The commercial property and casualty (P&C) market is driven by two powerful, albeit conflicting, forces: large catastrophic losses and excess capital. As a substantial part of real estate development is happening in areas exposed to floods, wildfires, severe storms, hurricanes and earthquakes, insurance companies are rethinking how to deploy their capital to manage aggregation in catastrophe exposed areas.

USI Insurance Services, a global insurance brokerage and consulting firm, recently released its 2019 Commercial Property & Casualty Market Outlook, which provides insight into the current dynamics of the property and casualty insurance market, as well as a deeper dive into covered sectors that include commercial real estate and construction, transportation, manufacturing/distribution, environmental, and aviation.

The report found a stable P&C industry in 2018, despite it having experienced five of the 15 costliest global catastrophes in the past two years, coupled with multiple large wildfires and other major loss events, which collectively caused in excess of $125 billion in total insured damages.

The P&C industry remains well capitalized, and its surplus now stands at $760 billion. Consequently, the industry has resisted significant and sustained market-wide rate increases, even as insured property losses from U.S. catastrophes alone went from $14.3 billion for 2.4 million claims from 33 catastrophes in 2010 to $101.9 billion for 5.2 million claims from 46 catastrophes in 2017, according to Property Claims Services and the U.S. Bureau of Economic Analysis.

It remains to be seen whether such restraint is sustainable if catastrophic events continue to increase and wreak havoc. USI says while most insureds should expect a flat to plus-5% rate change, but cautions that current rate trends will be difficult to maintain if the frequency and severity of catastrophes don’t abate.

The report notes specifically that pricing challenges are likely to persist in specific coverage lines such as property-exposed accounts in wind-prone areas, habitational risks, and large commercial trucking fleets.

Carriers, says USI, are also more likely to ask for moderate-to-high rate increases for many insureds in the public company directors’ and officers’ space, employment practices liability and medical malpractice for healthcare providers in certain classes.

Within the commercial real estate sector, multifamily properties could have the hardest time finding willing insurers. Beyond the natural catastrophe losses in 2017 and 2018, multifamily portfolios are producing fire and water damage losses, causing some carriers to either exit this risk class entirely, or increase rates and deductibles even for low-loss level insureds. With overall segment capacity shrinking, insureds with exposures to natural catastrophe and below average loss history can expect significant rate increases.

This could be especially true for frame construction, due to numerous large fire losses in recent years.

Despite the frequency of catastrophic events, insurers have so far resisted steady and high rate increases. Image: USI

The prospects are a bit brighter for nonresidential commercial properties, whose owners, developers, and managers have a distinct advantage, says USI: Quality risks remain the focus of carrier capacity offerings. Nevertheless, portfolios exposed to natural catastrophe will require a disciplined approach to achieve an optimal outcome in the marketplace.

USI joins other market observers in its expectation that spending on commercial construction will rise in 2019. Total construction spending may produce a 4% increase in insurance premiums in 2019, compared to 2018, while rates remain mostly flat in certain jurisdictions.

For larger construction projects, safety, specialization, timeliness, and staying within budget remain the biggest risks. “With good risk management and the use of Controlled Insurance Programs (CIPs), insureds can avoid disruptions, reduce loss costs, and meet expectations of all parties who have an insurable risk,” USI’s states.

Its report found in commercial construction a greater emphasis on jobsite safety to reduce claims per man-hour. The widespread application of BIM is fostering open collaboration and new ideas that are helping to mitigate risk, too.

USI also comments on the renewed interest in modular and prefabricated construction, which brings with it benefits of quality control and worker safety. However, those methods also raise insurance-related concerns, such as how a general liability insurance policy would respond to a potential claim, and how employees should be categories within their workers compensation programs.

Related Stories

Sponsored | | Oct 29, 2014

Why you should manage progress rather than people

Telling your employees to become more engaged and productive won’t work. But putting mechanisms in place that encourages their progress will. SPONSORED CONTENT

Sponsored | | Oct 29, 2014

What’s the difference between your building’s coating chalking and fading?

