McShane Companies top BD+C's ranking of the nation's largest apartment building and condominium general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 20, 2023

Top 70 Apartment and Condominium Engineering Firms for 2023

Kimley-Horn, WSP, Tetra Tech, and Thornton Tomasetti head BD+C's ranking of the nation's largest apartment building and condominium engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 20, 2023

Top 160 Apartment and Condominium Architecture Firms for 2023

Gensler, Humphreys and Partners, Solomon Cordwell Buenz, and AO top BD+C's ranking of the nation's largest apartment building and condominium architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.