HOK’s WorkPlace practice, in partnership with the UK Chapter of CoreNet Global, has released a new report that studies the impact of coworking from a corporate real estate (CRE) perspective.

Coworking is one of the fastest-growing sectors of the commercial real estate market. The new report, Coworking: A Corporate Real Estate Perspective, examines the drivers of coworking from the demand and supply sides, the industry risks and implications for corporate real estate, as well as information about the owners, coworkers and centers.

The HOK/CoreNet Global Coworking report highlights the ideas that changing business priorities and the need to attract talented people, reduce real estate costs, improve speed to innovation and increase productivity are driving corporations to consider different workplace models, including on- and off-site coworking.

Key findings from the Coworking report also include:

- The coworking concept is evolving to comprise accelerators, incubators and maker spaces. It reaches beyond office settings to include college campuses, retail locations, hotels and libraries.

- The impact of coworking spaces on CRE includes providing new uses for older properties and for underutilized spaces in existing facilities.

- The lowest engagement levels are found in employees who never work remotely. The highest employee engagement levels occur among those who work remotely less than 20% of the time.

- Many coworking centers emerged in a time of high unemployment and low rents. But 54% of the coworkers will leave a specific location in less than a year. The high turnover and tenant instability challenge coworking centers to maintain profitability. They are vulnerable to market conditions and new competitors.

“For corporate occupiers and other real estate professionals, the coworking trend is worth watching, exploring and testing,” said Curtis Knapp, director of consulting for HOK. “It is a way to add flexibility to the portfolio and help match the ebb and flow of supply and demand. It can be one solution to the many challenges posed by the changing nature of both work and worker.”

Related Stories

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.

Multifamily Housing | May 11, 2022

Kitchen+Bath AMENITIES – Take the survey for a chance at a $50 gift card

MULTIFAMILY DESIGN + CONSTRUCTION is conducting a research study on the use of kitchen and bath products in the $106 billion multifamily construction sector.

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

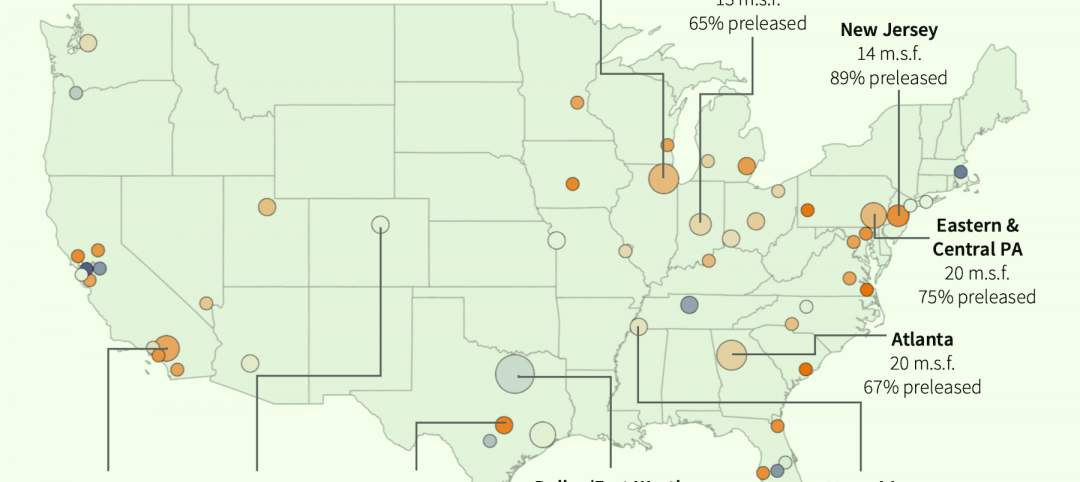

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment

Industry Research | Apr 4, 2022

Nonresidential Construction Spending Drops Slightly in February, Says ABC

National nonresidential construction spending was down 0.1% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.

Industry Research | Mar 23, 2022

Architecture Billings Index (ABI) shows the demand for design service continues to grow

Demand for design services in February grew slightly since January, according to a new report today from The American Institute of Architects (AIA).