After another year when the growth in multifamily housing exceeded expectations, apartment demand and property values could keep rolling through 2017.

“The forces that have produced the best multifamily market in recent memory remain largely in place,” says John Affleck, apartment research strategist for CoStar Group.

In a recent report from Real Capital Markets, 49% of investors polled said that multifamily remains an ideal investment in commercial real estate, and that the market doesn’t look like it will be slowing down any time soon.

The National Association of Home Builders expects multifamily starts to rise to 384,000 units, or 1,000 above last year’s number. Robert Dietz, NAHB’s chief economist, believes this pace is being driven by demographics and the balance between supply and demand.

CoStar actually forecasts that sales volumes, units per sale, and price growth of multifamily properties will finally level off this year from record highs. However, CoStar also acknowledges the sector’s momentum, where—through the third quarter of 2016—multifamily had the lowest vacancy rate (5.2%) of all major property types, and had seen rents rise by 3.9%.

Aggressive pricing aside, the sector’s record of steady rent growth and high occupancy with low volatility continue to make apartment properties an ideal defensive asset as the economic cycle extends into a seventh year, Affleck says.

CoStar predicts that the national vacancy rate for multifamily properties will increase to 5.6% this year and to 5.7% in 2018. Rental rate growth should moderate to 2.3% this year and 2.1% next.

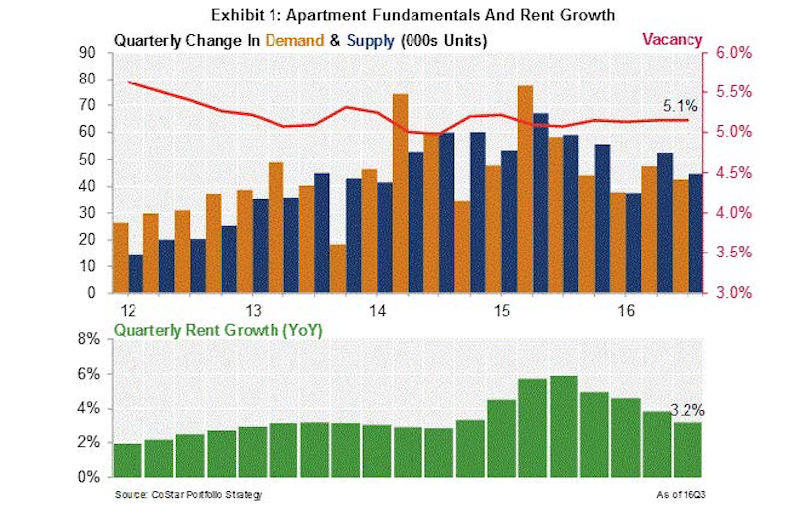

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

David Brickman, Executive Vice President and head of Freddic Mac’s multifamily business, foresees a spike in renter households, spurred on by positive job growth and a stable economy. In addition, home prices are on the rise, which might cause renters to further postpone any residential purchases. And aging baby boomers continue to downsize into rental units.

Fannie Mae is a bit more conservative in its estimates about multifamily growth over the next two years. But Kim Betancourt, Fannie’s Director of Economics, doesn’t expect any moderation to be long lasting.

“Considering that rent concessions have declined steadily for nearly seven straight years, and that their current level is now below 1%, it is probably only a question of ‘when’ and not ‘if’ concessions begin to rise again,” Betancourt says.

CoStar’s Affleck sees the “unprecedented propensity to rent, even among the most affluent” as “the chief risk to this cycle,” because higher rents will inevitably coax more renters to consider homeownership, especially if interest rates stay relatively low.

Related Stories

High-rise Construction | Mar 3, 2016

HOK’s Hertsmere House will be Western Europe’s tallest residential tower

Recently approved for development, the 67-story building will have more than 900 units.

University Buildings | Feb 29, 2016

4 factors driving the student housing market

In the hyper-competitive higher education sector, colleges and universities view residence halls as extensions of their academic brands, both on and off campus.

Multifamily Housing | Feb 24, 2016

Senior housing sector experiences record-setting year, says CBRE

Senior housing occupancy is at its highest level since 2007, and 2015 was a record year for sales and institutional transactions, according to CBRE.

Industry Research | Feb 22, 2016

8 of the most interesting trends from Gensler’s Design Forecast 2016

Technology is running wild in Gensler’s 2016 forecast, as things like virtual reality, "smart" buildings and products, and fully connected online and offline worlds are making their presence felt throughout many of the future's top trends.

Multifamily Housing | Feb 10, 2016

Miami review board recommends approval for Arquitectonica’s top-heavy condo tower

The 57-story Elysee Miami will offer residents impeccable views and plenty of amenities.

Multifamily Housing | Feb 5, 2016

Design guidelines for retail space in NYC affordable housing projects released

Aimed at designing efficient, flexible ground-floor space.

Multifamily Housing | Feb 2, 2016

10 top bathroom design trends for 2016

Floating vanities, tricked-out showers, and freestanding tubs highlight the top bathroom design trends, according to a survey of kitchen and bath design professionals by the National Kitchen and Bath Association.

Multifamily Housing | Feb 1, 2016

Top 10 kitchen design trends for 2016

Charging stations, built-in coffeemakers, and pet stations—these are among the top kitchen design trends for the coming year, according to a new survey of kitchen and bath designers by the National Kitchen & Bath Association.

Codes and Standards | Jan 22, 2016

Treasury Dept. will start crackdown on illicit money in luxury real estate

The move is expected to impact high-end condo development.

| Jan 14, 2016

How to succeed with EIFS: exterior insulation and finish systems

This AIA CES Discovery course discusses the six elements of an EIFS wall assembly; common EIFS failures and how to prevent them; and EIFS and sustainability.