The multifamily sector continues to be strong in 2024, even when a handful of challenges are present. That is according to the Matrix Multifamily National Report for Summer 2024.

This research report looks towards the second half of the year to see what we can expect for rent growth, supply, and economic uncertainty.

U.S. Multifamily Outlook for Summer 2024

While demand remains steady, factors like rising supply and financing difficulties are creating headwinds. The coming months will likely see a slowdown in growth, with regional variations depending on supply and economic factors.

Moderate Challenges

While the economy remains stable and job growth persists, some challenges are emerging for multifamily markets. Rent growth and occupancy rates, once strong, have softened since the 2022 peak.

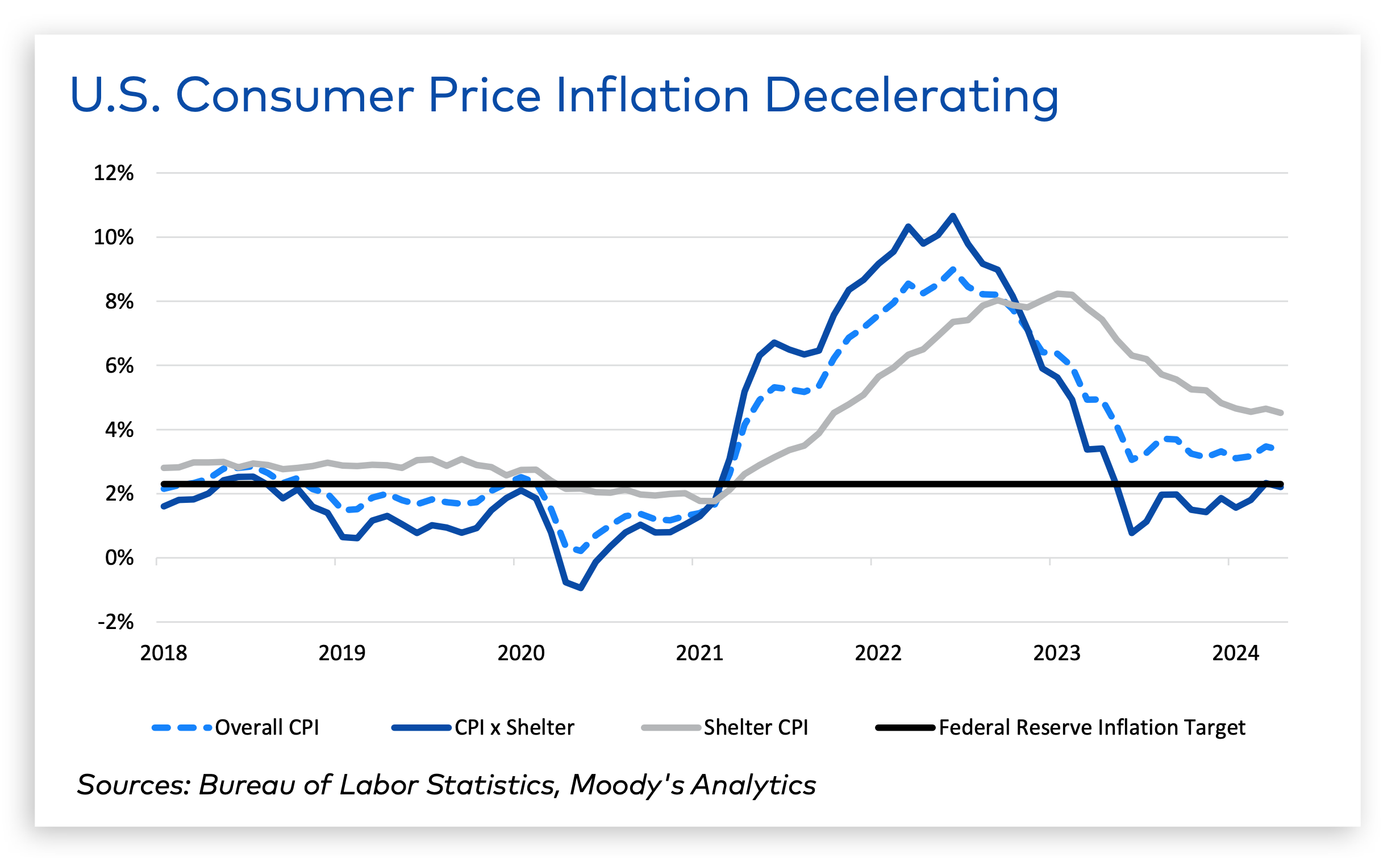

“All eyes in the multifamily market are on the direction of inflation and interest rates,” the report states.

