It’s been a busy couple of months for the architecture and design firm NELSON. It was wrapping up its merger with Wakefield Beasley & Associates and WB Interiors, a deal that was announced last November. It recapitalized its business with two financial partners, H.I.G. Capital and Prudential. And today, NELSON announced that it had entered into a merger agreement with FRCH Design Worldwide, an architecture and design firm with three offices and 200-plus employees, which specializes in retail, hospitality, and mixed-use.

NELSON’s Chairman and CEO, John “Ozzie” Nelson Jr., and FRCH’s CEO, Jim Tippmann, will serve as Co-CEOs of the combined company, which now consists of 25 offices and more than 1,100 employees. FRCH Design Worldwide will be known as FRCH a NELSON company.

Tippmann tells BD+C that he and Nelson started talking “15-16 months ago” about the possibility of merging their two businesses. Such a deal made sense, explains Tippmann, because “we’re both operating in a dynamic, changing business environment.”

FRCH, with estimated revenue of $40 million, had concluded that it either had to acquire a company itself, or find a partner like NELSON that had the geographic reach FRCH needed in order to compete for business from larger clients, especially those propagating brands in multiple markets.

Just as the Wakefield Beasley deal got NELSON deeper into the mixed-use realm, merging with FRCH would bring into NELSON’s stable “a sizable hospitality business,” says Nelson. His company would also benefit from FRCH’s “big retail engine” in a sector where NELSON on its own has had difficulty gaining traction.

Jim Tippmann (left) and John “Ozzie” Nelson Jr., Co-CEOs of NELSON, will manage their company after the merger by region and practice sector. Image: NELSON

As Co-CEOs, Nelson and Tippmann have crafted a regionally defined operating model. Tippmann says he will be “the first point of contact” for NELSON’s business in the Northeast and Southeast, and Nelson will take the lead for its offices in the Midwest and West. Practice responsibilities will align with each of the merging company’s specialties: for example, Tippmann will oversee retail and “consumer interface” projects, whereas office, financial, and industrial projects will fall under Nelson’s domain.

The combined company’s holding company will continue to be based in Minnesota. But Cincinnati—FRCH’s headquarters city—is now NELSON’s biggest office. Atlanta is the company’s biggest market, and will be managed by two offices there. Over the coming months, the leadership of both organizations will further integrate their expanded service offering.

Nelson tells BD+C that he still sees his company as a “global boutique” with an office structure that Tippmann thinks is now “a contemporary model, where leaders can be anywhere in the U.S.” FRCH and NELSON both use video conferencing to connect their offices, which came in handy yesterday when the CEOs were announcing the merger to their employees via electronic town hall-like meetings. (Nelson notes that he spent 2½ hours with 250 people in his company’s Atlanta offices answering their questions. “You want to be as transparent as you can in those meetings,” he says.)

“I couldn’t have been more pleased with how this came together,” says Tippmann.

Nelson says his company has gotten to a size where “we will have an opportunity to grow organically and attract talent.”

However, having been involved in 40 mergers during his 30-year career with the company, Nelson says he’s still on the lookout for acquisition candidates in Southern California and Texas, and for firms that would strengthen NELSON’s competitive position in such sectors as industrial architecture and healthcare.

What he will avoid, though, is finalizing a merger just to get it done. “Culture trumps everything, and you don’t want to do a deal that leaves you with an operating nightmare.”

Related Stories

Architects | Feb 8, 2024

LPA President Dan Heinfeld announced retirement

LPA Design Studios announced the upcoming retirement of longtime president Dan Heinfeld, who led the firm’s growth from a small, commercial development-focused architecture studio into a nation-leading integrated design practice setting new standards for performance and design excellence.

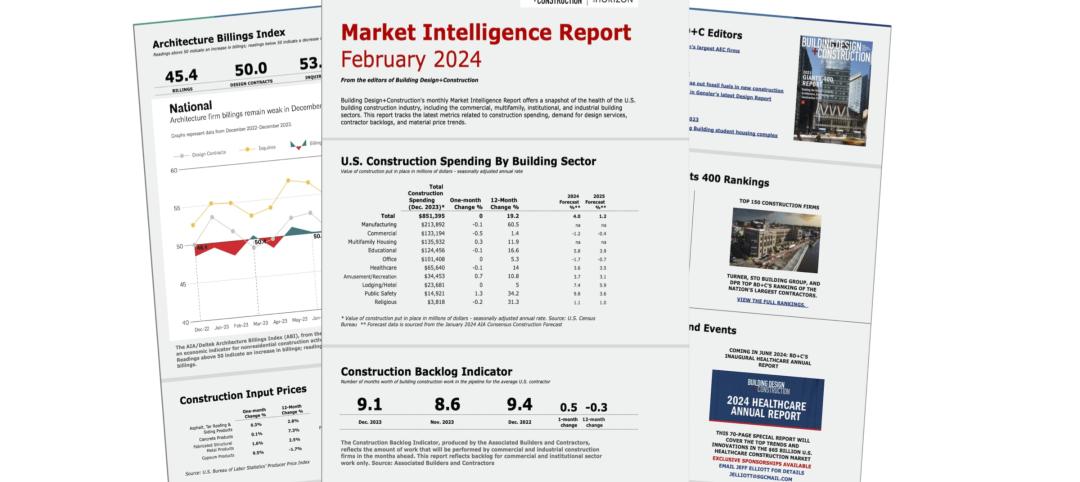

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Giants 400 | Feb 6, 2024

Top 80 Religious Facility Architecture Firms for 2023

Parkhill, FGM Architects, GFF, Gensler, and HOK top BD+C's ranking of the nation's largest religious facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Modular Building | Feb 6, 2024

Modular fire station allows for possible future reconfigurations

A fire station in Southern California leveraged prefab, modular construction for faster completion and future reconfiguration.

Giants 400 | Feb 5, 2024

Top 30 Entertainment Center, Cineplex, and Theme Park Architecture Firms for 2023

Gensler, JLL, Nelson Worldwide, AO, and Stantec top BD+C's ranking of the nation's largest entertainment center, cineplex, and theme park architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Urban Planning | Feb 5, 2024

Lessons learned from 70 years of building cities

As Sasaki looks back on 70 years of practice, we’re also looking to the future of cities. While we can’t predict what will be, we do know the needs of cities are as diverse as their scale, climate, economy, governance, and culture.

Giants 400 | Feb 5, 2024

Top 90 Shopping Mall, Big Box Store, and Strip Center Architecture Firms for 2023

Gensler, Arcadis North America, Core States Group, WD Partners, and MBH Architects top BD+C's ranking of the nation's largest shopping mall, big box store, and strip center architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Laboratories | Feb 5, 2024

DOE selects design-build team for laboratory focused on clean energy innovation

JE Dunn Construction and SmithGroup will construct the 127,000-sf Energy Materials and Processing at Scale (EMAPS) clean energy laboratory in Colorado to create a direct path from lab-scale innovations to pilot-scale production.

Architects | Feb 2, 2024

SRG Partnership joins CannonDesign to form 1,300-person design giant across 18 offices

SRG Partnership, a dynamic architecture, interiors and planning firm with studios in Portland, Oregon, and Seattle, Washington, has joined CannonDesign. This merger represents not only a fusion of businesses but a powerhouse union of two firms committed to making a profound difference through design.

Giants 400 | Feb 1, 2024

Top 90 Restaurant Architecture Firms for 2023

Chipman Design Architecture, WD Partners, Greenberg Farrow, GPD Group, and Core States Group top BD+C's ranking of the nation's largest restaurant architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.