While the reasons for chalk and fade are different, both occurrences are something to watch for. SPONSORED CONTENT

Sponsored | | Oct 29, 2014

Historic Washington elementary school incorporates modular design

More and more architects and designers are leveraging modern modular building techniques for expansion projects planned on historical sites. SPONSORED CONTENT

| Oct 29, 2014

Diller Scofidio + Renfro selected to design Olympic Museum in Colorado Springs

The museum is slated for an early 2018 completion, and will include a hall of fame, theater, retail space, and a 20,000-sf hall that will showcase the history of the Olympics and Paralympics.

Smart Buildings | Oct 29, 2014

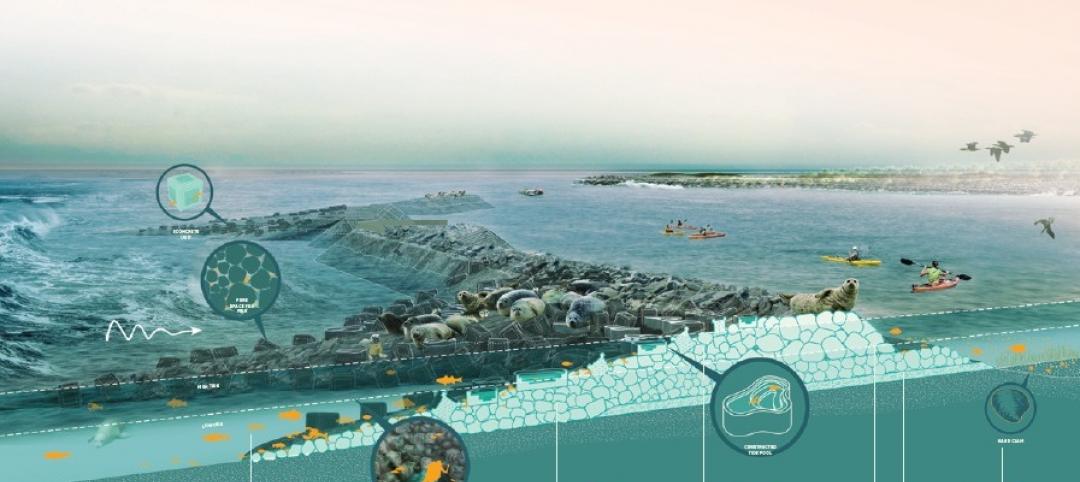

SCAPE’s 'living breakwaters' resiliency development wins 2014 Buckminster Fuller Challenge

New York-based landscape architecture firm SCAPE won the Buckminster Fuller Institute’s 2014 Fuller Challenge, billed as socially responsible design’s highest award.

| Oct 28, 2014

4 keys to mastering 'design thinking' and the iteration process

When using design thinking and iteration, we’ll sometimes spend multiple days iterating idea after idea, heads down, only to realize we still don’t have it right, writes HDR's Amy Lussetto. She offers tips for success with these idea-nurturing tools.

| Oct 28, 2014

Miami accepts more modest plan to renovate its convention center

The city of Miami has awarded an $11 million contract for its on-again, off-again convention center renovation to Denver-based Fentress Architects, which will serve as the design criteria professional on this project.

| Oct 27, 2014

Davis, Calif., latest city to join race to develop 'innovation hubs'

The city plans to develop two "innovation centers" with a total of seven million sf of commercial space geared for local research and technology companies.

| Oct 27, 2014

Report estimates 1.2 million people experience LEED-certified retail centers daily

The "LEED In Motion: Retail" report includes USGBC’s conceptualization of the future of retail, emphasizing the economic and social benefit of green building for retailers of all sizes and types.

| Oct 27, 2014

Top 10 green building products for 2015

Among the breakthrough products to make BuildingGreen's annual Top-10 Green Building Products list are halogen-free polyiso insulation and a high-flow-rate biofiltration system.