Despite looming economic concerns and nearing the tail end of an extended growth cycle, the nonresidential buildings industry continues to march ahead with no major slowdown in sight, according to a panel of economists.

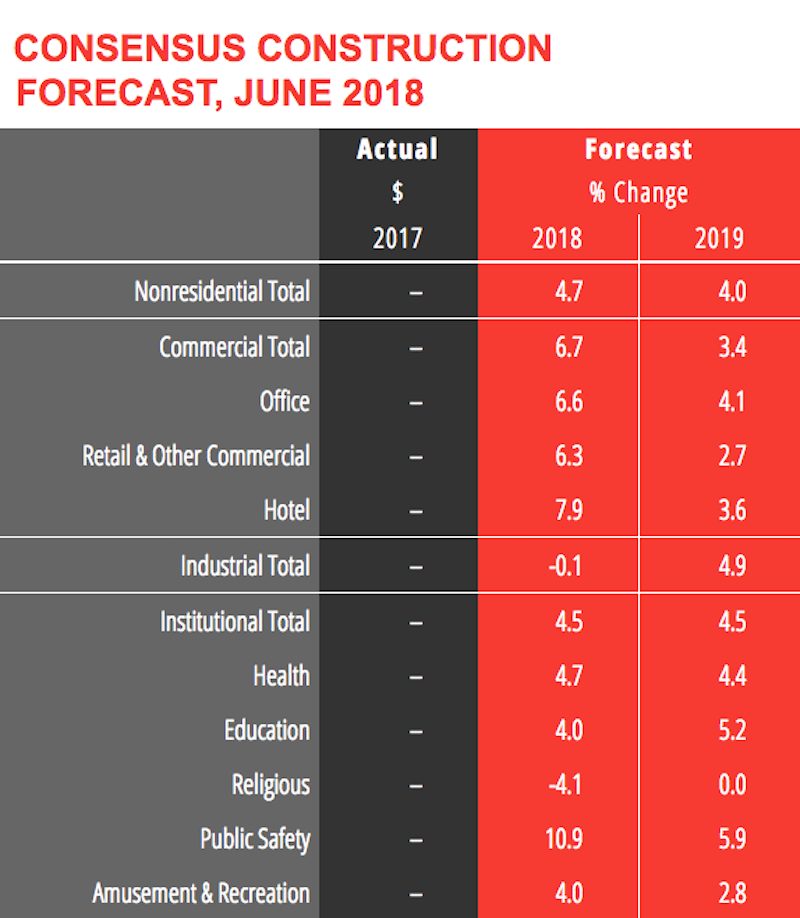

The AIA Consensus Construction Forecast—which consists of economic forecasts from Associated Builders and Contractors, ConstructConnect, Dodge Data & Analytics, FMI, IHS Economics, Moody’s, and Wells Fargo Securities—is projecting 4.7% growth in nonresidential construction spending in 2018 and a 4.0% rise in 2019. Both forecasts are up from the panel’s initial estimate (4.0% and 3.9%) at the beginning of the year.

“At the halfway point of the year, this panel is even more optimistic,” said Kermit Baker, PhD, Hon. AIA, Chief Economist at the American Institute of Architects. “If these projections materialize, by the end of next year the industry will have seen nine years of consecutive growth, and total spending on nonresidential buildings will be 5% greater—ignoring inflationary adjustments—than the last market peak

of 2008.”

At the midpoint of the year, the AIA Consensus Construction Forecast Panel upgraded its 2018 and 2019 outlook for the nonresidential construction industry.

At the midpoint of the year, the AIA Consensus Construction Forecast Panel upgraded its 2018 and 2019 outlook for the nonresidential construction industry.

Baker and the other economists point to several bright spots for the market:

• The commercial sector continues to overperform. With numbers strong through the first half of the year, the consensus is that spending on commercial buildings will increase 6.7% this year (up from 4.4% projected at the beginning of the year), and 3.4% next year (up from 2.9%).

• More optimism surrounding institutional building activity, with a modest uptick in the forecast.

• Growing workloads at architecture firms. Firms saw healthy growth in both ongoing billings and new project activity last year, and the pace of gains for both of these indicators has remained strong through the first half of 2018.

• Business confidence levels are at their highest scores since 2004. Businesses are generally seeing a more accommodative regulatory environment, and have seen healthy growth in corporate profits.

• Consumer sentiment scores are at their highest level since 2000. The economy is on pace to add almost 2.6 million net new payroll positions this year, exceeding the 2.2 million that were added in 2017.

Related Stories

Industrial Facilities | Apr 14, 2022

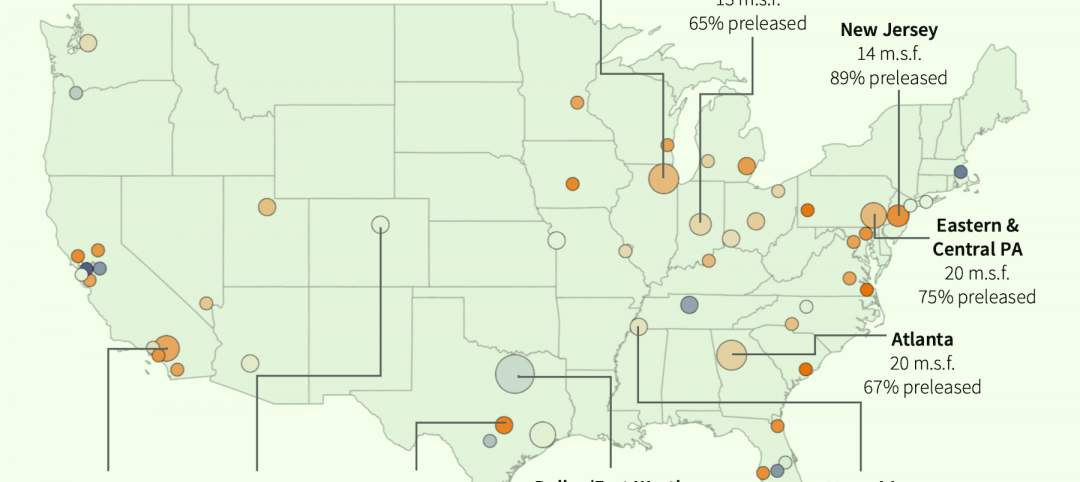

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.

Industry Research | Mar 23, 2022

Architecture Billings Index (ABI) shows the demand for design service continues to grow

Demand for design services in February grew slightly since January, according to a new report today from The American Institute of Architects (AIA).

Codes and Standards | Mar 1, 2022

Engineering Business Sentiment study finds optimism despite growing economic concerns

The ACEC Research Institute found widespread optimism among engineering firm executives in its second quarterly Engineering Business Sentiment study.

Codes and Standards | Feb 24, 2022

Most owners adapting digital workflows on projects

Owners are more deeply engaged with digital workflows than other project team members, according to a new report released by Trimble and Dodge Data & Analytics.

Market Data | Feb 23, 2022

2022 Architecture Billings Index indicates growth

The Architectural Billings Index measures the general sentiment of U.S. architecture firms about the health of the construction market by measuring 1) design billings and 2) design contracts. Any score above 50 means that, among the architecture firms surveyed, more firms than not reported seeing increases in design work vs. the previous month.

Market Data | Feb 15, 2022

Materials prices soar 20% between January 2021 and January 2022

Contractors' bid prices accelerate but continue to lag cost increases.

Market Data | Feb 4, 2022

Construction employment dips in January despite record rise in wages, falling unemployment

The quest for workers intensifies among industries.