Financing presents another hurdle. High interest rates are dampening transaction activity. Investors are waiting for prices to adjust before buying, while lenders are cautious and many banks are staying on the sidelines.

Debt is a concern, especially for properties financed with short-term loans. Well-capitalized investors can weather the storm, but some value-add properties face potential distress.

Mixed-Bag Supply & Demand

Demand is a double-edged sword. Would-be homebuyers are staying put due to high mortgage rates, which bolsters rental demand. However, these same high rates are hindering refinancing and sales activity in the multifamily market.

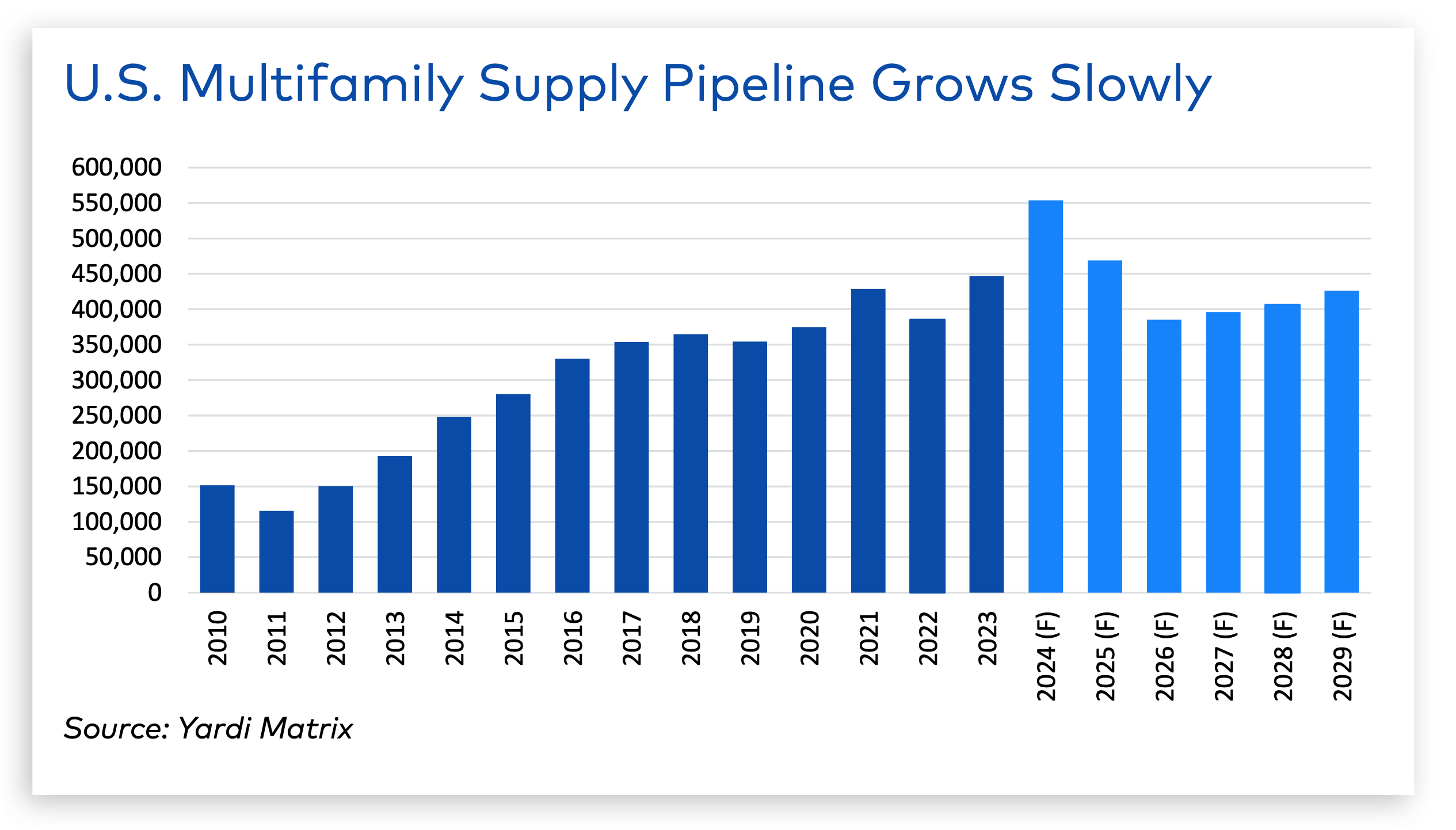

Supply is on the rise, especially in Sun Belt markets. This influx of new units is putting pressure on rent growth in those areas, while other regions with slower delivery rates are seeing more stable rents. This trend is expected to continue in the short term, with a peak of 553,000 new units projected for 2024.

“Multifamily is on schedule this year to achieve the highest number of deliveries in decades, but the pipeline will moderate in following years as starts slow,” the report states.

From January to May 2024, rent growth reached 1.1%—a $19 increase. Although average rent prices across the country remains positive, growth has slowed considerably in the past two years.

Overall, the U.S. multifamily market is experiencing a period of mixed signals that will persist throughout the rest of 2024.

RELATED

Related Stories

Mixed-Use | Jan 19, 2024

Trademark secures financing to develop Fort Worth multifamily community

National real estate developer, investor, and operator, Trademark Property Company, has closed on the land and secured the financing for The Vickery, a multifamily-led mixed-use community located on five acres at W. Vickery Boulevard and Hemphill Street overlooking Downtown Fort Worth.

Affordable Housing | Jan 18, 2024

Habitat tops off second apartment building at 43 Green

The co-developers of 43 Green celebrate the latest milestone for the $100 million, mixed-income, mixed-use project in Bronzeville: topping off Phase 2 while reaching full lease-up of the Phase 1 apartment building.

Adaptive Reuse | Jan 12, 2024

Office-to-residential conversions put pressure on curbside management and parking

