Multifamily 2018 outlook: Developers tap the brakes, but will maintain historic pace

By CBRE

Development will play a key role in the U.S. multifamily market in 2018. Developers are poised to register the second-highest annual completions count of this cycle, with as many as 258,000 units delivered. This is based on 62 markets tracked by CBRE Econometric Advisors.

This would be down by 9.2% from 2017’s cycle peak, projected at 284,000. Apartment starts began to slow in 2017, so the multifamily market will get a reprieve from new supply by late 2018 and throughout 2019.

Starts will continue to slow in 2018, as banks have scaled back development lending over the past two years. While other sources of development capital have emerged (e.g., debt funds) or reemerged (e.g., HUD financing), the climate for financing new development should remain more conservative, and debt capital costs more expensive.

For more, download CBRE’s free 2018 Multifamily Outlook report (registration required).

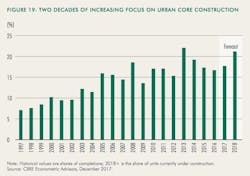

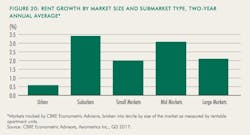

As of December 2017, nearly 23% of all units under construction in U.S. markets are in urban cores. In the long term, urban core multifamily will perform well, but for the short term, market statistics indicate that the best development opportunities are in the suburbs.