Uncertainty about government spending clouds an otherwise positive economic outlook among 59 middle market construction firms polled recently by GE Capital.

Those firms—which average 652 employees and $144.6 million in annual revenue—are particularly confident about U.S. and local markets, though less so about the global arena. Only 12% of those polled said they were “extremely confident” about the condition of global economies, versus 21% who felt the same way about the U.S. economy, and 42% who liked what they were seeing about their local economies.

The firms’ confidence reflects their financial performance. Seven of 10 respondents reported improvements in their companies’ financials as of September 2014, versus fewer than three in five polled last March.

However, while half of the construction firms surveyed said they were hiring more people, the number was slightly down from the 57% who were hiring last March. The good news is that nearly half of the firms polled—47%—expect the construction industry to expand through September 2015, during which construction-related employment is expected to increase by 5.4%.

The survey’s respondents see the energy sector as holding out the greatest potential for future construction projects and hiring. Office and residential projects are also expected to be stronger. But a lot of these firms’ optimism seems contingent on public works spending, which “continues to have an immense impact on the industry and is a key consideration in expenditure decisions,” according to GE Capital.

Another factor that is likely to impact construction firms’ profitability is the direction that healthcare costs take. One-third of respondents are anticipating an increasing cost structure. Still, the respondents expect their margins to grow by average of 3.7% over the next year, which greatly exceeds the 0.2% growth that respondents were projecting last March.

GE Capital produces its quarterly surveys in cooperation with the National Center for the Middle Market, a multiyear partnership between GE Capital and Ohio State University’s Fisher College of Business. For more information about construction and other industries, visit gecapital.com/cxosurvey.

Related Stories

Architects | Feb 15, 2022

Binkley Garcia Architecture and Goodwyn Mills Cawood join forces in Nashville

Goodwyn Mills Cawood (GMC) is pleased to announce the acquisition of architecture and interior design firm Binkley Garcia Architecture in Nashville.

Resiliency | Feb 15, 2022

Design strategies for resilient buildings

LEO A DALY's National Director of Engineering Kim Cowman takes a building-level look at resilient design.

Products and Materials | Feb 14, 2022

How building owners and developers can get ahead of the next supply chain disaster

Global supply chain interruptions that started at the very beginning of the pandemic are still with us and compounding every step of the way. Below are a few proven tips on how to avert some of the costly fallout should we be faced with similar commercial disasters at any time in the future.

Urban Planning | Feb 14, 2022

5 steps to remake suburbs into green communities where people want to live, work, and play

Stantec's John Bachmann offers proven tactic for retrofitting communities for success in the post-COVID era.

Urban Planning | Feb 11, 2022

6 ways to breathe life into mixed-use spaces

To activate mixed-use spaces and realize their fullest potential, project teams should aim to create a sense of community and pay homage to the local history.

Senior Living Design | Feb 11, 2022

Design for senior living: A chat with Rocky Berg, AIA

Rob Cassidy, Editor of MULTIFAMILY Design + Construction, chats with Rocky Berg, AIA, Principal with Dallas architecture firm three, about how to design senior living communities to meet the needs of the owner, seniors, their families, and staff.

Architects | Feb 11, 2022

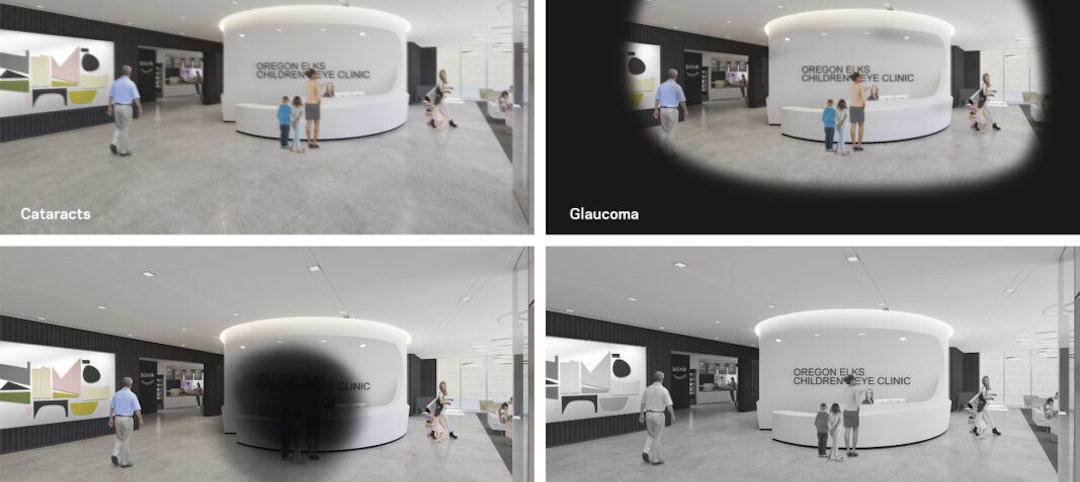

How computer simulations of vision loss create more empathetic buildings for the visually impaired

Here is a look at four challenges identified from our research and how the design responds accordingly.

Healthcare Facilities | Feb 10, 2022

Respite for the weary healthcare worker

The pandemic has shined a light on the severe occupational stress facing healthcare workers. Creating restorative hospital environments can ease their feelings of anxiety and burnout while improving their ability to care for patients.

Architects | Feb 8, 2022

Perkins Eastman and BLT Architects merge

Expanding services in hospitality, education, and mixed-use sectors to better serve clients.

Architects | Feb 3, 2022

SmithGroup elevates Mark Adams to lead workplace practice

In his new role, Adams leads the firm’s practice devoted to the design of corporate and commercial facilities.