With many office and commercial buildings being converted to residential use, two important issues—curbside management and parking—are sometimes not given their due attention. Cities need to assess how vehicle storage, bike and bus lanes, and drop-off zones in front of buildings may need to change because of office-to-residential conversions.

MFPRO+ News | Jan 12, 2024

Detroit may tax land more than buildings to spur development of vacant sites

The City of Detroit is considering a revamp of how it taxes property to encourage development of more vacant lots. The land-value tax has rarely been tried in the U.S., but versions of it have been adopted in many other countries.

MFPRO+ News | Jan 12, 2024

As demand rises for EV chargers at multifamily housing properties, options and incentives multiply

As electric vehicle sales continue to increase, more renters are looking for apartments that offer charging options.

Student Housing | Jan 12, 2024

UC Berkeley uses shipping containers to block protestors of student housing project

The University of California at Berkeley took the drastic step of erecting a wall of shipping containers to keep protestors out of a site of a planned student housing complex. The $312 million project would provide badly needed housing at the site of People’s Park.

Sustainability | Jan 10, 2024

New passive house partnership allows lower cost financing for developers

The new partnership between PACE Equity and Phius allows commercial passive house projects to be automatically eligible for CIRRUS Low Carbon financing.

Apartments | Jan 9, 2024

Apartment developer survey indicates dramatic decrease in starts this year

Over 56 developers, operators, and investors across the country were surveyed in John Burns Research and Consulting's recently-launched Apartment Developer and Investor Survey.

Giants 400 | Jan 8, 2024

Top 60 Senior Living Facility Construction Firms for 2023

Whiting-Turner, Ryan Companies US, Weis Builders, Suffolk Construction, and W.E. O'Neil Construction top BD+C's ranking of the nation's largest senior living facility general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 8, 2024

Top 40 Senior Living Facility Engineering Firms for 2023

Kimley-Horn, Olsson, Tetra Tech, EXP, and IMEG head BD+C's ranking of the nation's largest senior living facility engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.