After another year when the growth in multifamily housing exceeded expectations, apartment demand and property values could keep rolling through 2017.

“The forces that have produced the best multifamily market in recent memory remain largely in place,” says John Affleck, apartment research strategist for CoStar Group.

In a recent report from Real Capital Markets, 49% of investors polled said that multifamily remains an ideal investment in commercial real estate, and that the market doesn’t look like it will be slowing down any time soon.

The National Association of Home Builders expects multifamily starts to rise to 384,000 units, or 1,000 above last year’s number. Robert Dietz, NAHB’s chief economist, believes this pace is being driven by demographics and the balance between supply and demand.

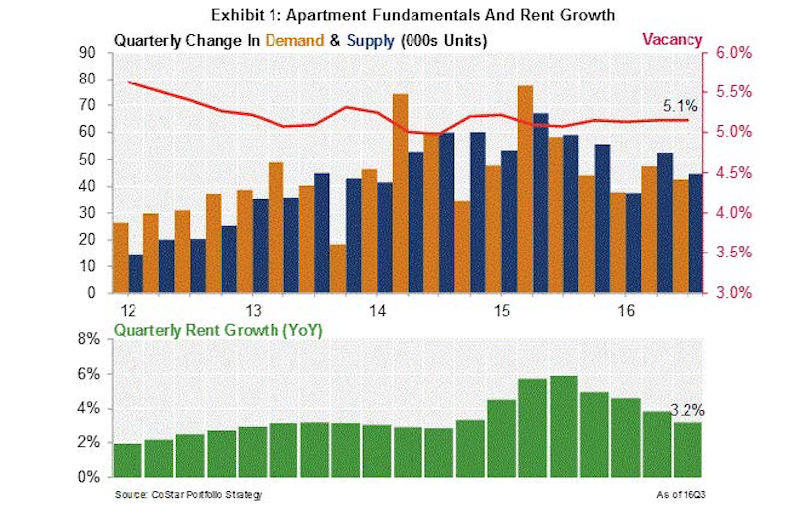

CoStar actually forecasts that sales volumes, units per sale, and price growth of multifamily properties will finally level off this year from record highs. However, CoStar also acknowledges the sector’s momentum, where—through the third quarter of 2016—multifamily had the lowest vacancy rate (5.2%) of all major property types, and had seen rents rise by 3.9%.

Aggressive pricing aside, the sector’s record of steady rent growth and high occupancy with low volatility continue to make apartment properties an ideal defensive asset as the economic cycle extends into a seventh year, Affleck says.

CoStar predicts that the national vacancy rate for multifamily properties will increase to 5.6% this year and to 5.7% in 2018. Rental rate growth should moderate to 2.3% this year and 2.1% next.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

David Brickman, Executive Vice President and head of Freddic Mac’s multifamily business, foresees a spike in renter households, spurred on by positive job growth and a stable economy. In addition, home prices are on the rise, which might cause renters to further postpone any residential purchases. And aging baby boomers continue to downsize into rental units.

Fannie Mae is a bit more conservative in its estimates about multifamily growth over the next two years. But Kim Betancourt, Fannie’s Director of Economics, doesn’t expect any moderation to be long lasting.

“Considering that rent concessions have declined steadily for nearly seven straight years, and that their current level is now below 1%, it is probably only a question of ‘when’ and not ‘if’ concessions begin to rise again,” Betancourt says.

CoStar’s Affleck sees the “unprecedented propensity to rent, even among the most affluent” as “the chief risk to this cycle,” because higher rents will inevitably coax more renters to consider homeownership, especially if interest rates stay relatively low.

Related Stories

Multifamily Housing | Jun 21, 2022

Two birds, one solution: Can we solve urban last-mile distribution and housing challenges at the same time?

When it comes to the development of both multifamily housing and last-mile distribution centers, particularly in metropolitan environments, each presents its own series of challenges and hurdles. One solution: single-use structures.

Sponsored | HVAC | Jun 14, 2022

Healing the urban fabric: The surprising impact of MagicPak HVAC

The Legends at Berry active adult housing complex in St. Paul, Minnesota helped transform a former industrial site into a thriving residential campus. MagicPak All-in-One® HVAC Systems provided the energy-efficient heating needed to handle extreme Minnesota winters while enabling architects to create an inviting home environment—and even qualify for additional funding incentives.

Multifamily Housing | Jun 9, 2022

Cityview's Adam Perry on multifamily housing innovation in the Western U.S.

Adam Perry, SVP of Development and Construction Management with developer Cityview, chats with Multifamily Design+Construction Editor Rob Cassidy about the latest design and construction innovations for multifamily housing in the West.

Hotel Facilities | May 31, 2022

Checking out: Tips for converting hotels to housing

Many building owners are considering repositioning their hotels into another property type, such as senior living communities and rental apartments. Here's advice for getting started.

Multifamily Housing | May 25, 2022

9 noteworthy multifamily developments to debut in 2022

A 1980s-era shopping mall turned mixed-use housing and a mid-rise multifamily tower with unusual rowhomes highlight the innovative multifamily developments to debut recently.

Sponsored | Multifamily Housing | May 23, 2022

An Integrated WRB Sheathing System Offers Big Benefits at Big Haus

Legislation | May 20, 2022

Arlington County, Virginia may legalize multifamily housing countywide

Arlington County, Va., a Washington, D.C.-area community, is considering proposed legislation that would remove zoning restrictions on multifamily housing up to eight units in size.

Multifamily Housing | May 11, 2022

Kitchen+Bath AMENITIES – Take the survey for a chance at a $50 gift card

MULTIFAMILY DESIGN + CONSTRUCTION is conducting a research study on the use of kitchen and bath products in the $106 billion multifamily construction sector.